Insurance Management System

This module helps manage insurance policies by categorising them into policy categories and subcategories. The Dashboard displays key information like active and expired policies, total claims, customers and agents etc. You can handle policies, agents, insured person details and nominee details. Payments can be managed monthly or with fixed amounts. Insurance documents and reports are easy to store and generate. Claims go through stages from draft to approval.

Hot Features

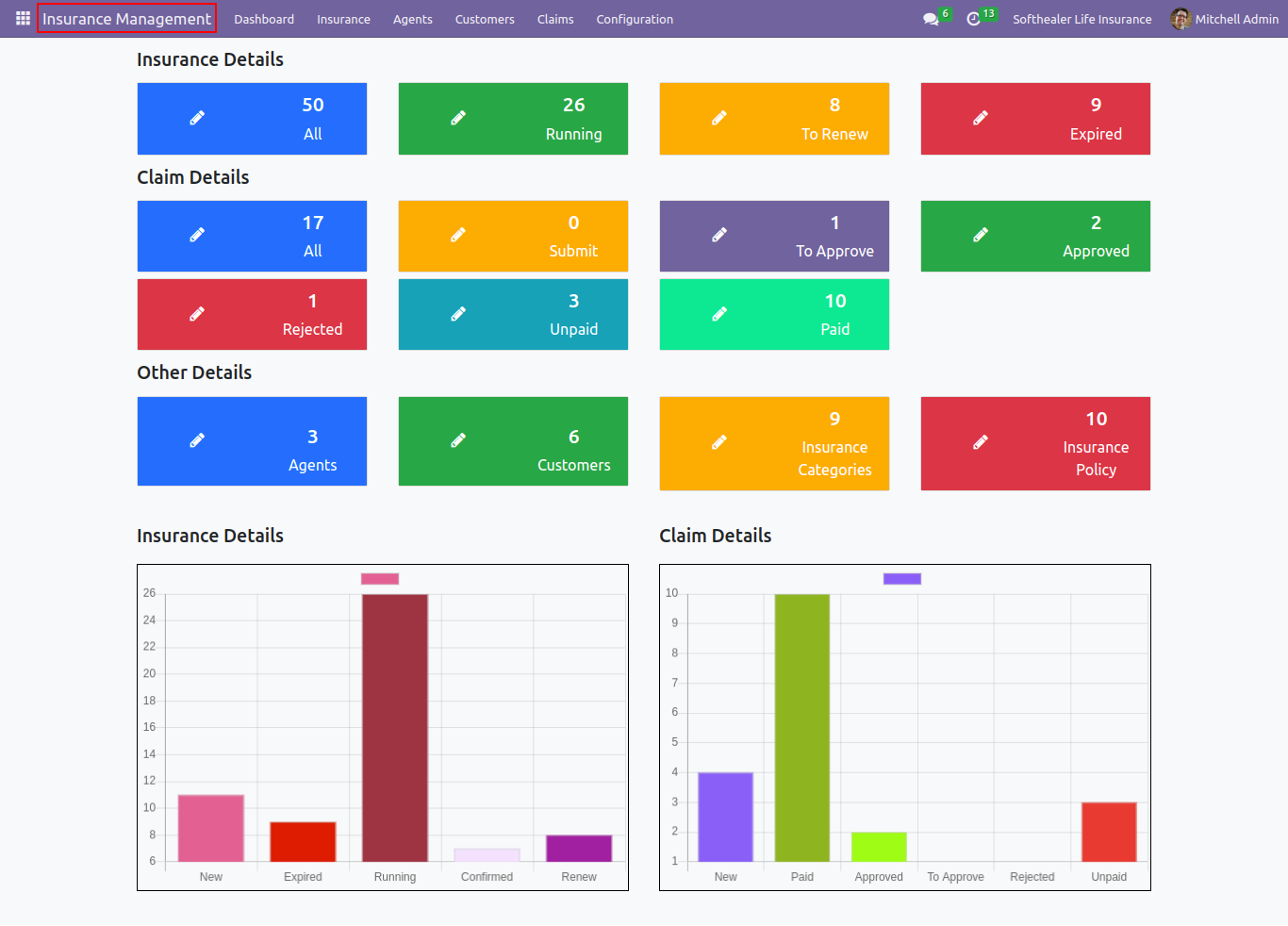

Colourful Dashboard

A colourful dashboard helps to identify the status of each Policy through different colours.

Insurance Policy Details

Insurance policy details refer to the specific information contained within an insurance policy.

Insurance Agents

You can manage insurance agents and their commissions under agent contact details.

Policy Time Period

Easy to manage policy terms in insurance policies and customise premiums based on the specified policy terms.

Insurance & Claim reports

Insurance policy reports and Claim reports can be generated in PDF format.

Nominee details

You can add nominees to the policy, indicating their relation to the policyholder and their proportional percentage.

Policy and Commission

Easy to pay policy premium and commission by confirming the policy details.

Claim details

Easy to create a claim with the reason, required documents and create a claim settlement bill.

Renew Policy

Easy to renew the policy for an expired policy and it creates a new policy with auto-filled details of the policyholder.

Reminders

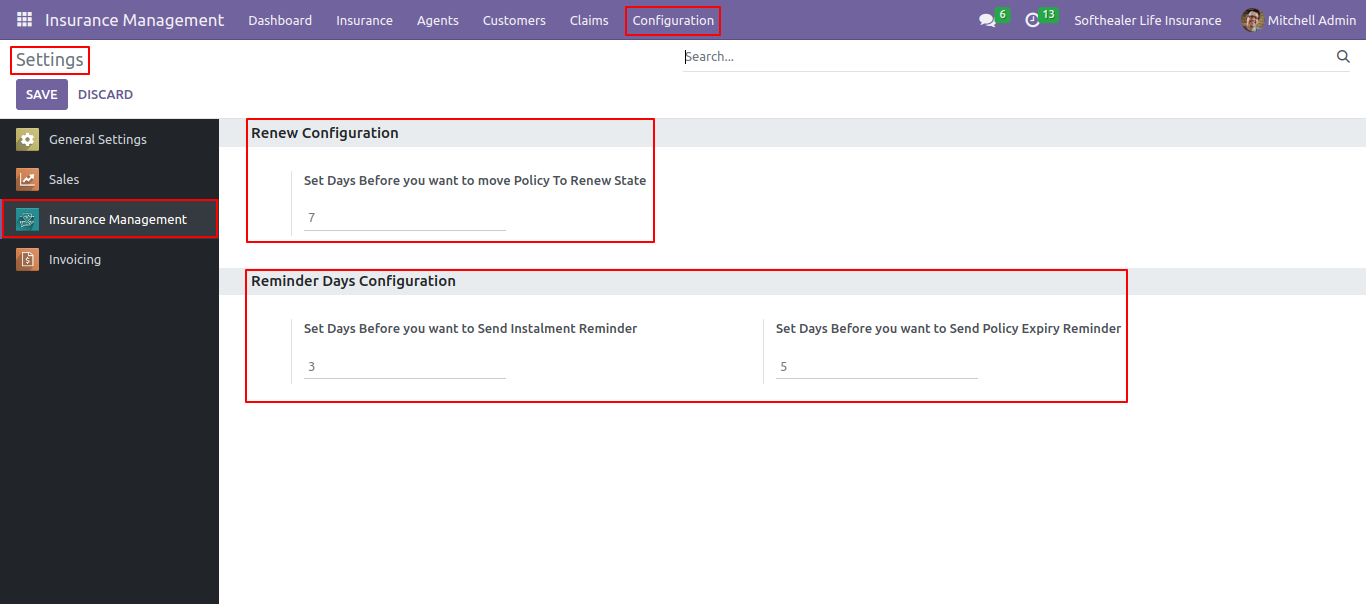

You can set reminder days for renewal, Installment and expiration of the policy.

- Easy to show important information like total policies, running, expired, total claims, submitted claims, approved claims and other data by the colourful dashboard including colourful graphs

- The dashboard provides details of customers, agents, and different types of insurance policies and categories.

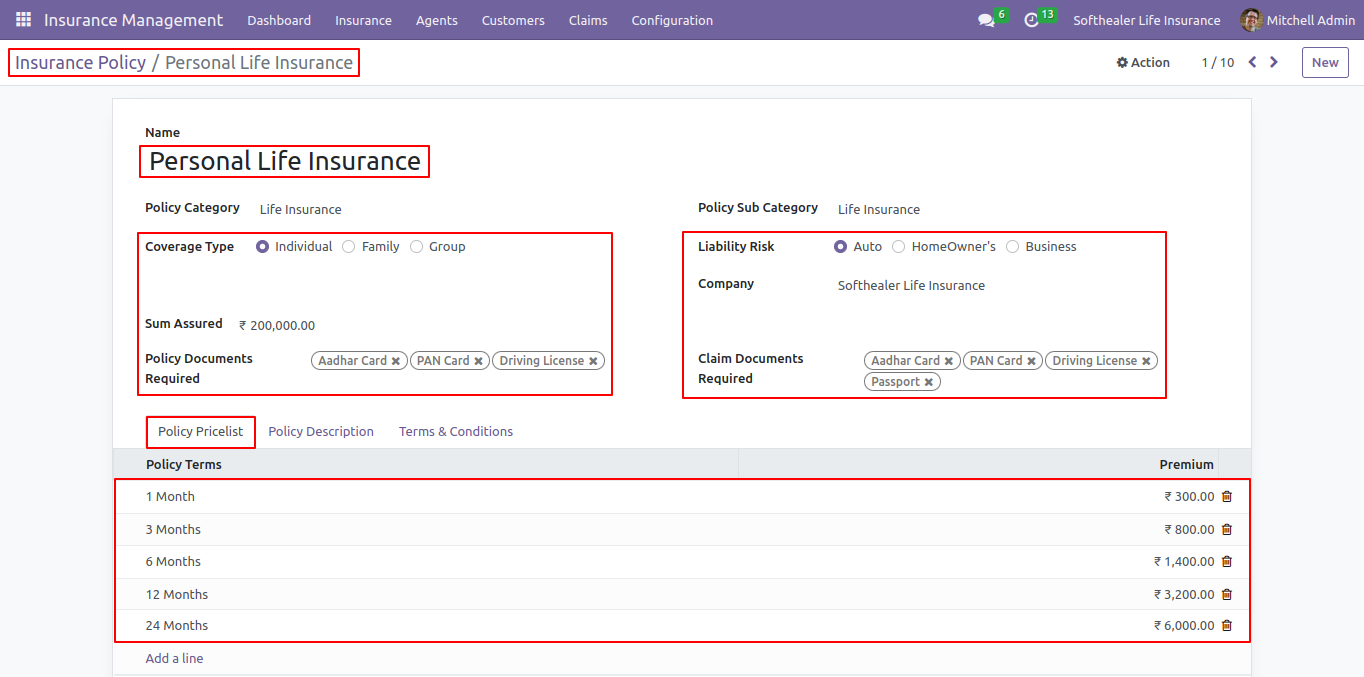

- You can manage insurance policies, categories, sub categories and policy terms.

- You can set a policy term wise premium.

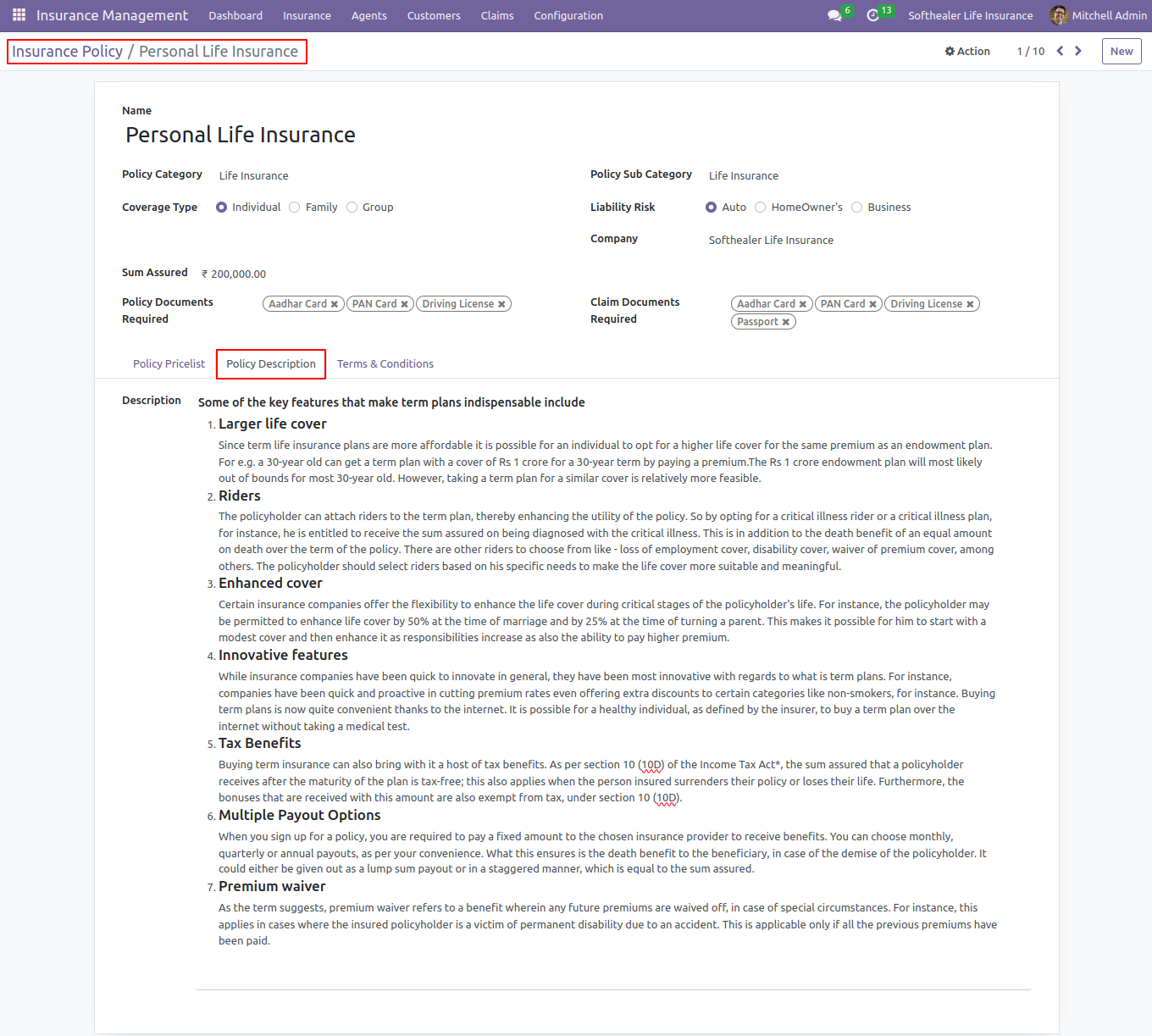

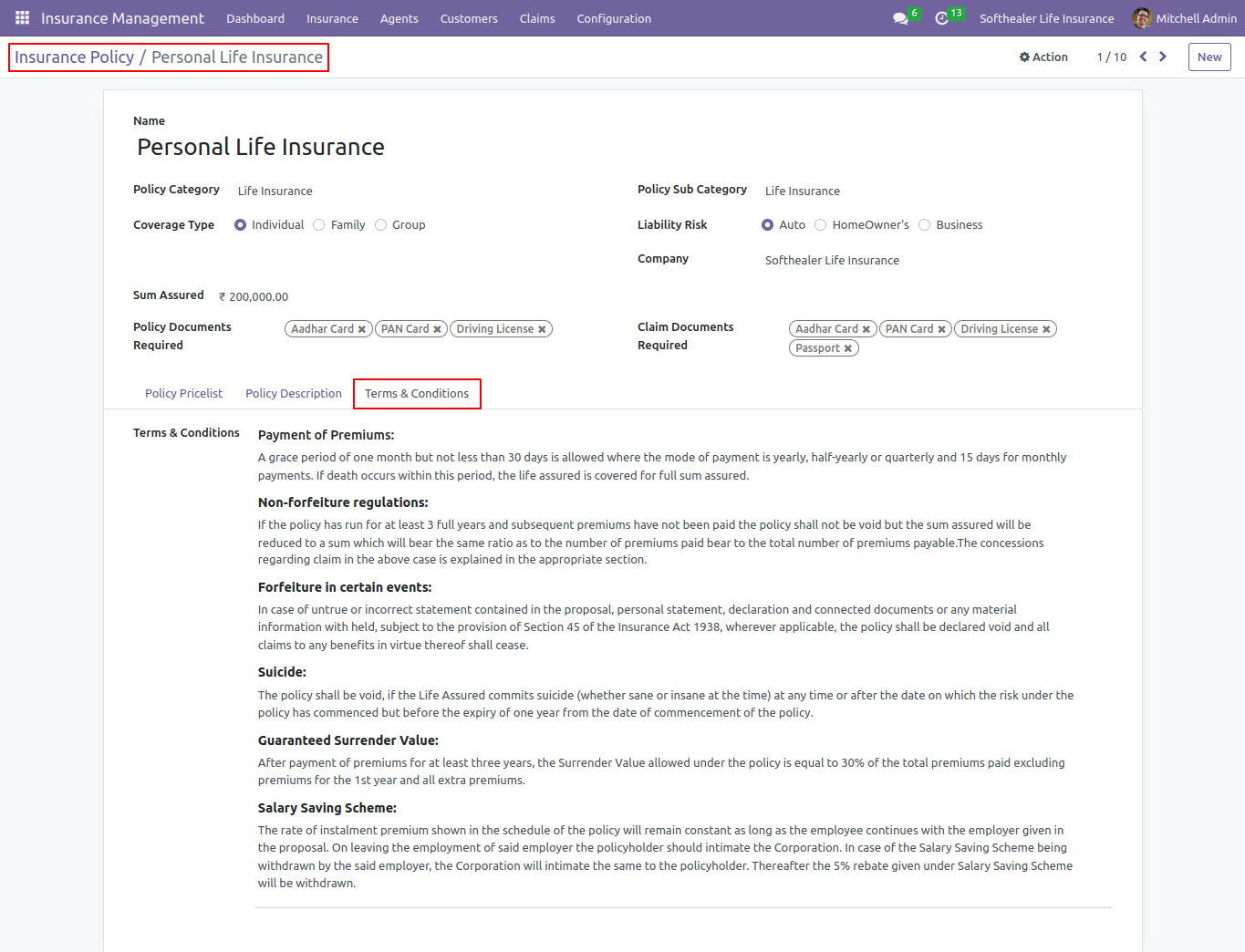

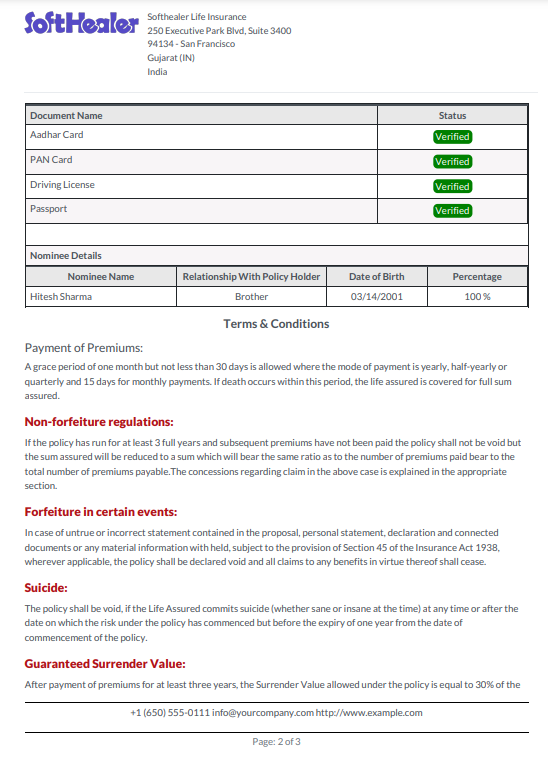

- You can add a policy description as well terms and conditions for the policy.

- You can set the required documents for policy.

- Easy to pay the Policy premium through monthly instalments or fixed premium amounts.

- You can manage insured person details.

- You can manage agents and their commissions.

- You can manage the details of the nominee, such as their age, relationship to the insured and percentage of the nominee.

- Insurance policy reports can be generated in PDF format with a detailed summary of policy information

- Policy details can be automatically filled in during the creation of a claim.

- You can set the required documents for claims.

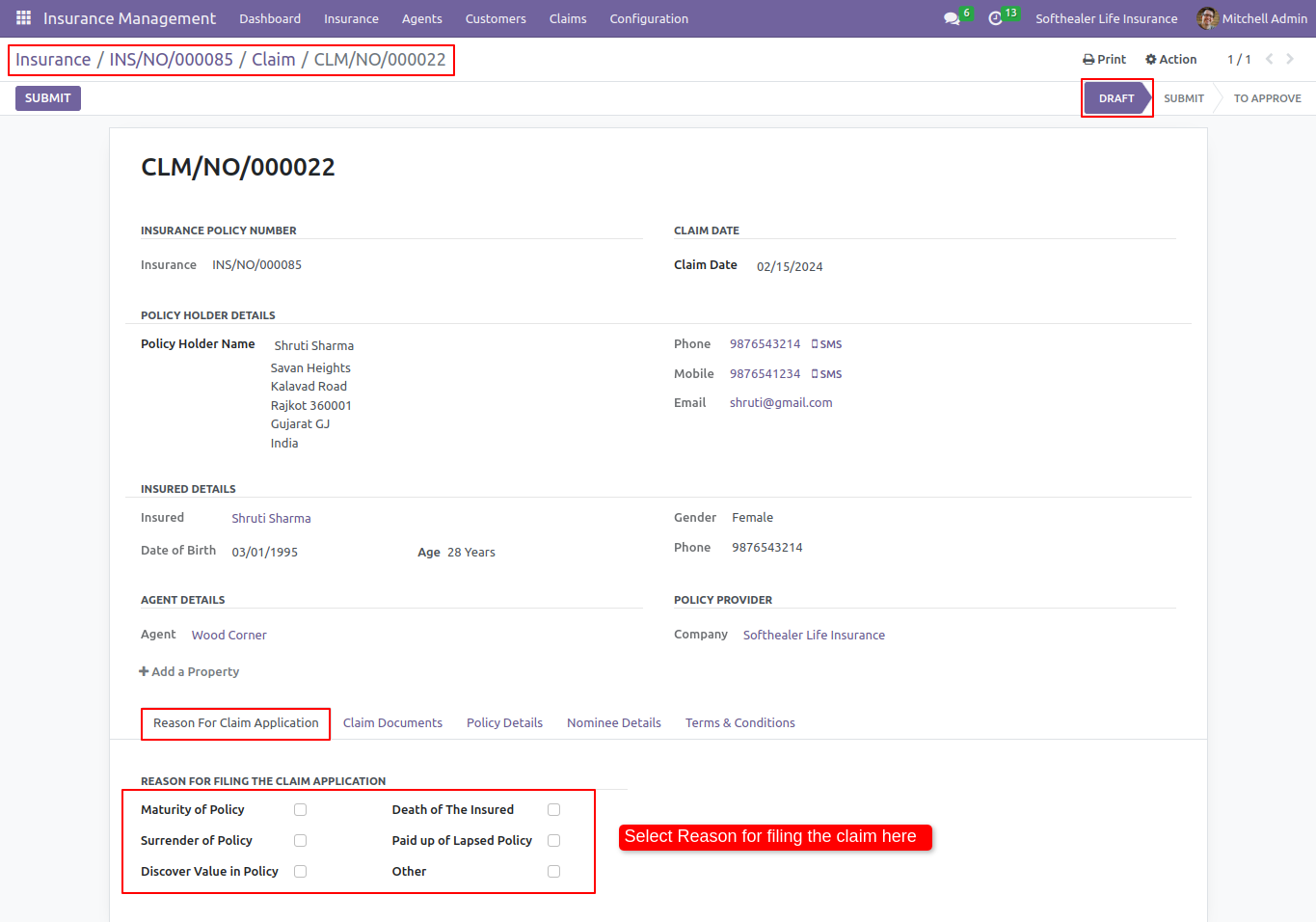

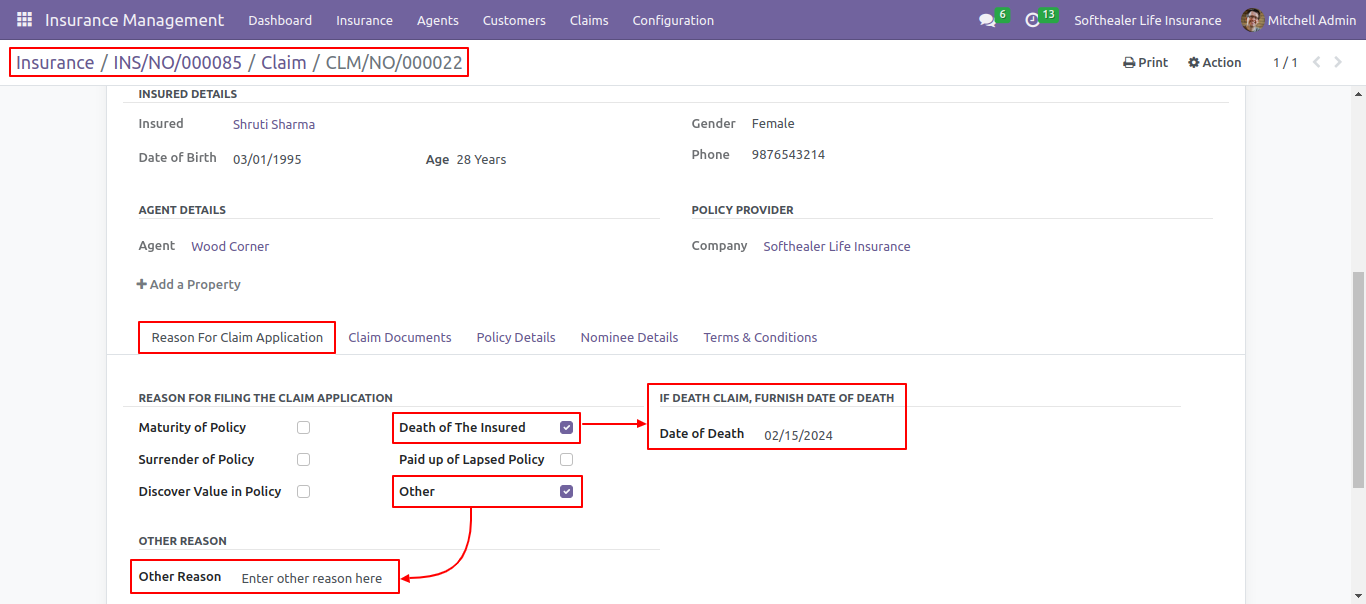

- You are required to add a valid reason for the claim. Here, we have added some predefined reasons, and you can also add other reasons.

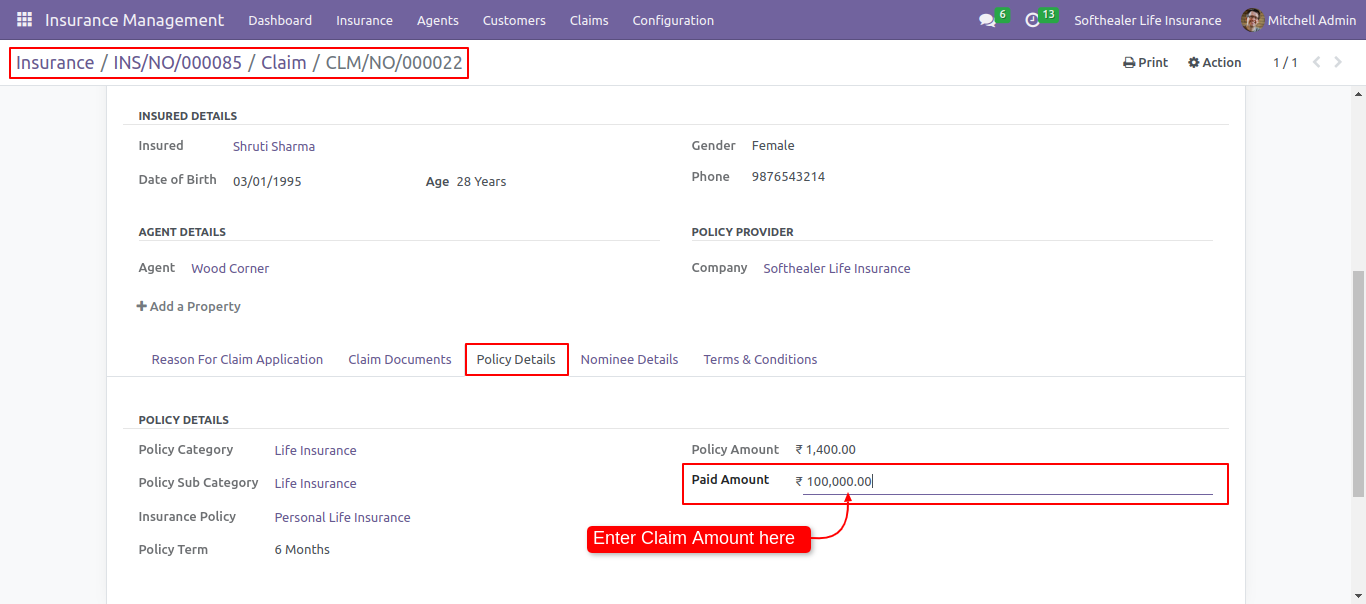

- You can create claim settlement bills that involve providing customers with the paid amount for the approved claim.

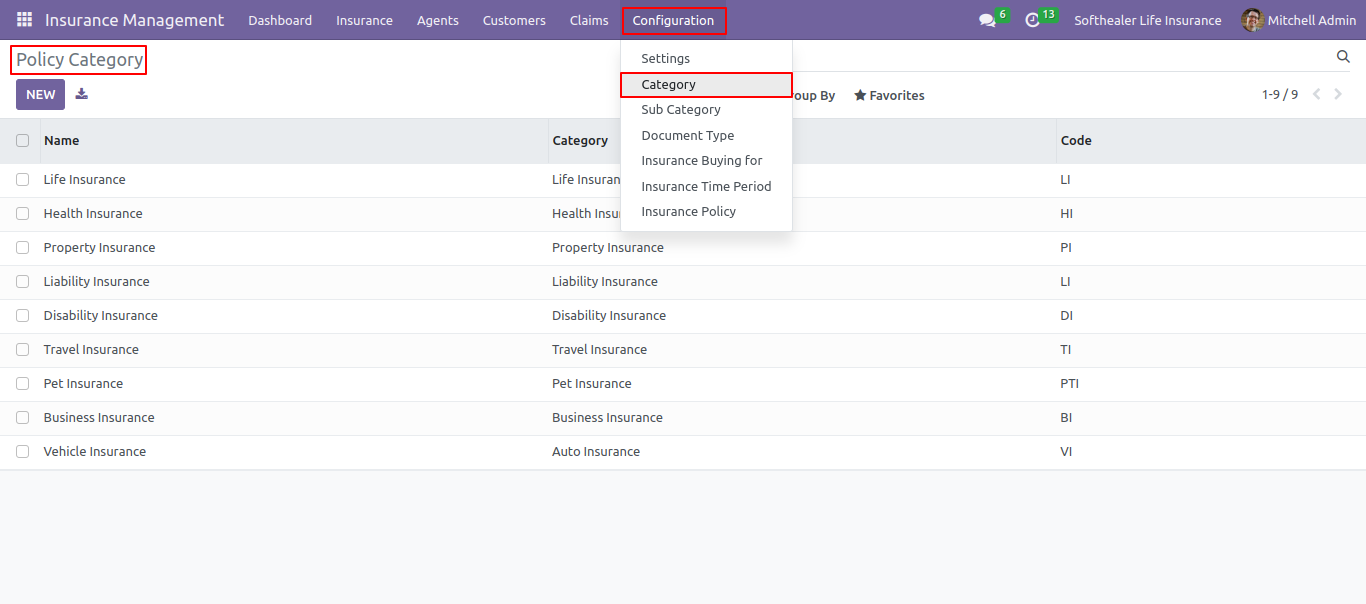

- We have added these categories: Life, Health, Property, Liability, Disability, Travel, Pet, Business and Auto insurance. Within each category, you can define subcategories.

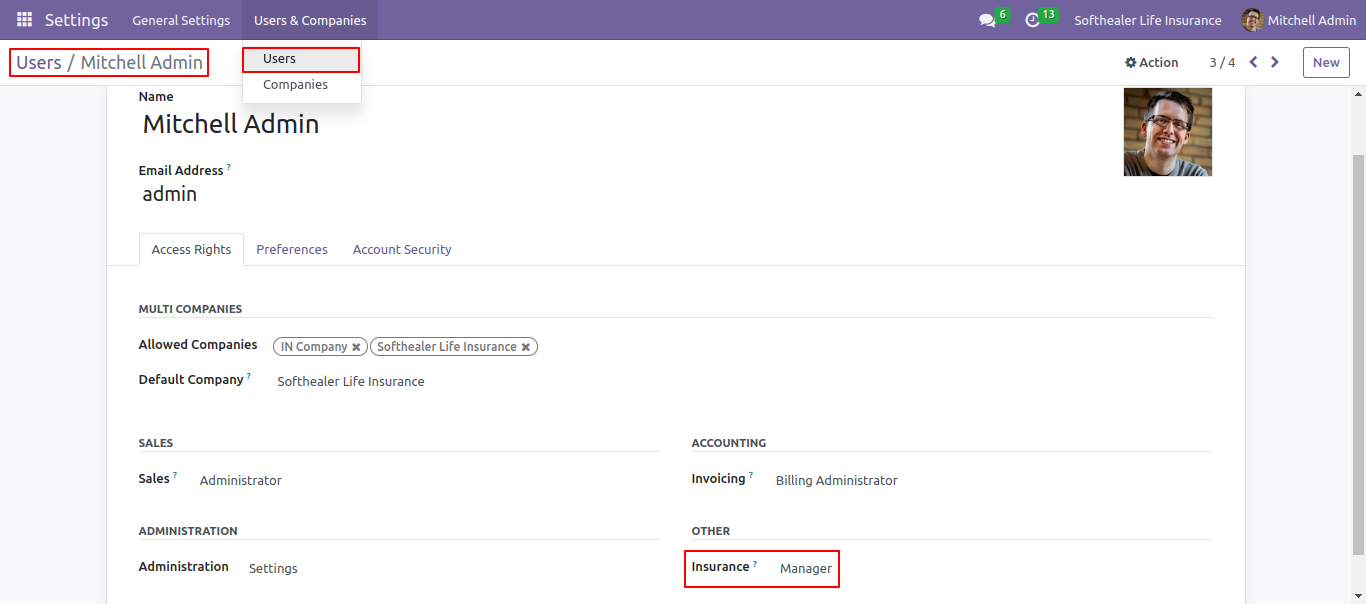

Go to your user settings ==> select Insurance Manager

Insurance Management system colourful dashboard.

Go to insurance configuration and select the category menu.

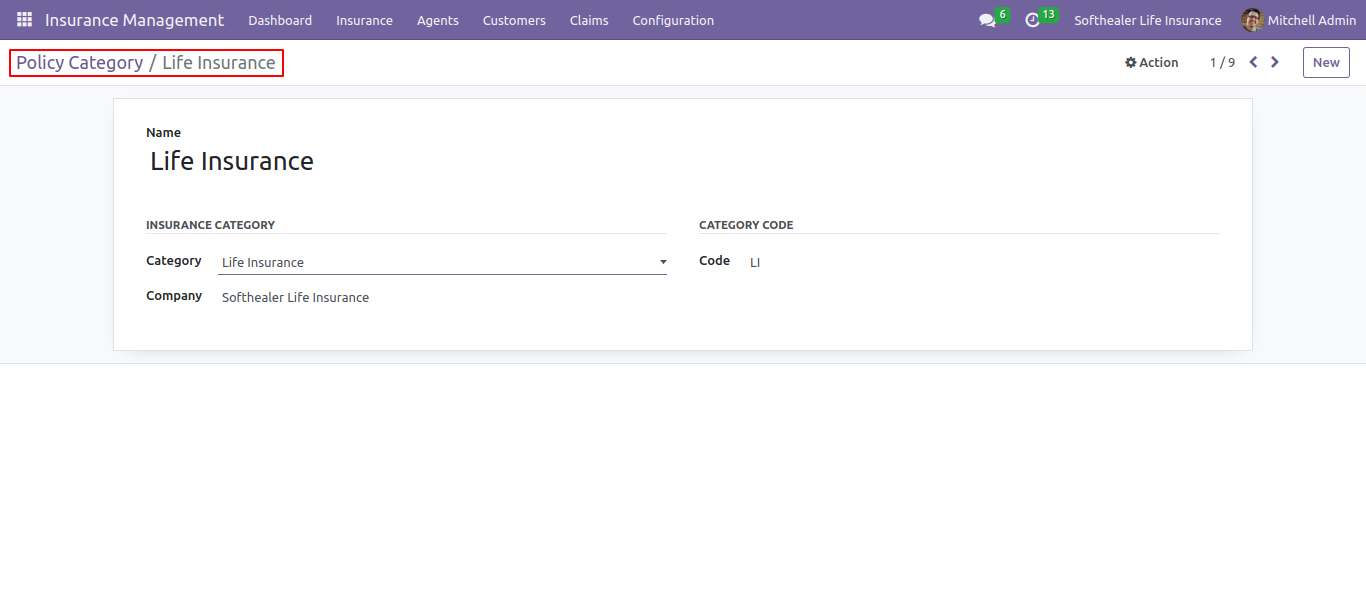

Create a policy category.

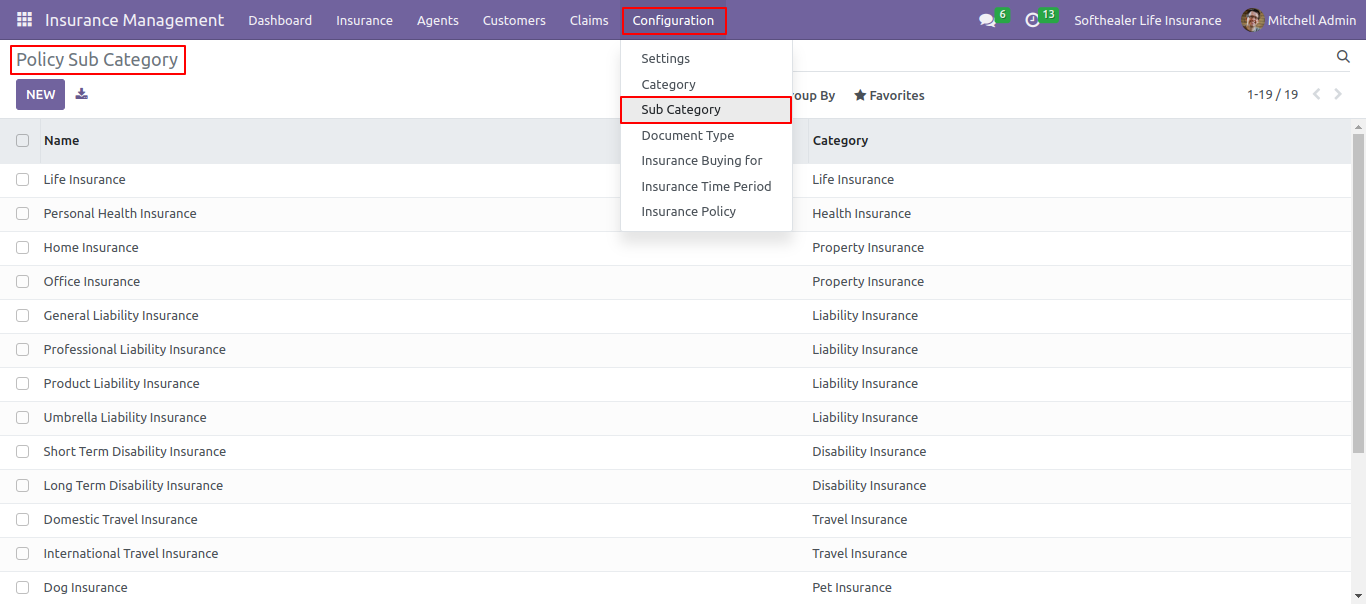

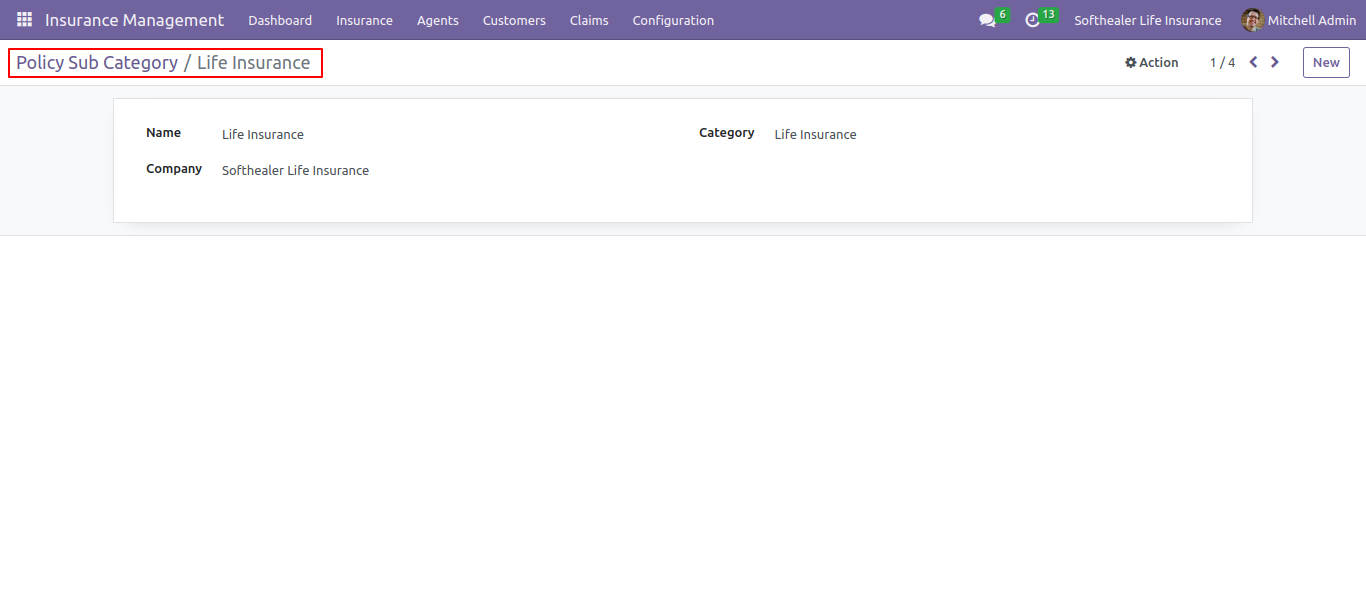

Go to insurance configuration and select the sub category menu.

Create a policy sub category.

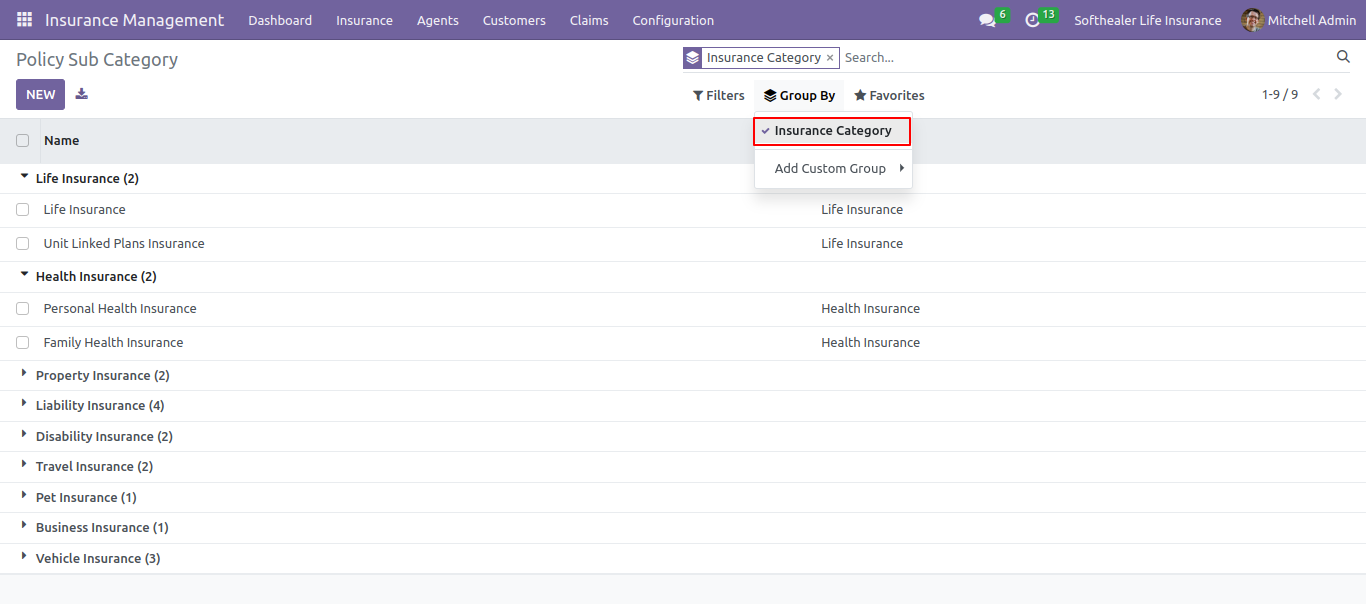

You can search insurance sub category group by insurance category.

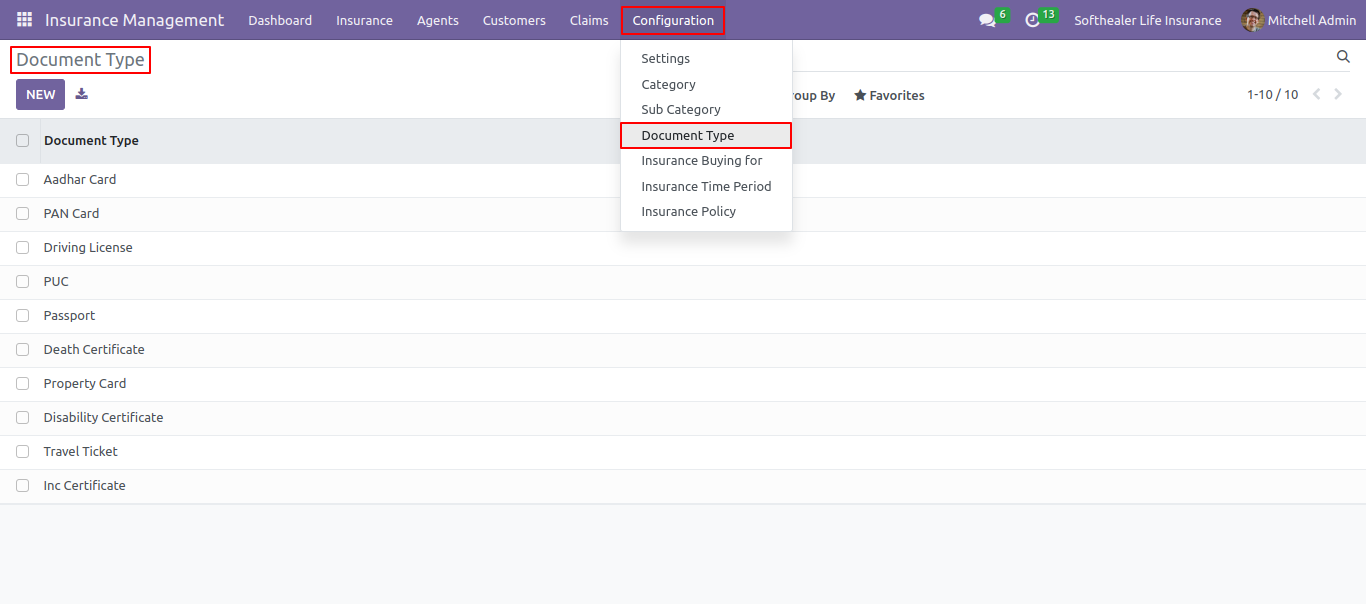

Go to insurance configuration and select the document type menu.

You can see the document type list view.

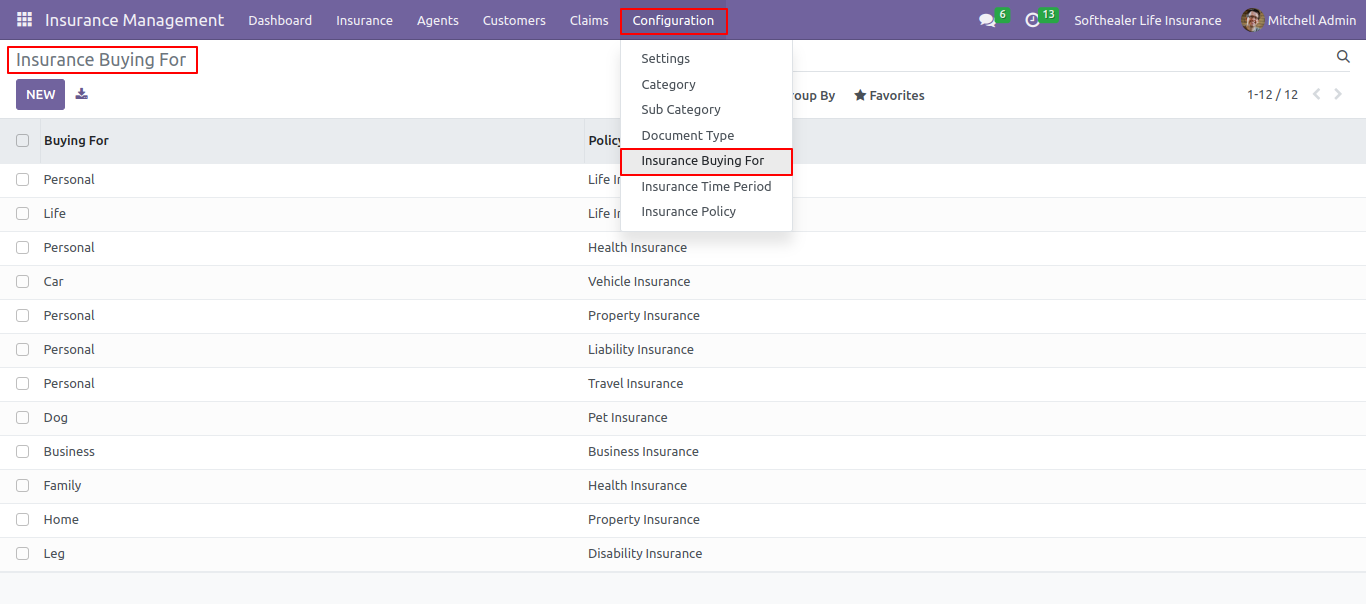

Go to insurance configuration and select insurance buying for the menu.

You can see insurance buying for a list view.

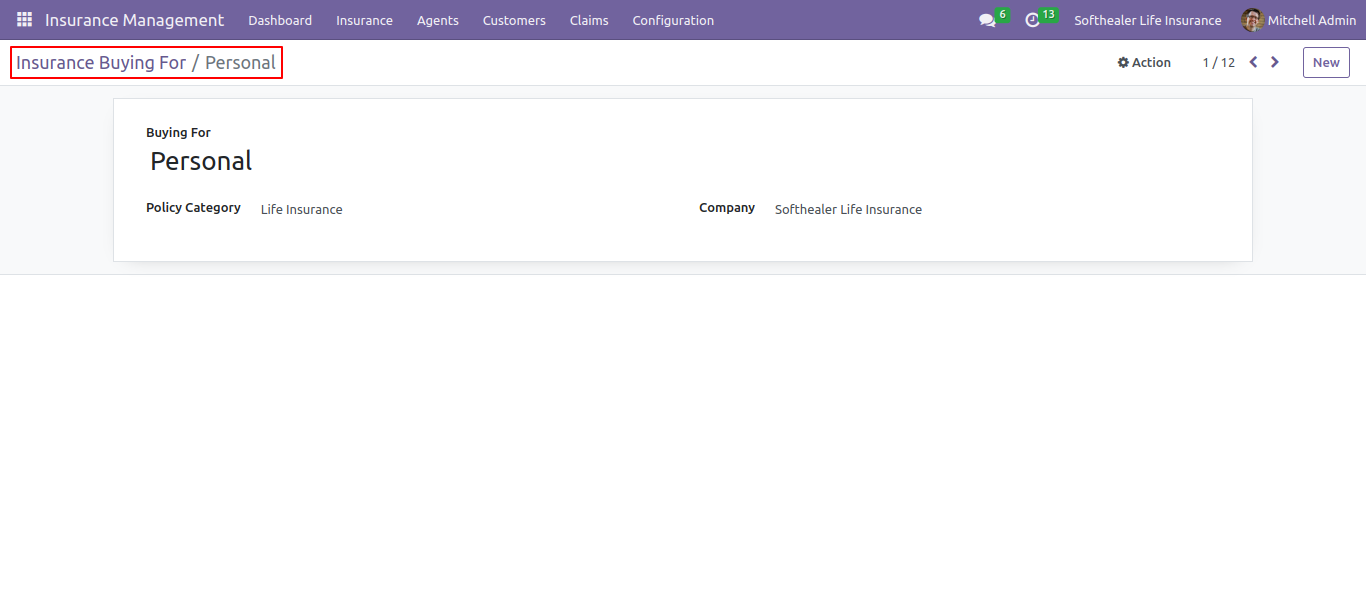

Form view of Insurance buying for.

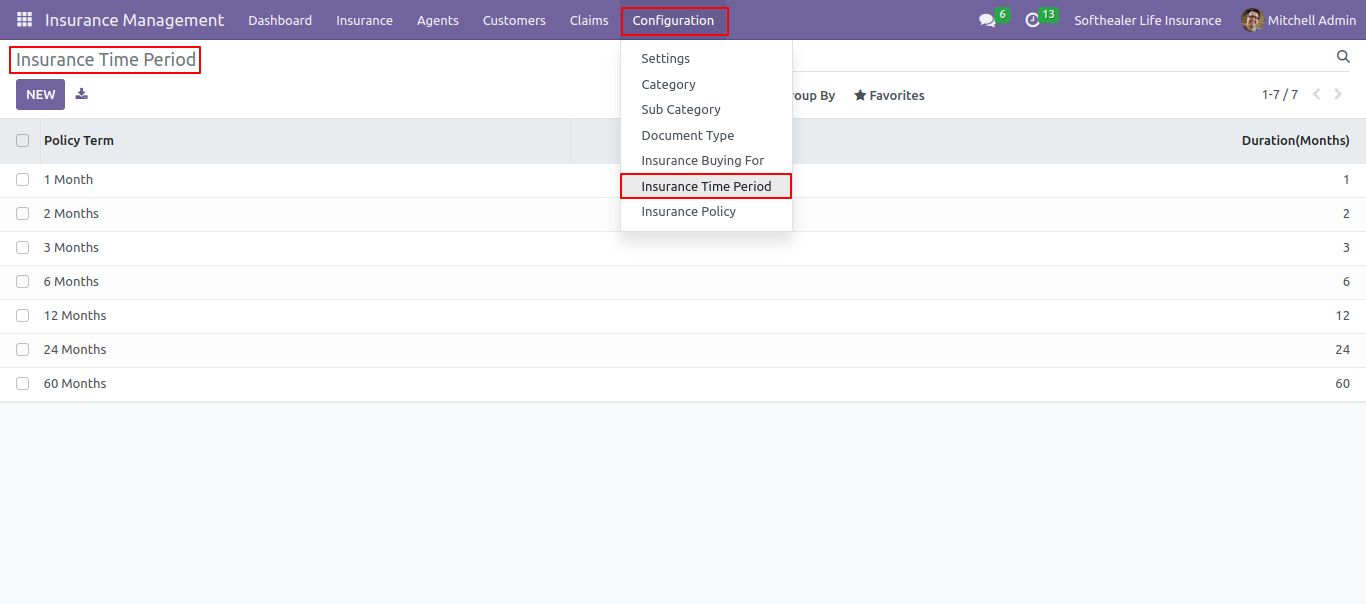

Go to insurance configuration and select the insurance time period menu.

You can see the insurance time period list view.

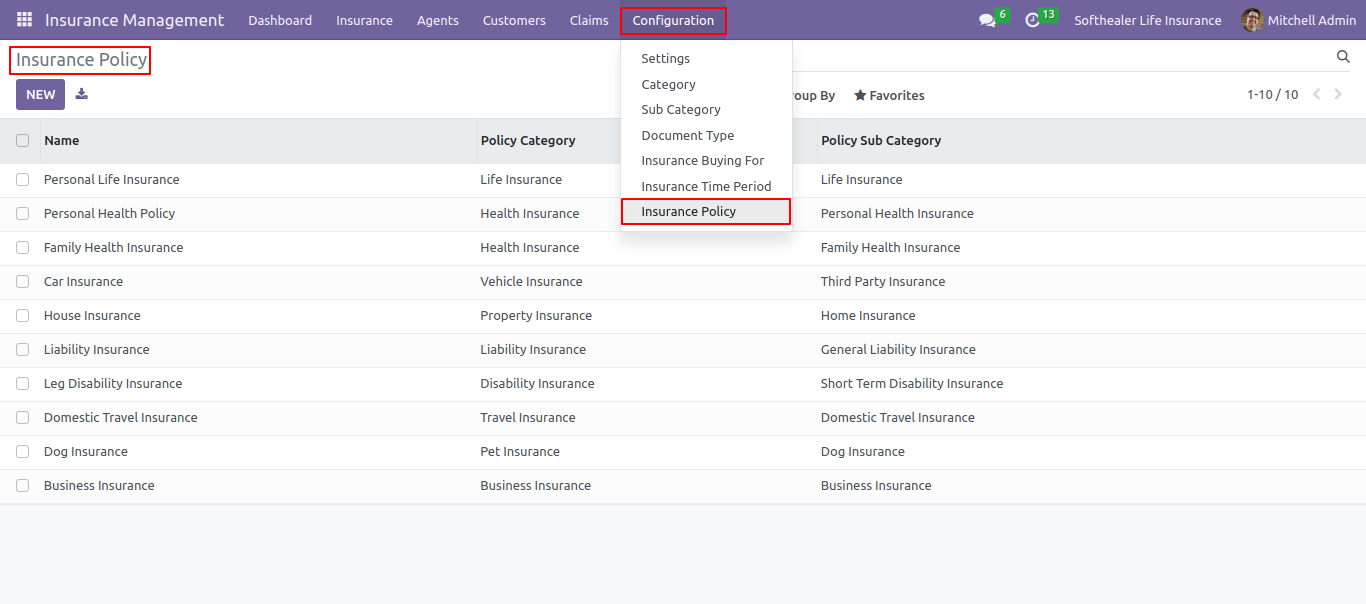

Go to insurance configuration and select the insurance policy menu.

You can see the insurance policy list view.

Insurance Policy form view.

You can add all the required details here in the policy form and also add the policy pricelist.

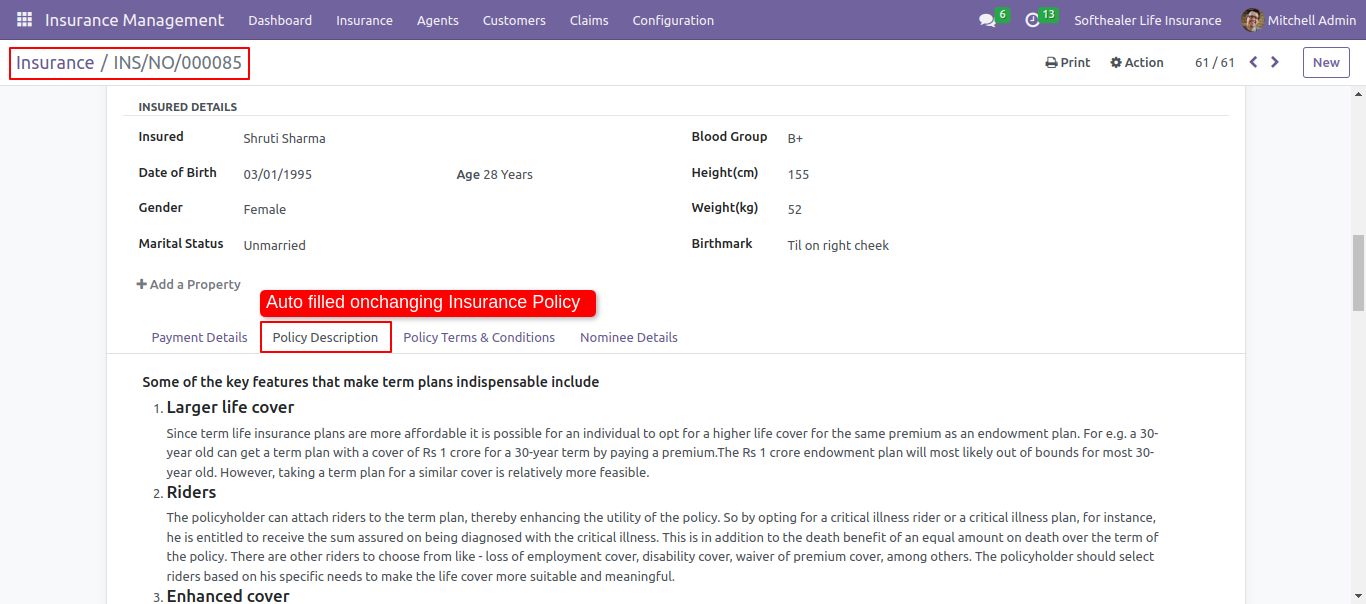

You can add a policy description.

You can add all the required details here in the policy form and also add policy terms & conditions.

You can set reminders for renewal of the policy, for instalments and also for the expiry of the policy.

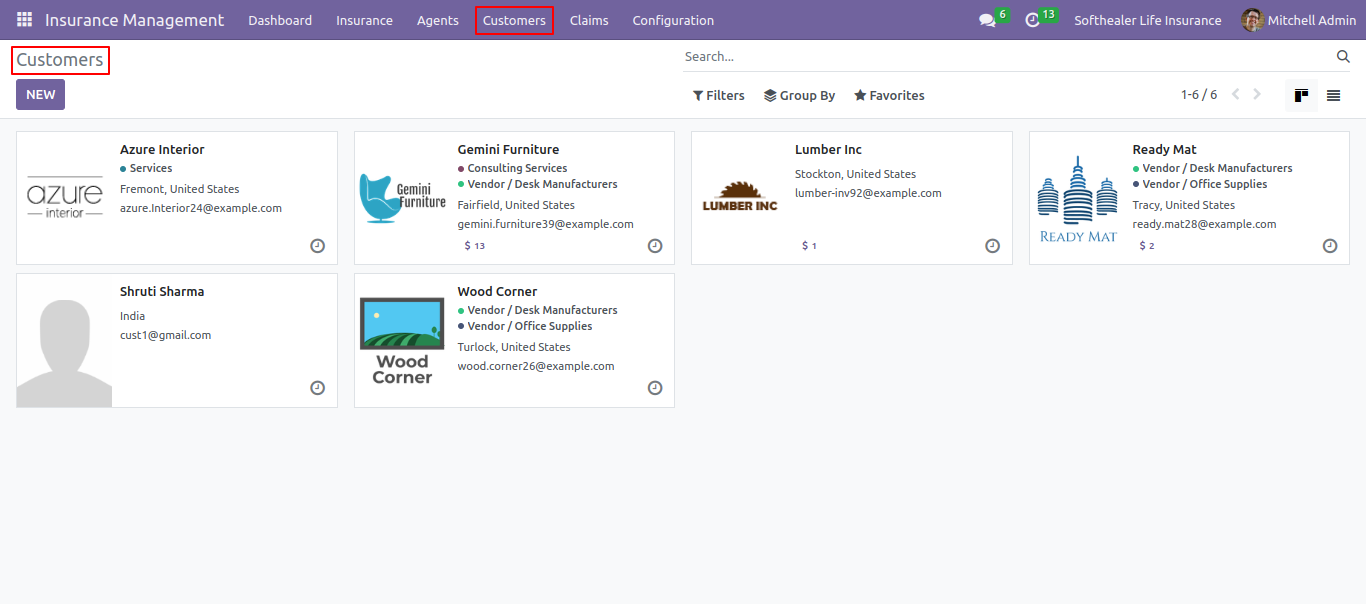

Customers kanban view.

Customers list view.

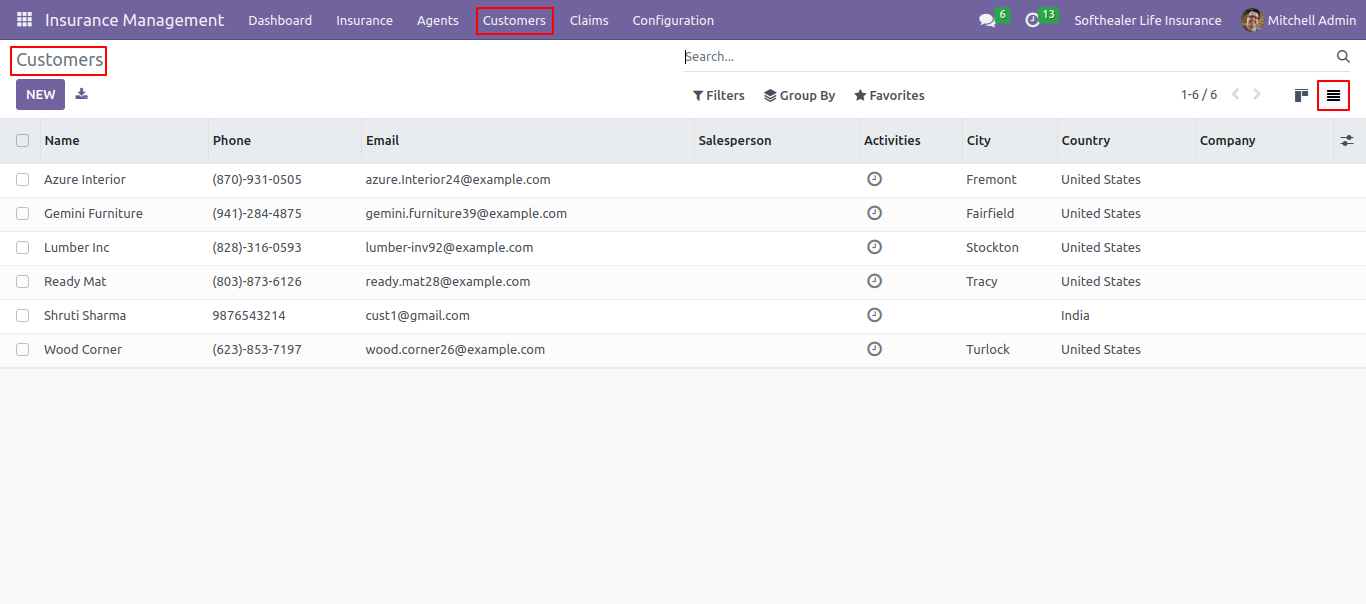

Create customers by clicking the Is Customer boolean and adding all required details.

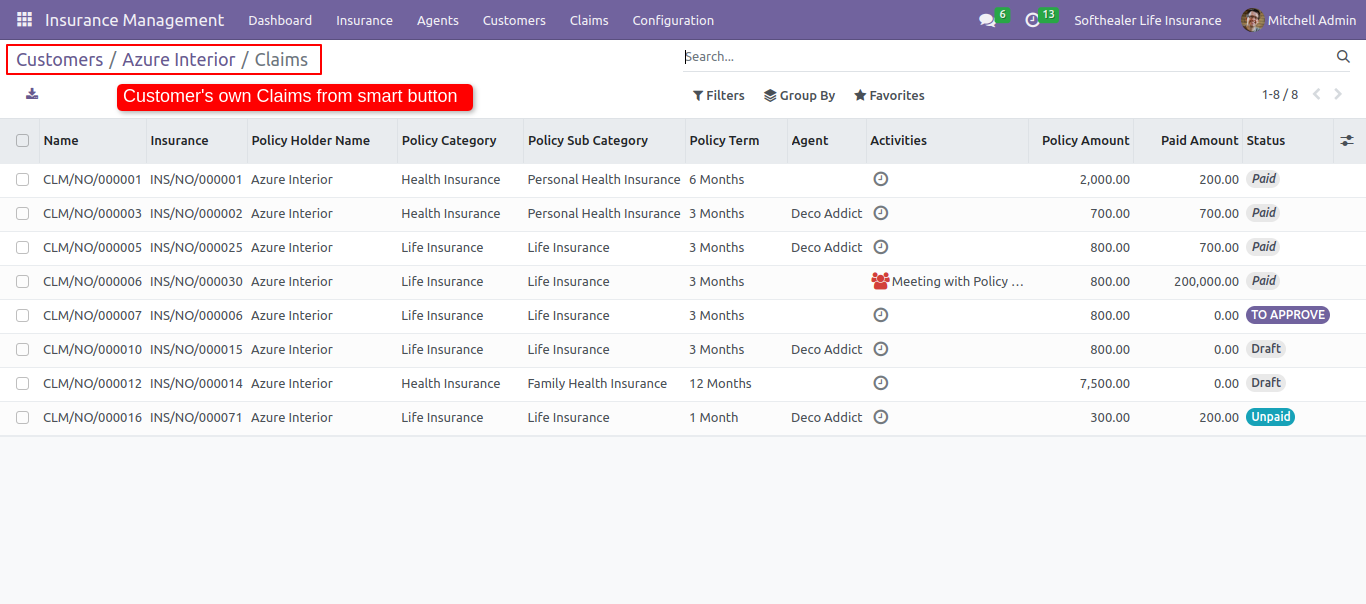

You can see insurance details and claims of customers from the smart button.

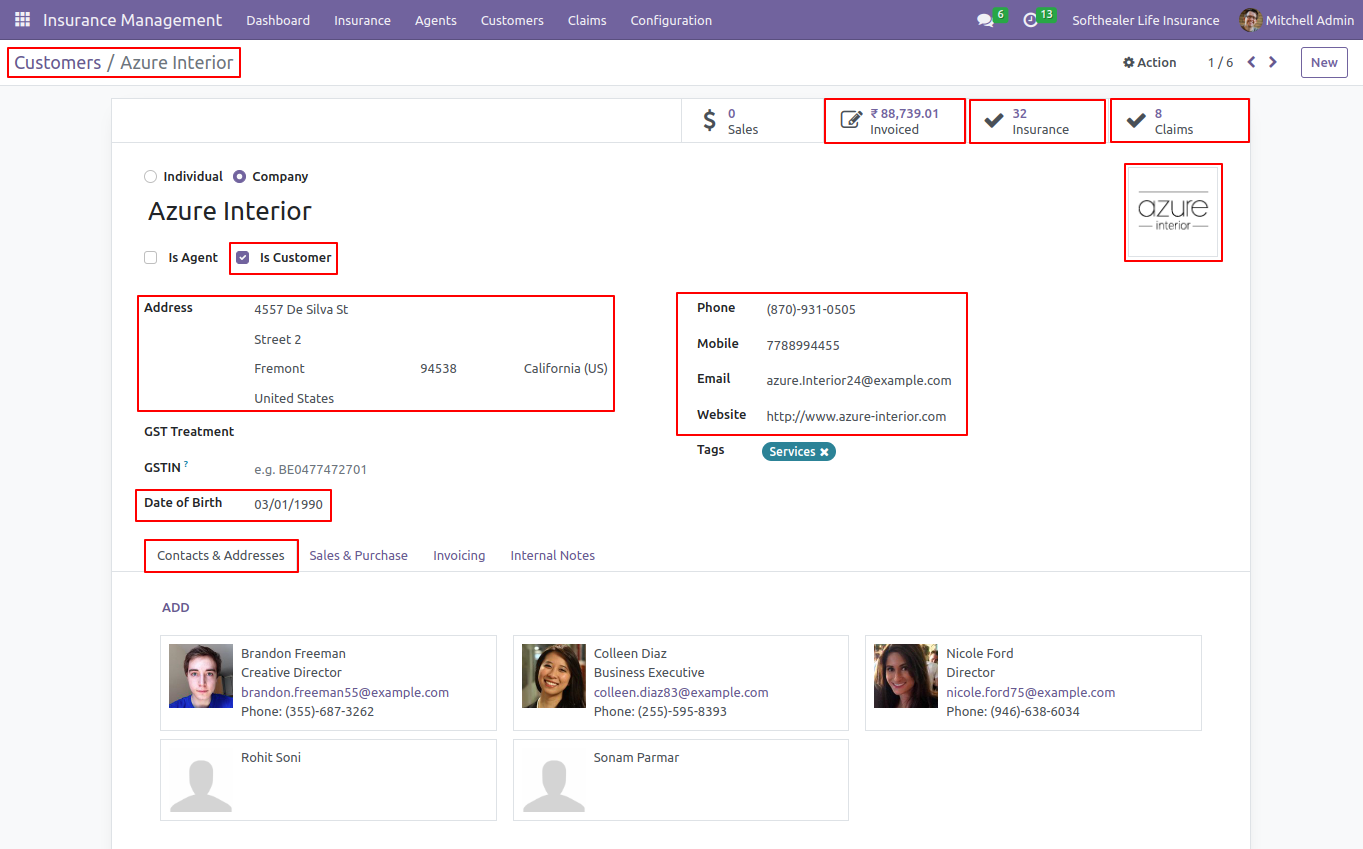

Click on the Insurance smart button from the customer and you can see a list of all policies of the selected customer.

Click on the Claim smart button from the customer and you can see a list of all claims of selected customers.

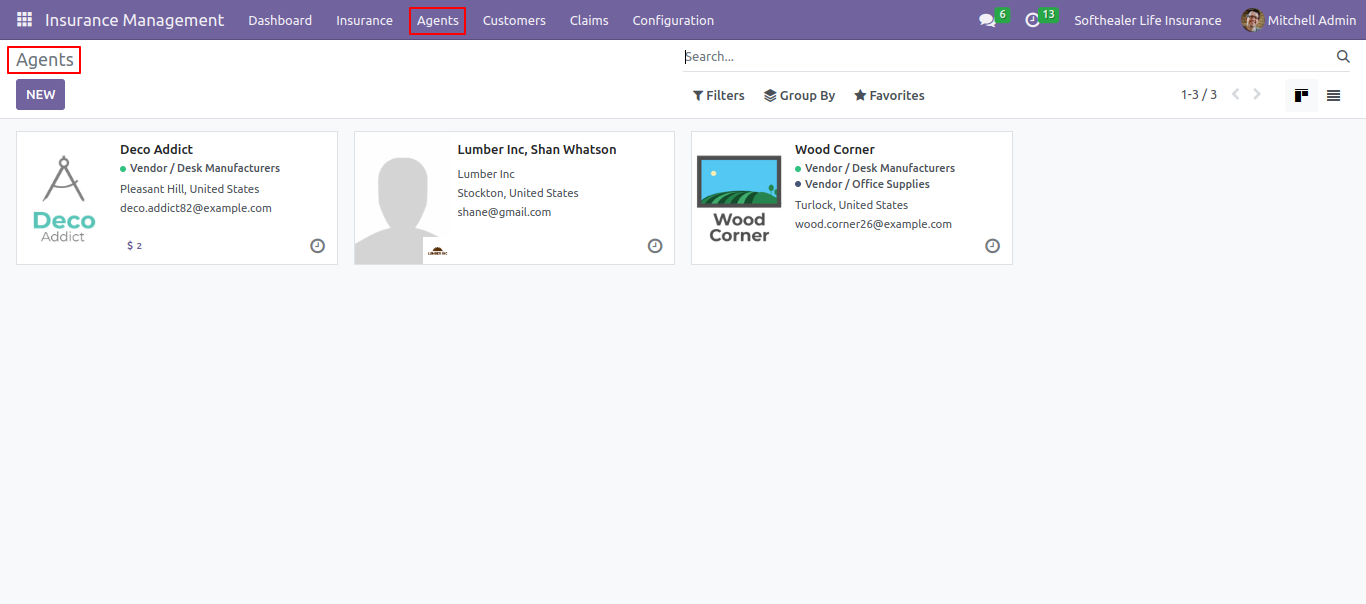

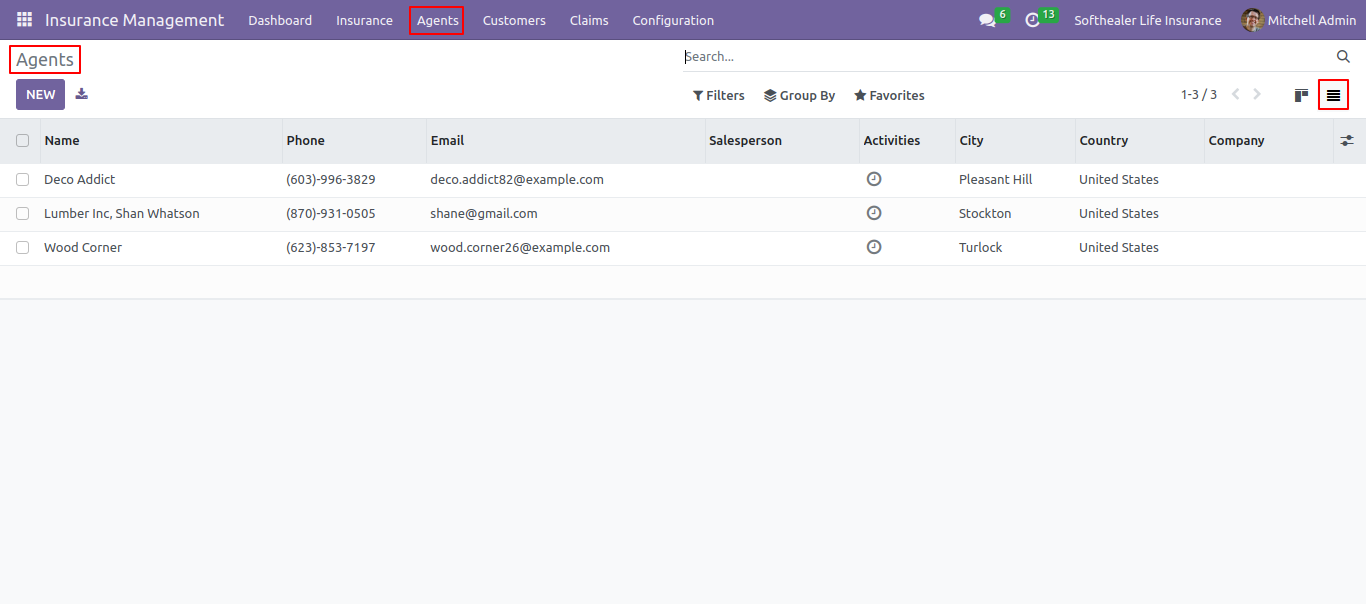

Agents kanban view.

Agents list view.

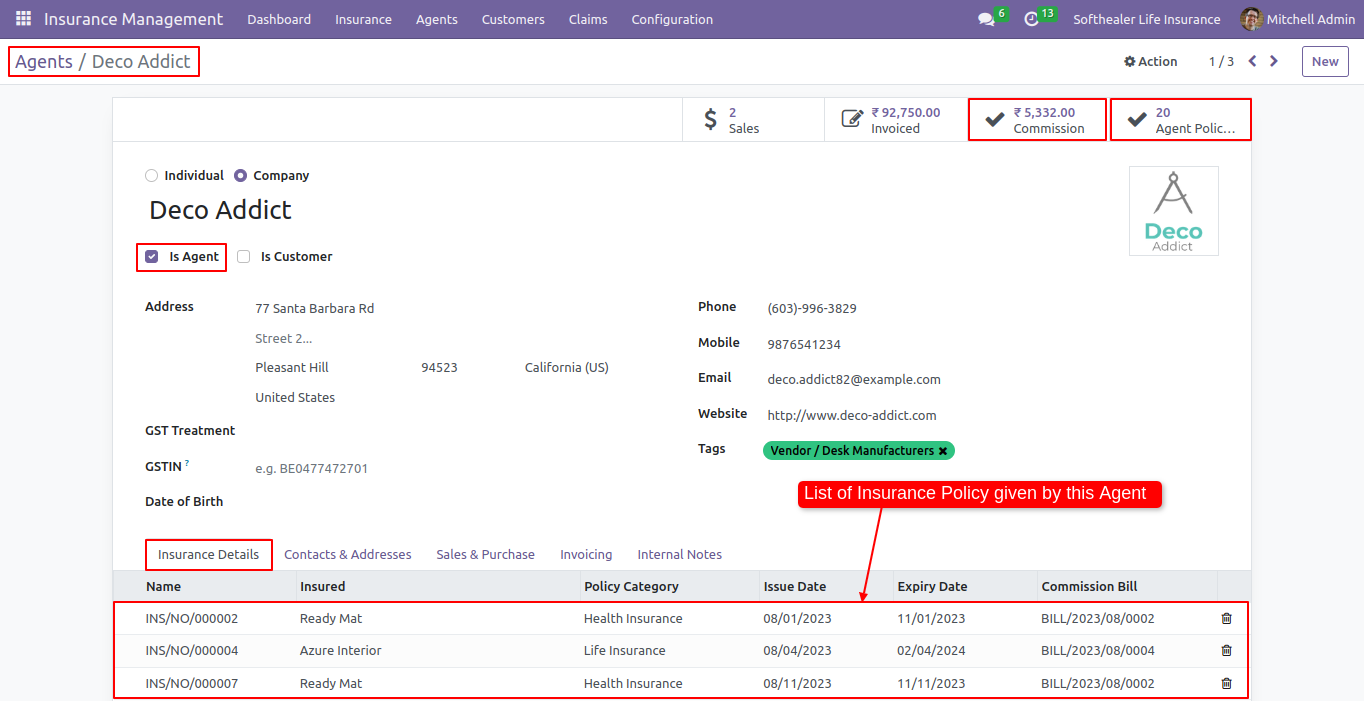

Create agents by clicking the Is Agent boolean and adding all required details.

You can see insurance policies and commission bills from the smart button.

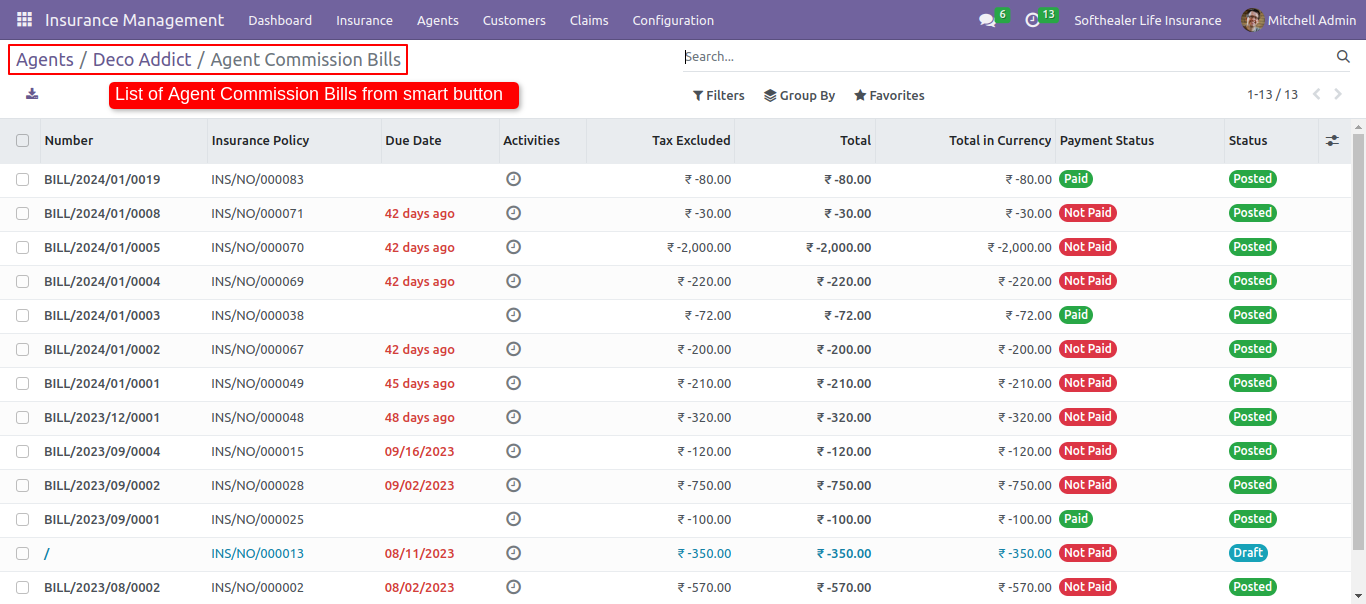

Click on the Commission Bills smart button from an agent and you can see a list of all commission bills of the selected agent.

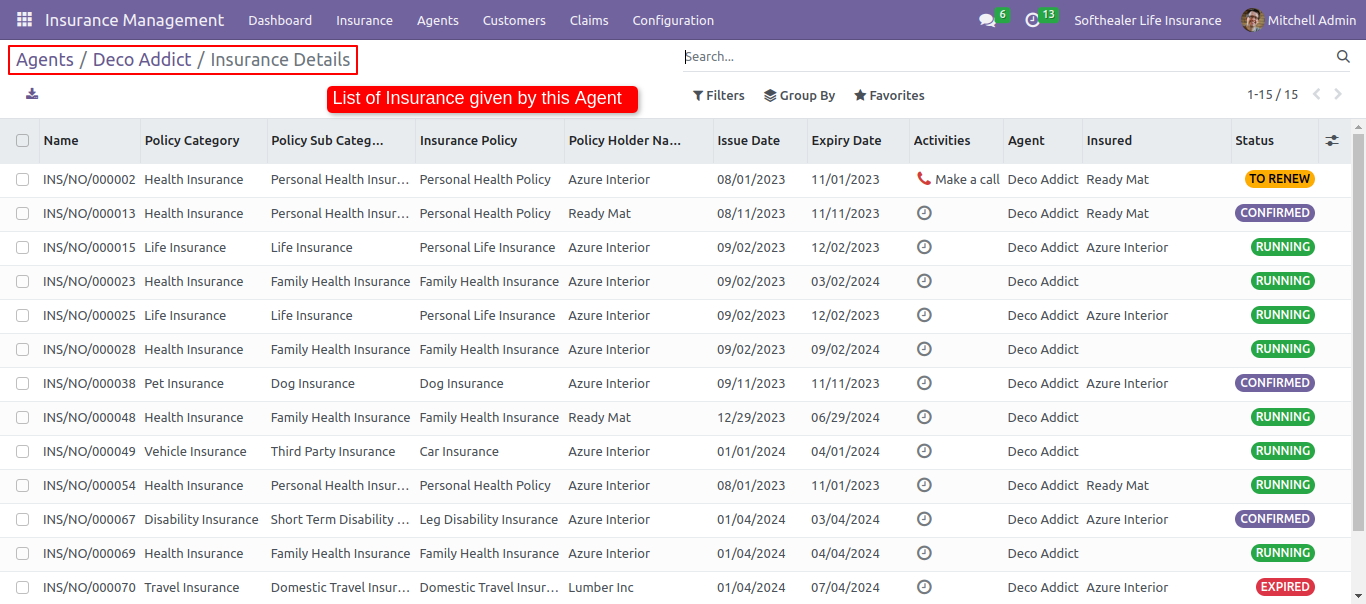

Click on the Insurance smart button from an agent and you can see a list of all policies of the selected agent.

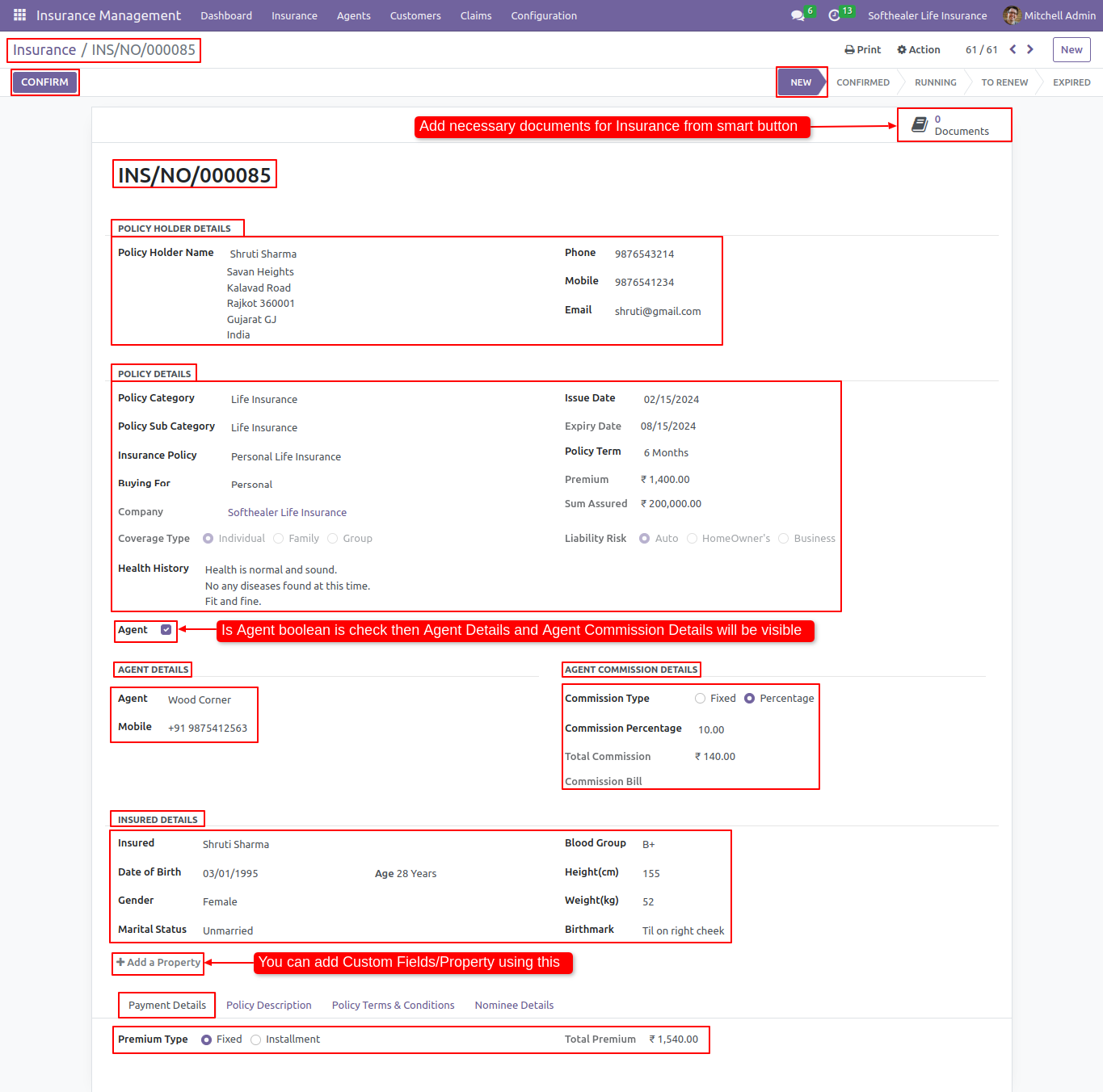

Create new insurance and add all the required details & select payment details.

The policy description field is auto-filled upon selecting the insurance policy.

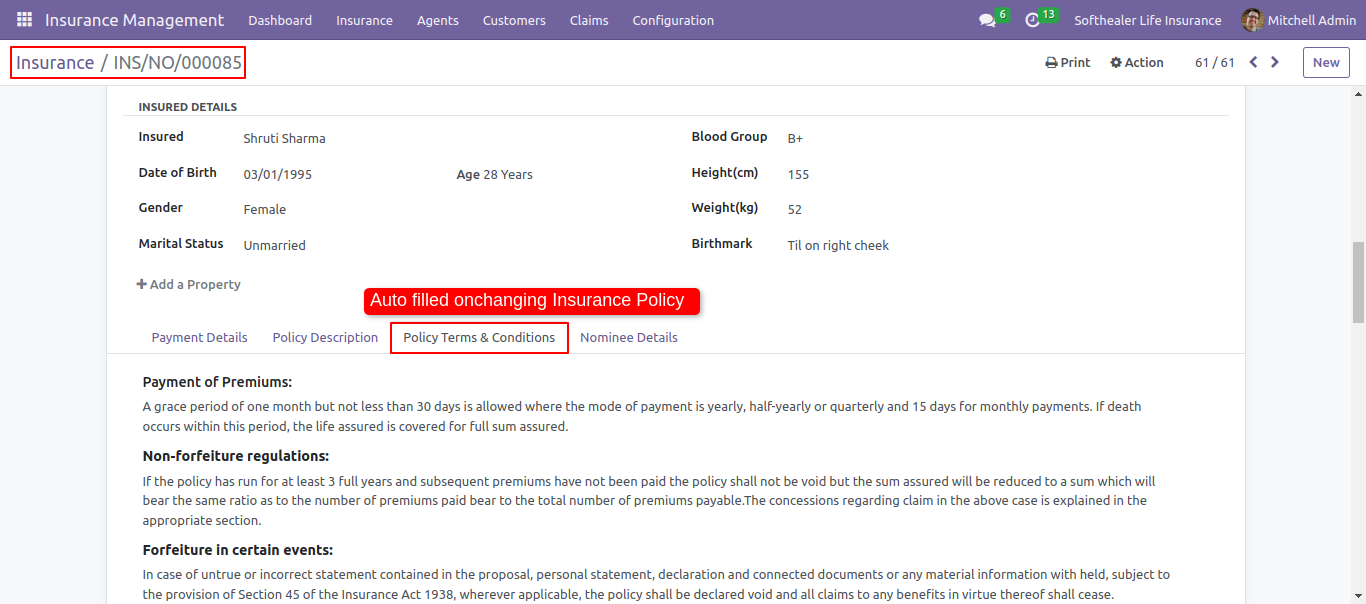

The policy Terms & Conditions field is auto-filled on selecting the insurance policy.

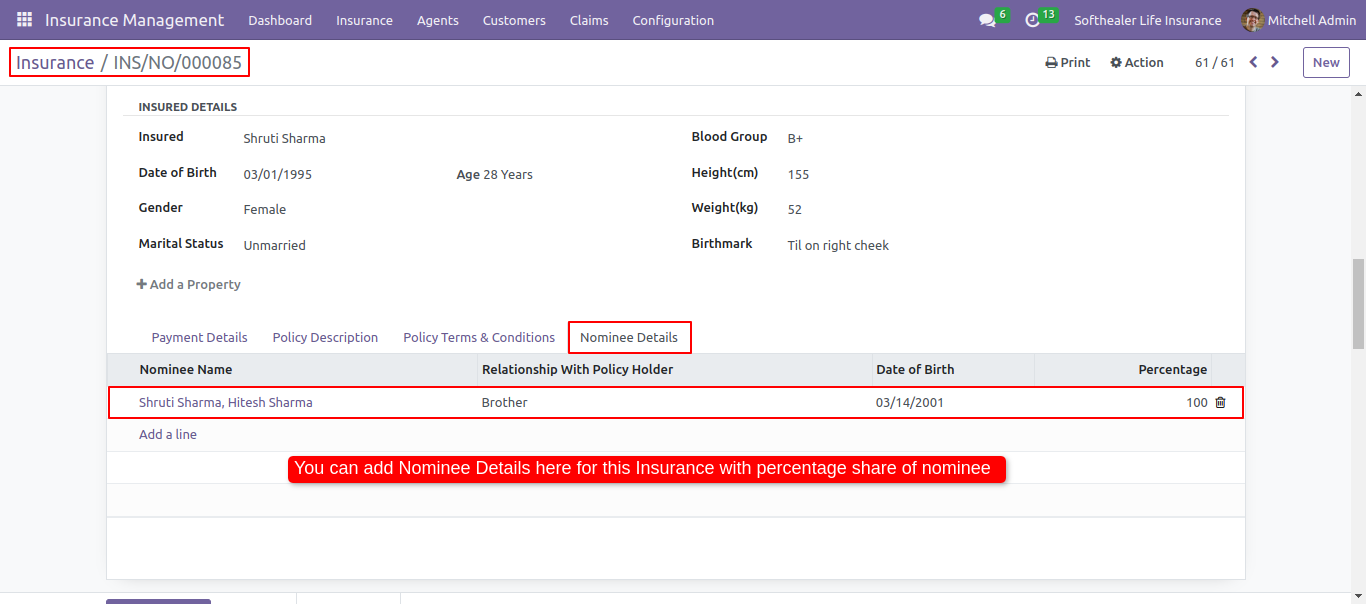

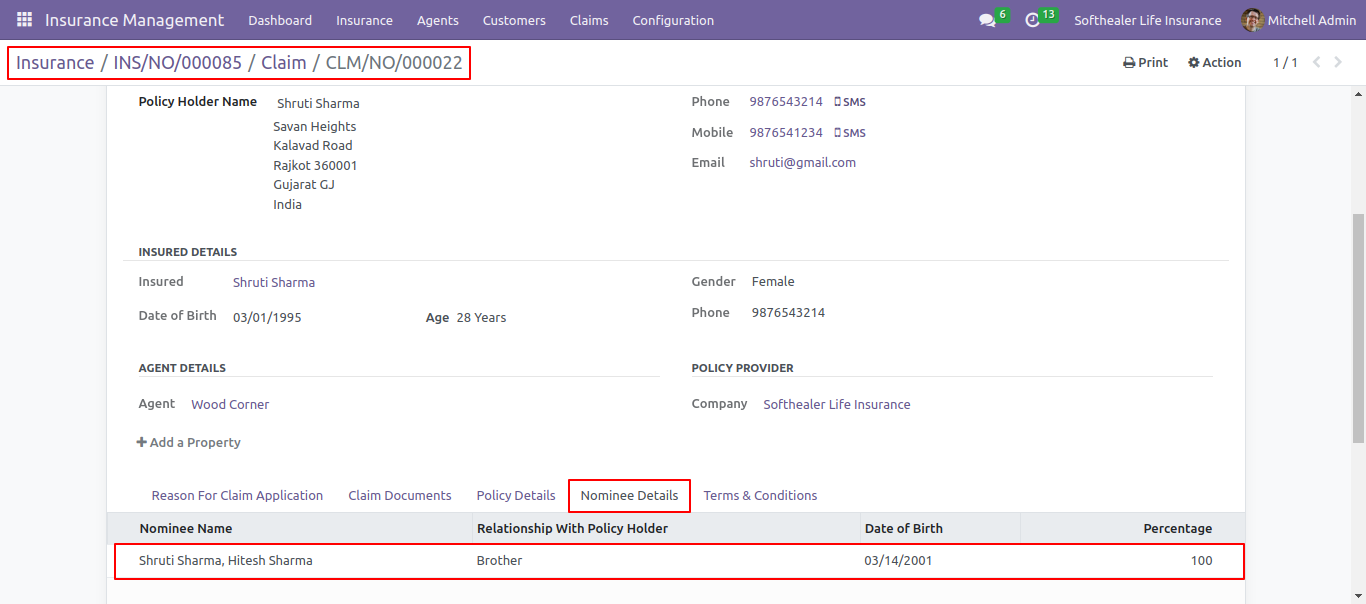

Add nominee details of the policy holder and also select the relation and percentage of the share.

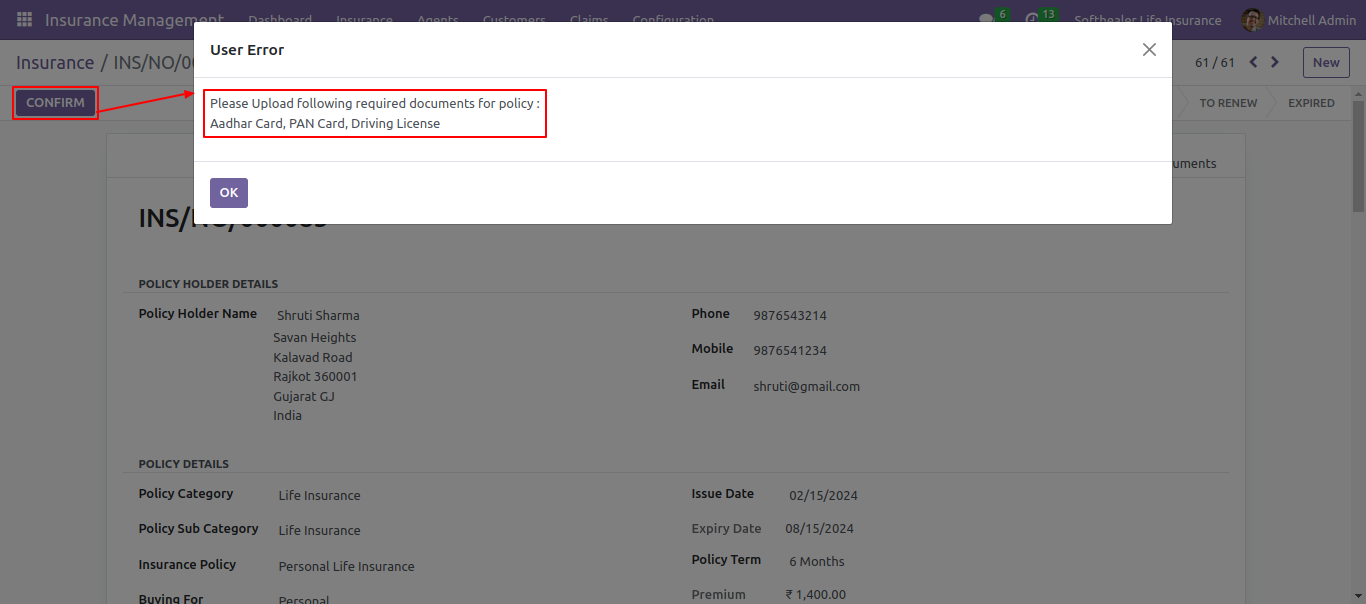

If you confirm without uploading documents it will accrue an error to upload a required document which we have set in an insurance policy.

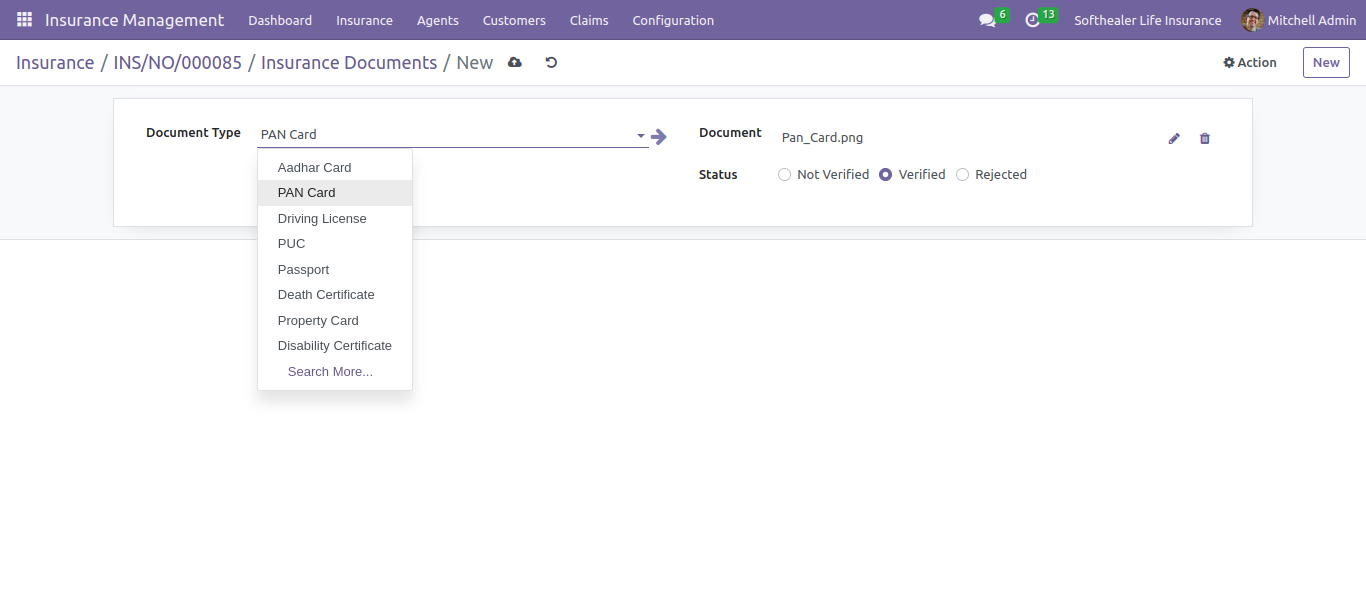

Insurance document form view.

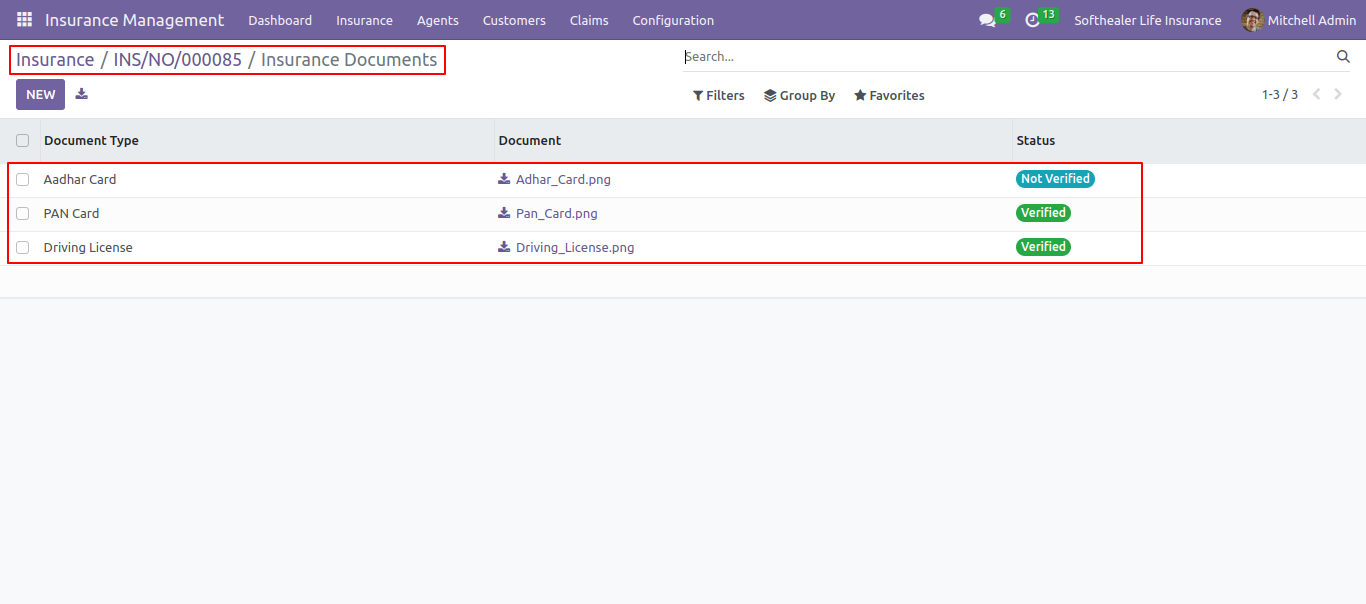

Insurance document list view.

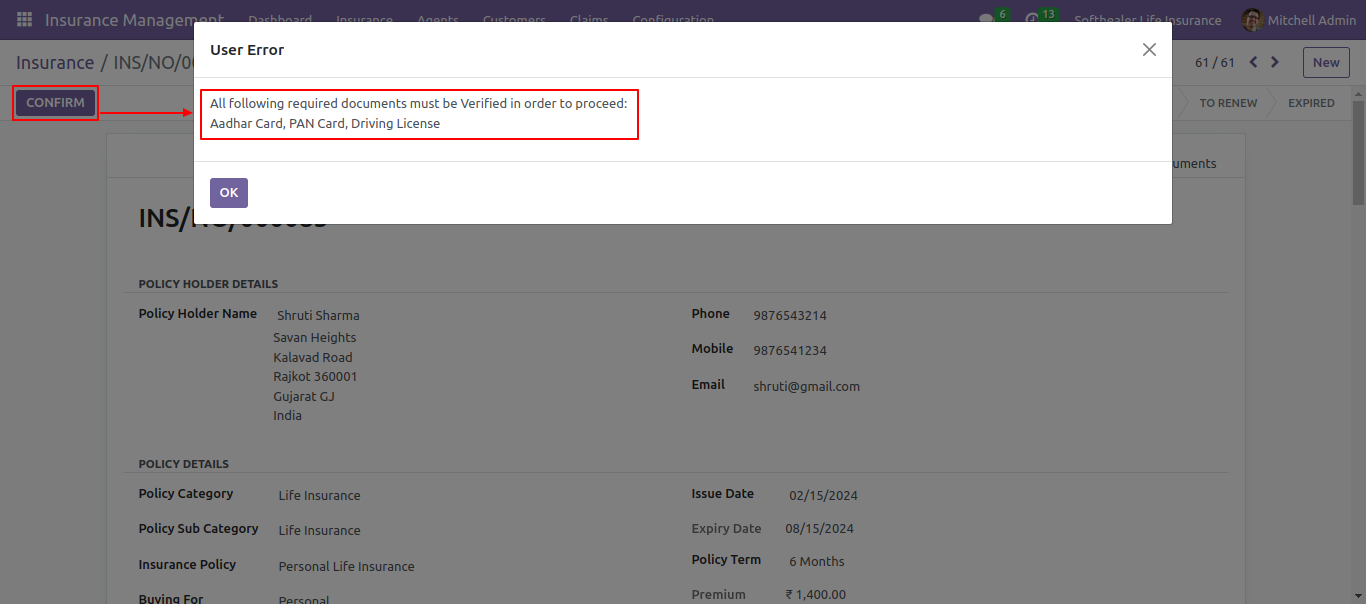

Uploaded documents must be verified if not verified it will generate a warning to varify the documents.

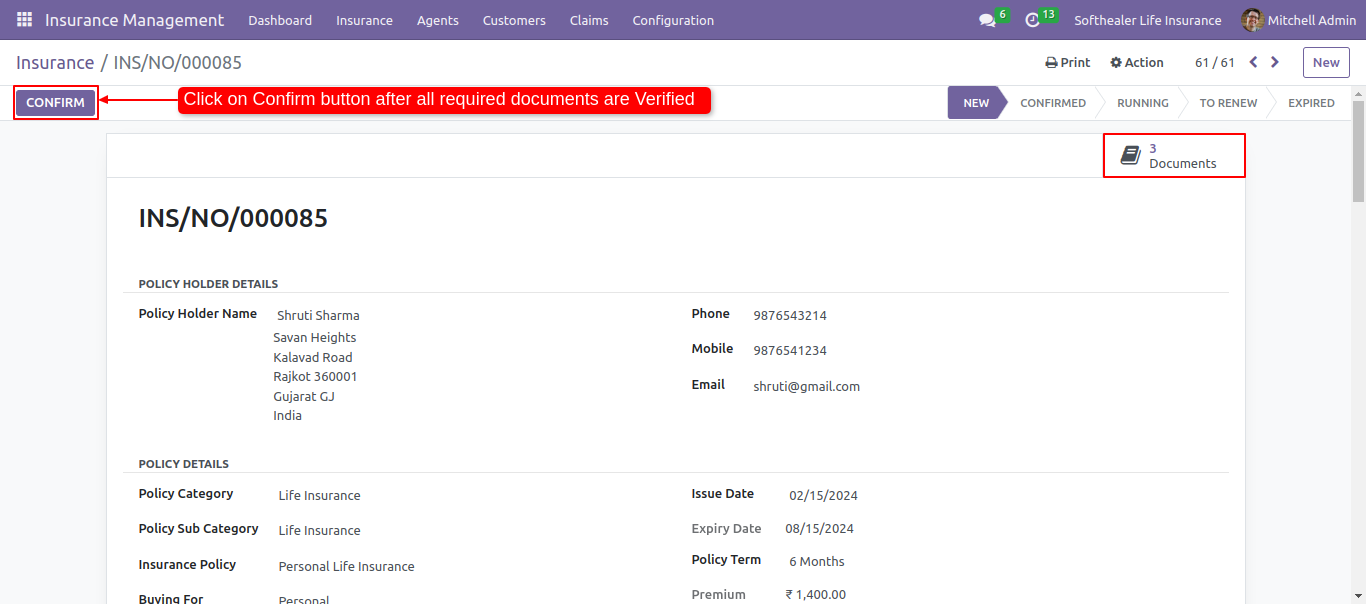

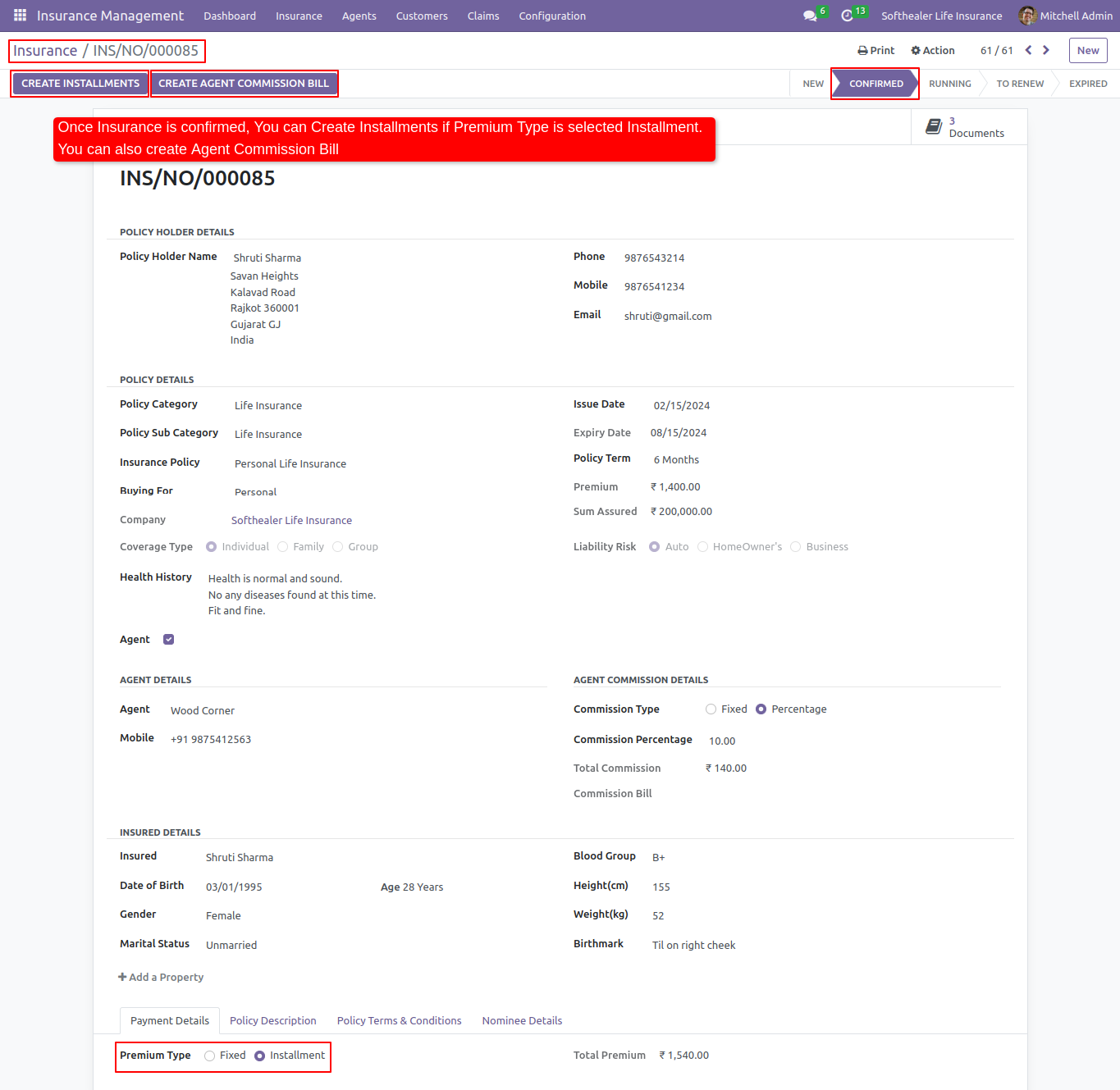

Click on the confirm button after all required documents are verified.

The stage will change from new to confirmed.

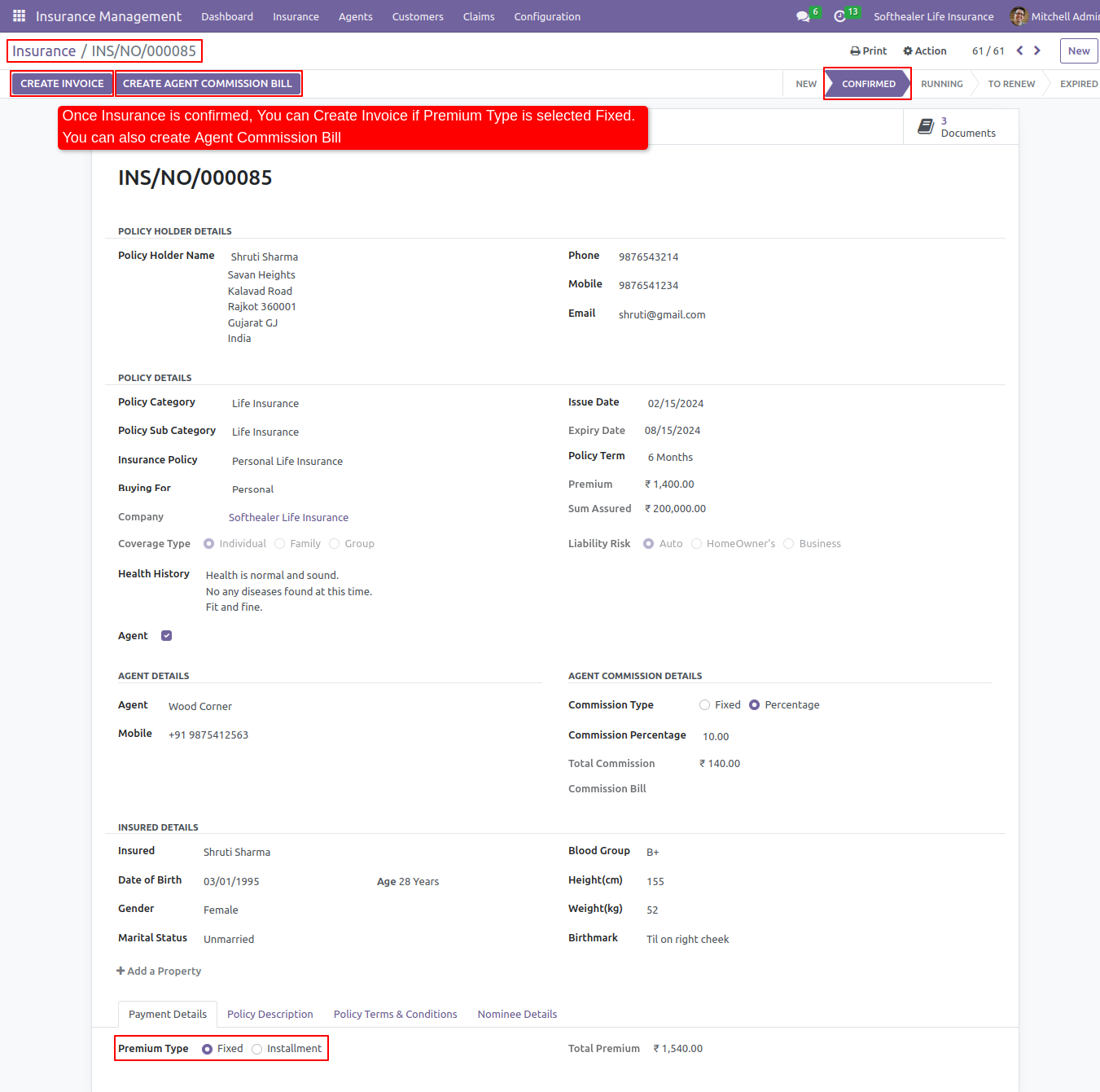

Once insurance is confirmed you can create an invoice if the premium type is selected fixed.

You can also create an agent commission bill from here.

Once insurance is confirmed you can create instalments if the premium type is selected instalment.

If you want to start the policy first pay the fixed premium or first installment.

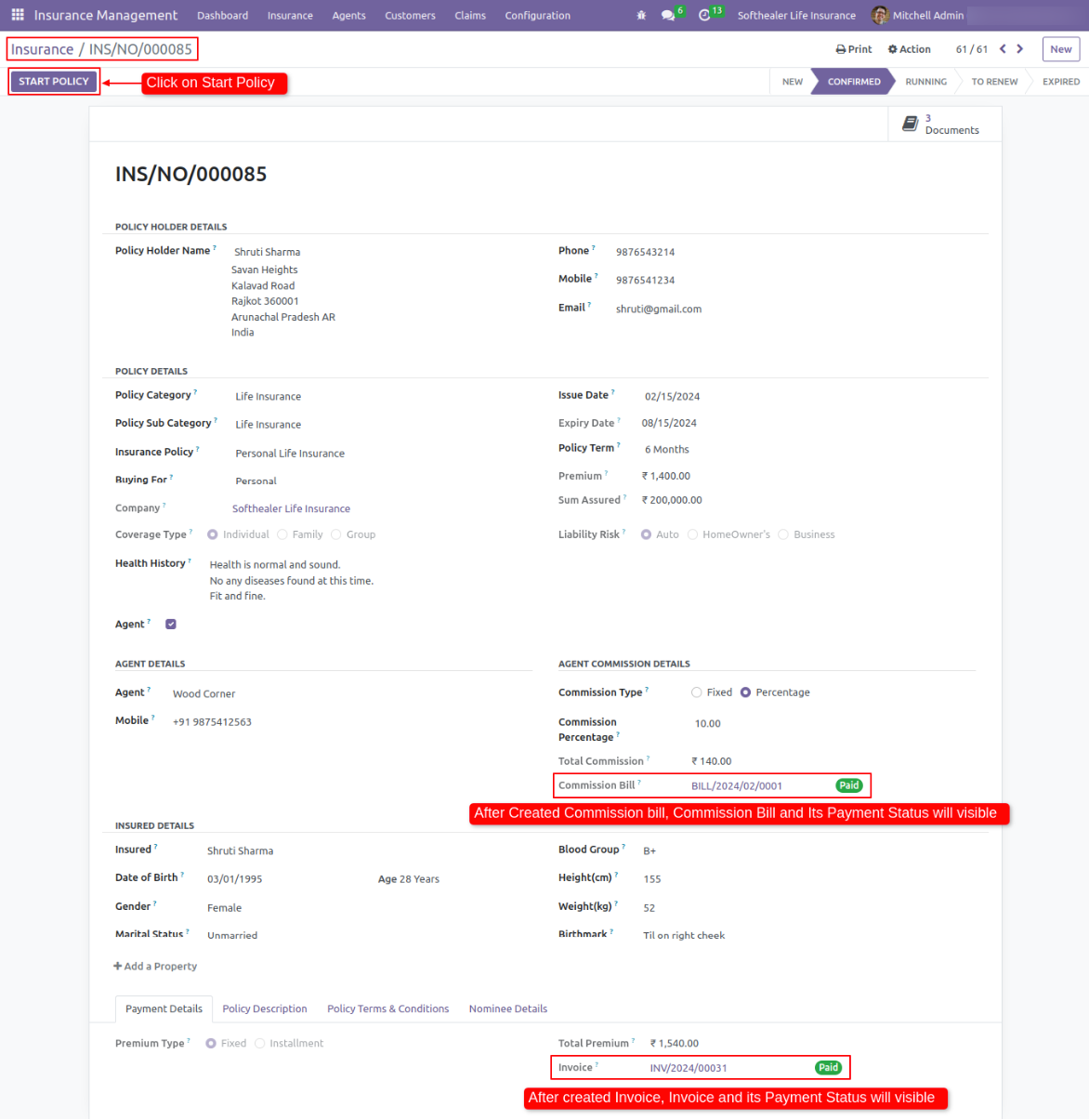

when the invoice is paid and the commission bill is paid click on the start policy button.

After the start policy, it will change in the running stage.

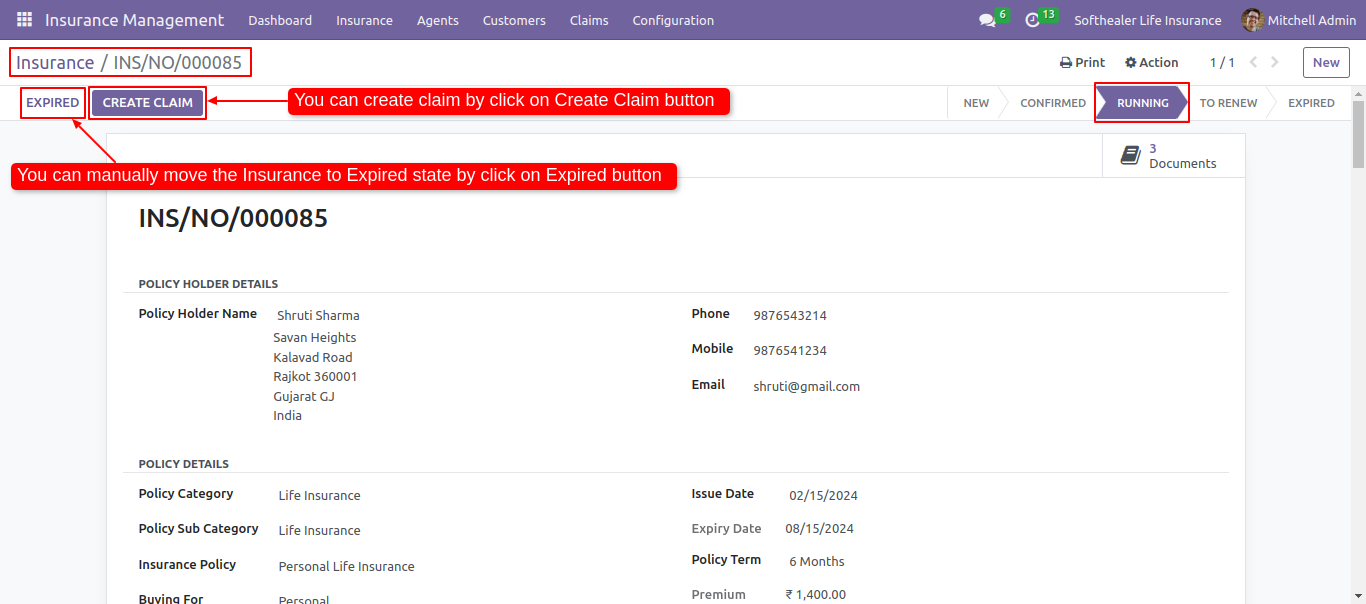

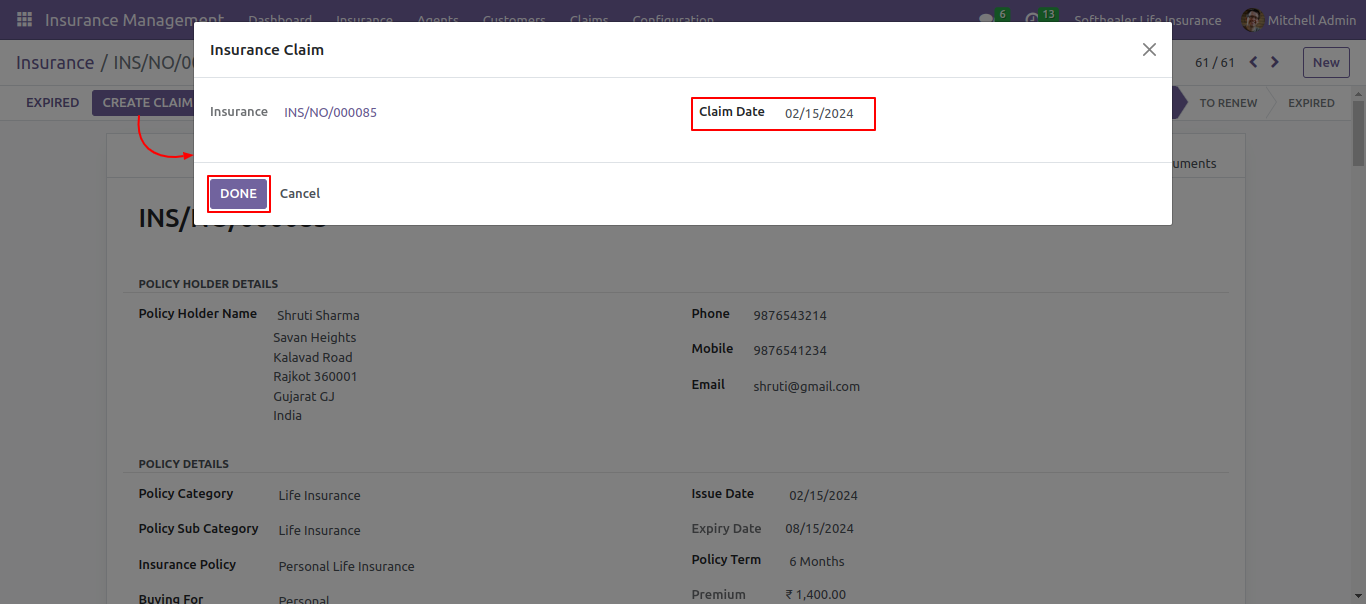

You can a create claim by clicking on the create claim button.

You can manually move to expire stage by clicking on an expired button.

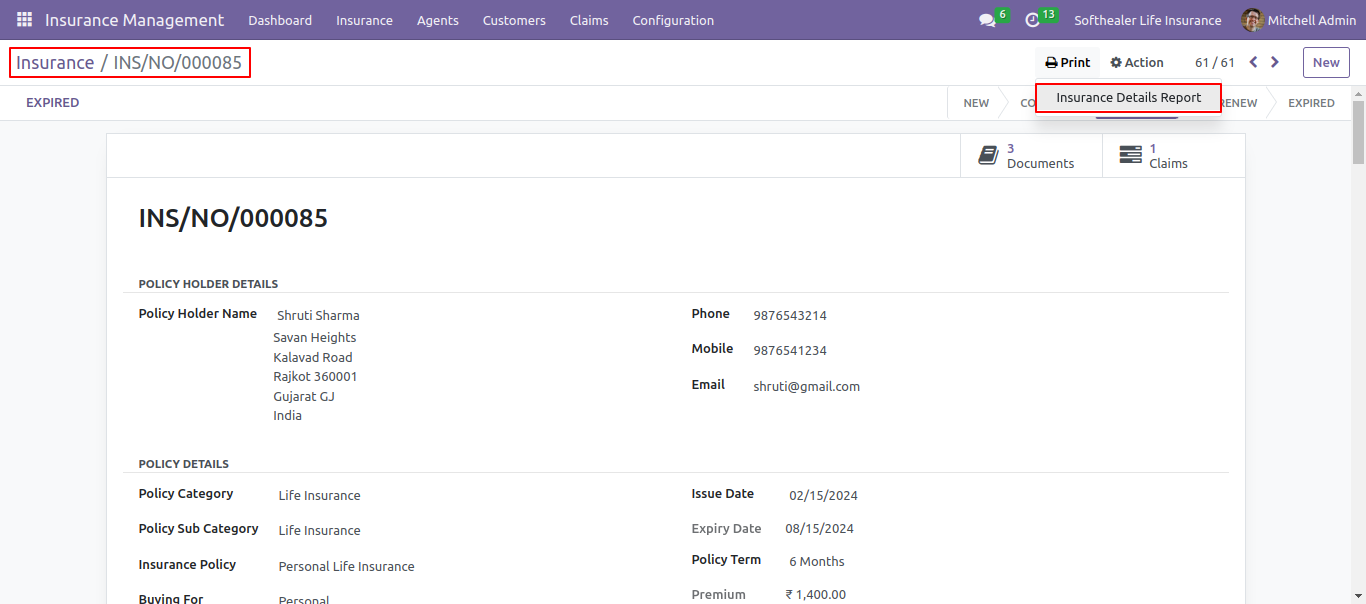

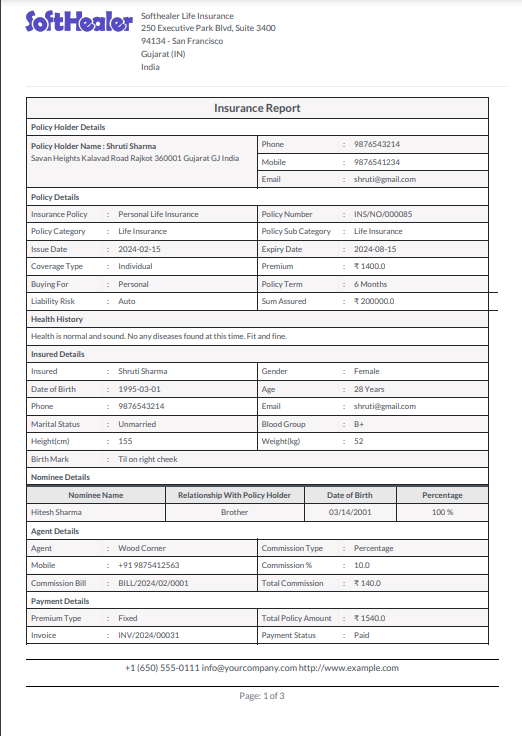

You can print insurance detail reports by clicking on print.

Insurance report in pdf format with all policy details.

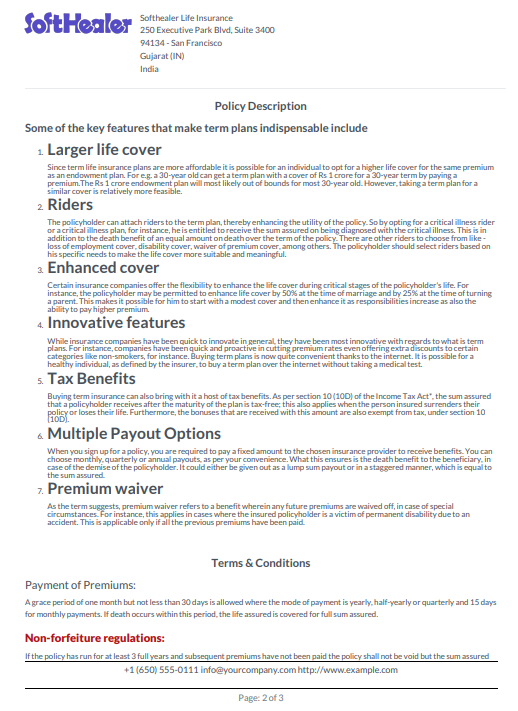

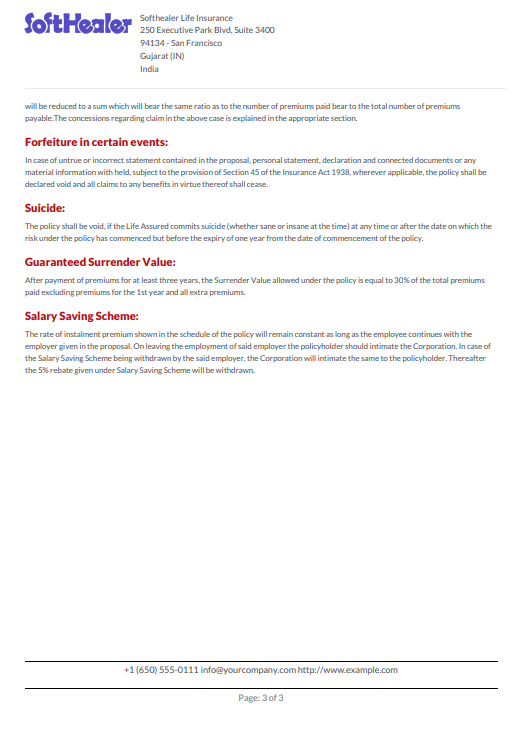

Policy description and terms & conditions in pdf print report.

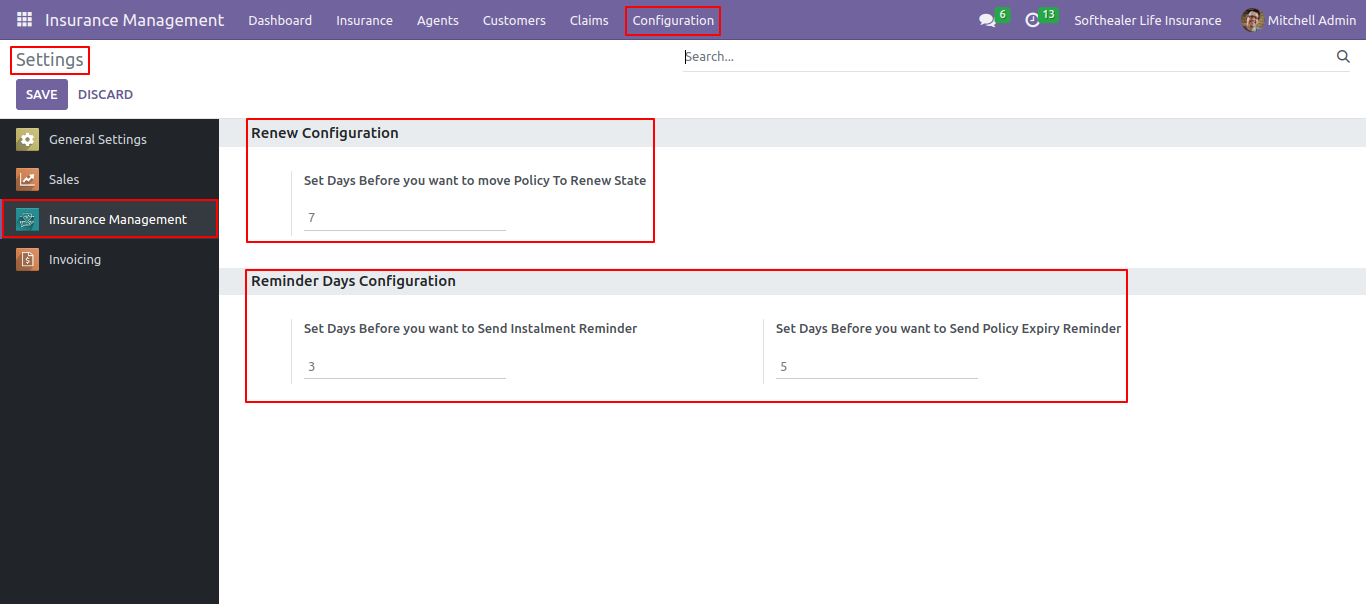

From Insurance management settings you can set reminders.

You can set renew configurations.

You can set reminder days configuration.

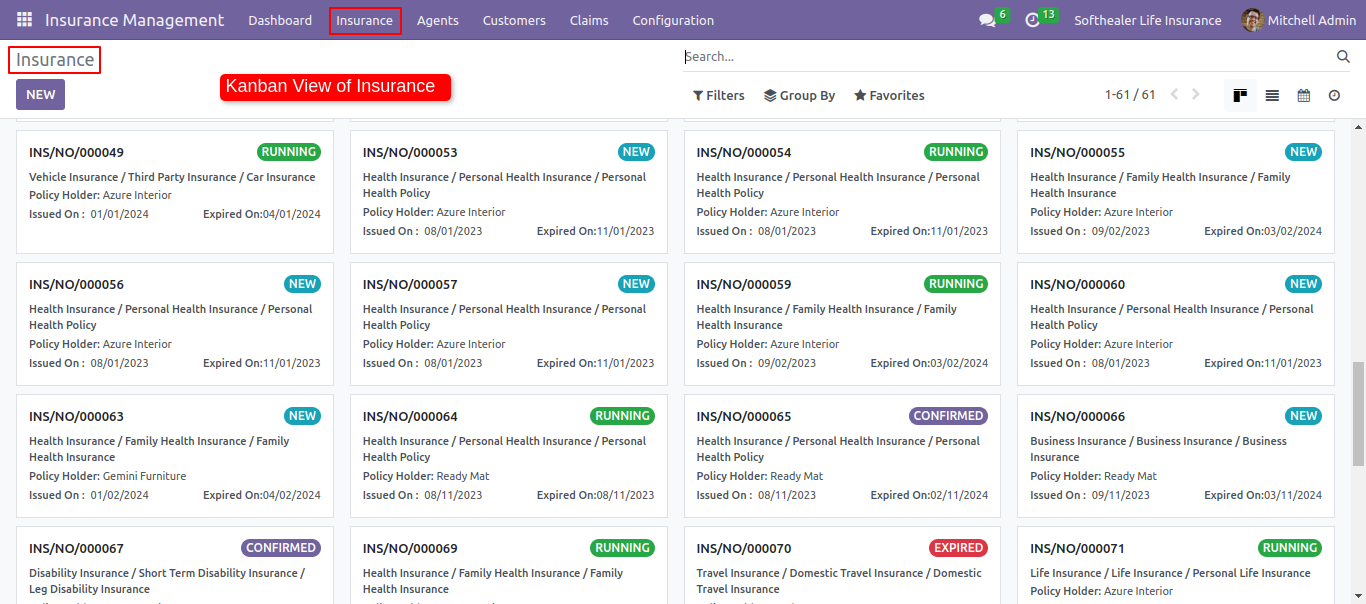

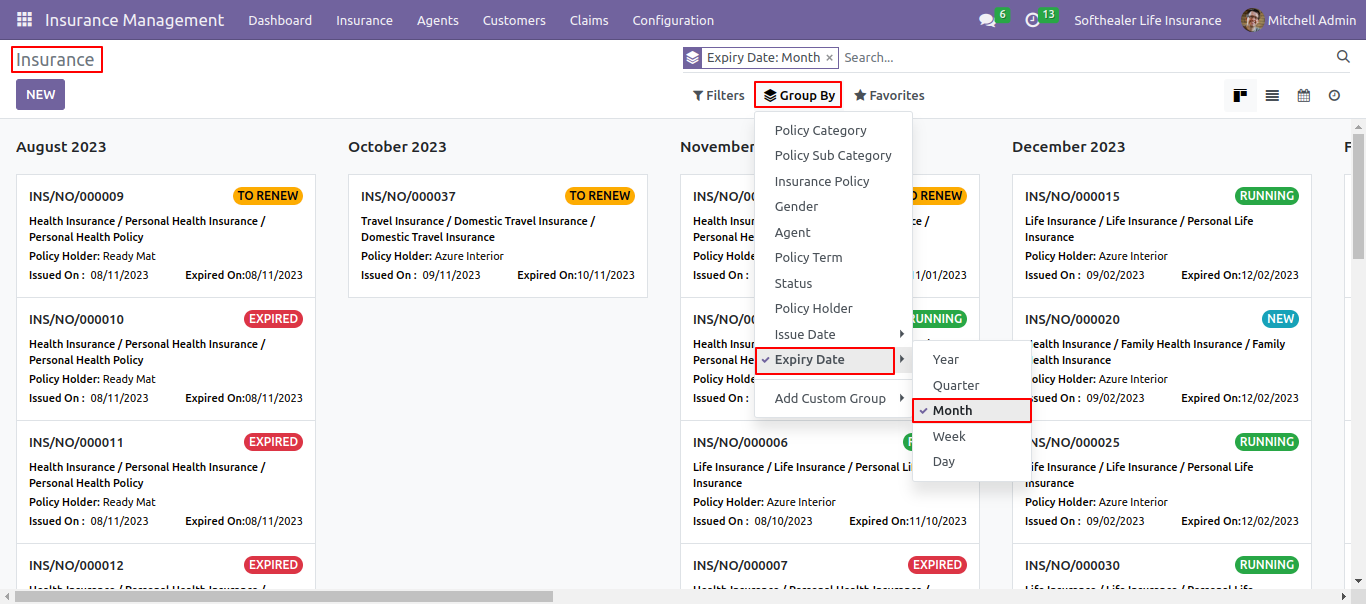

Insurance kanban view.

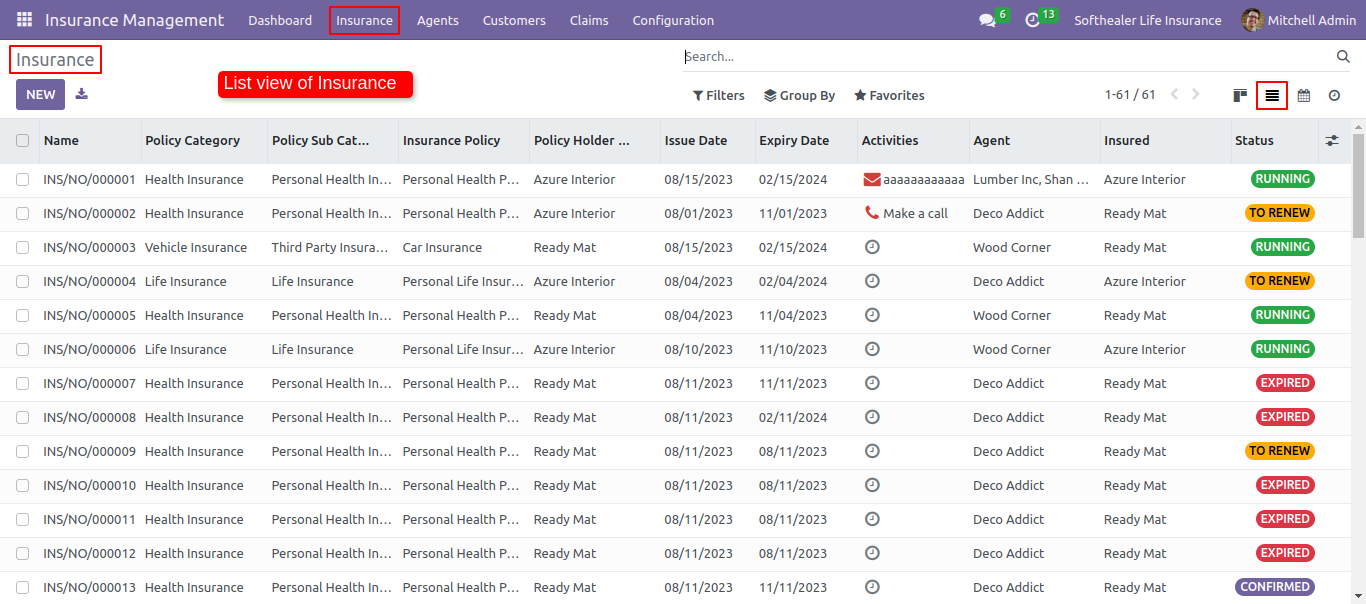

Insurance list view.

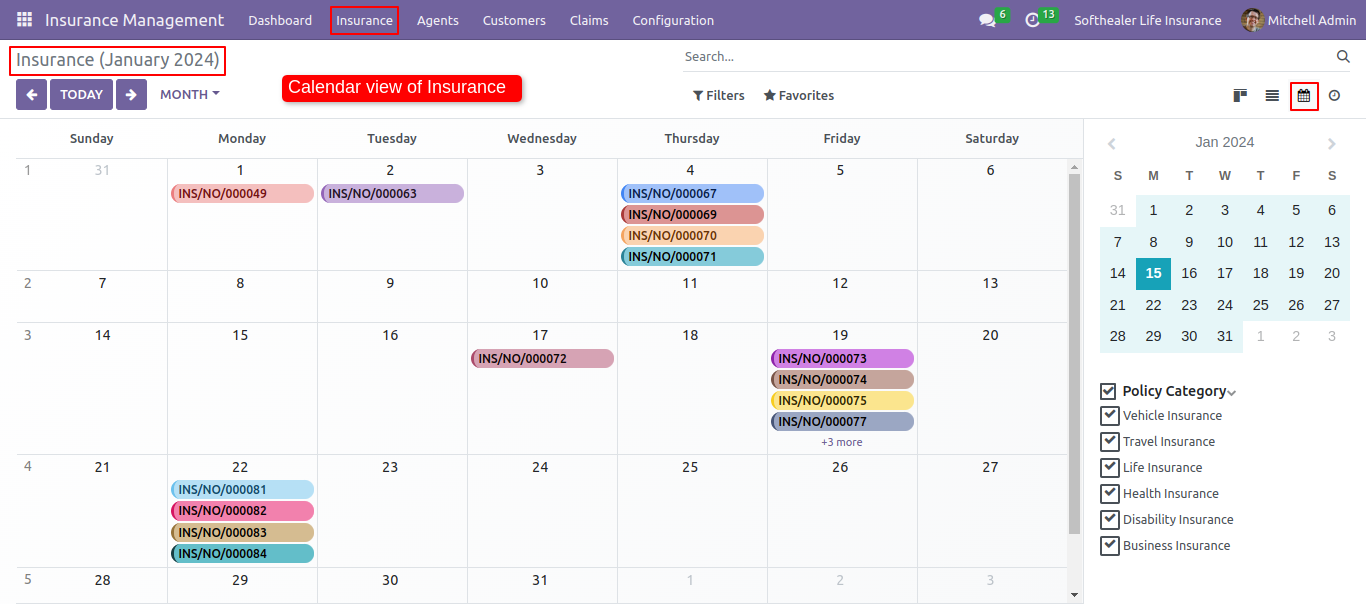

Insurance calendar view.

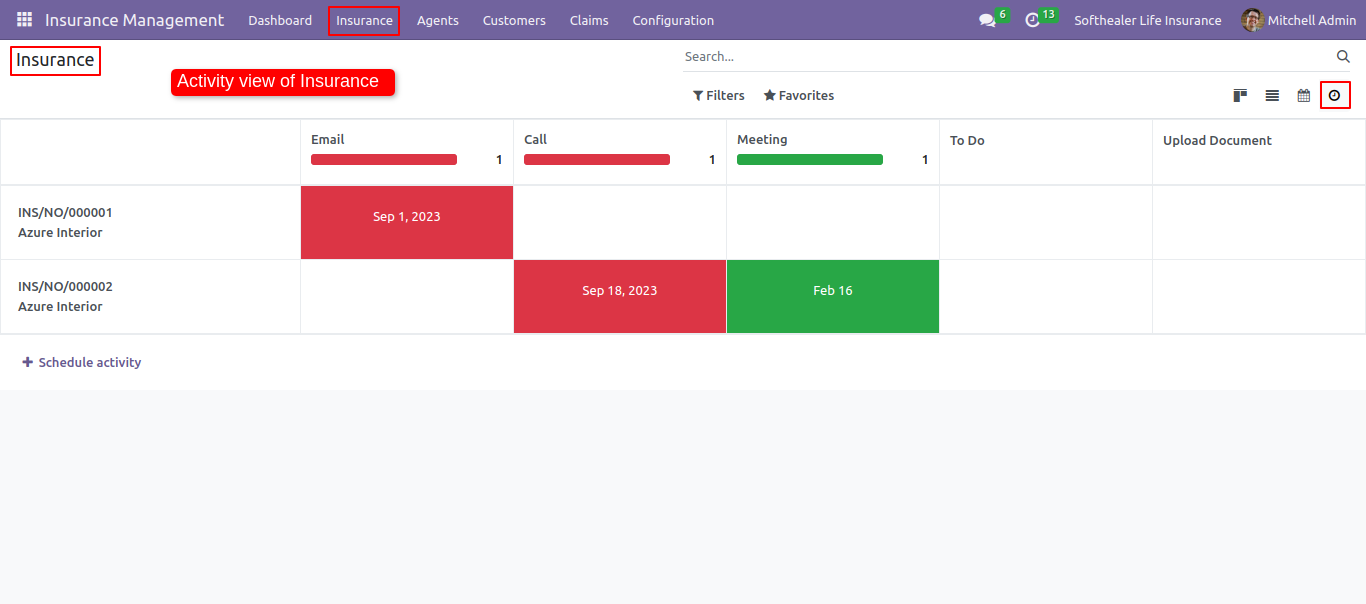

Insurance activity view.

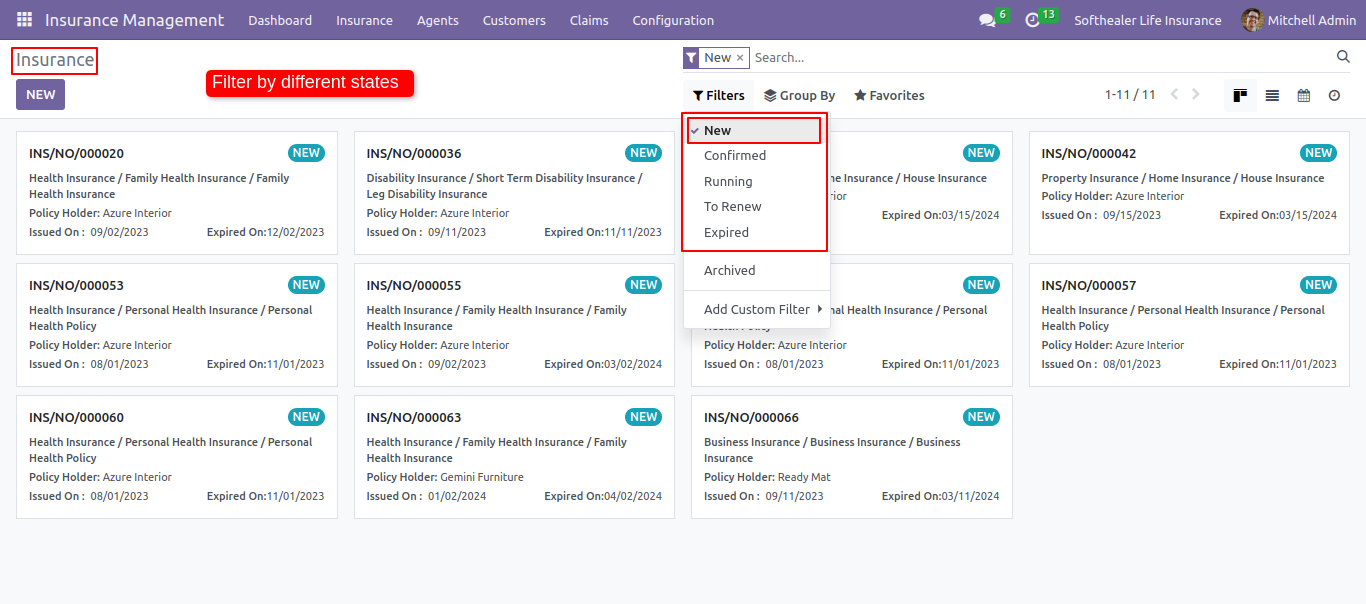

Insurance filter by different stages.

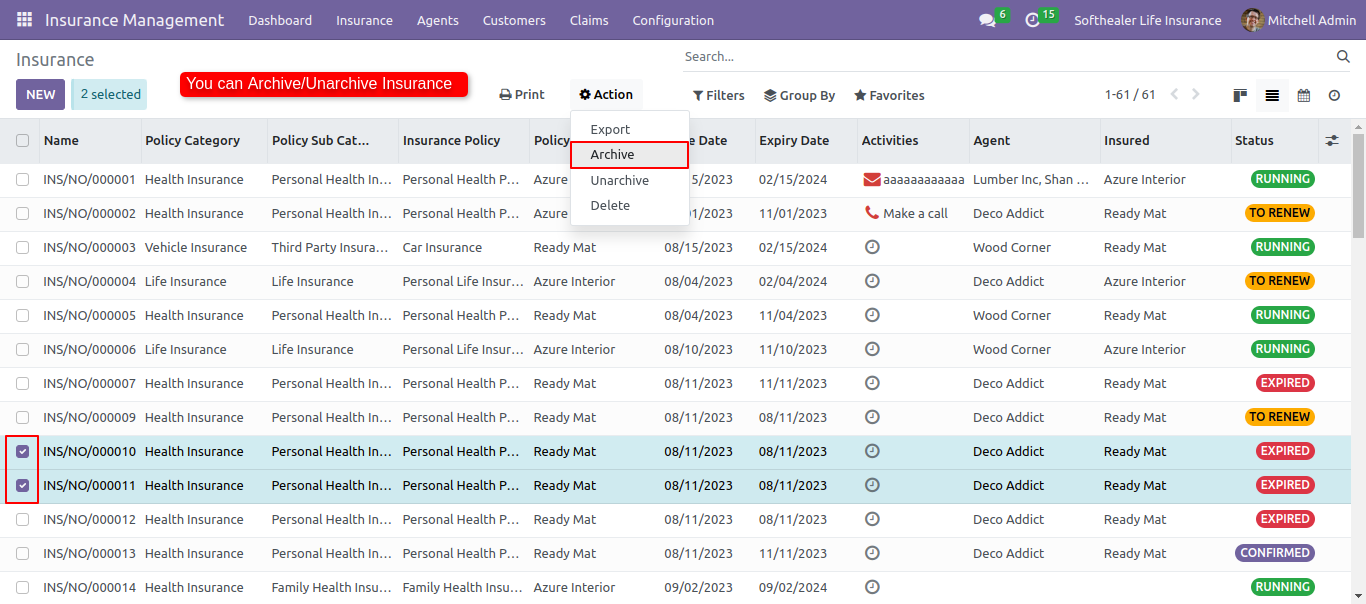

You can Archive or unarchive Insurance by action button.

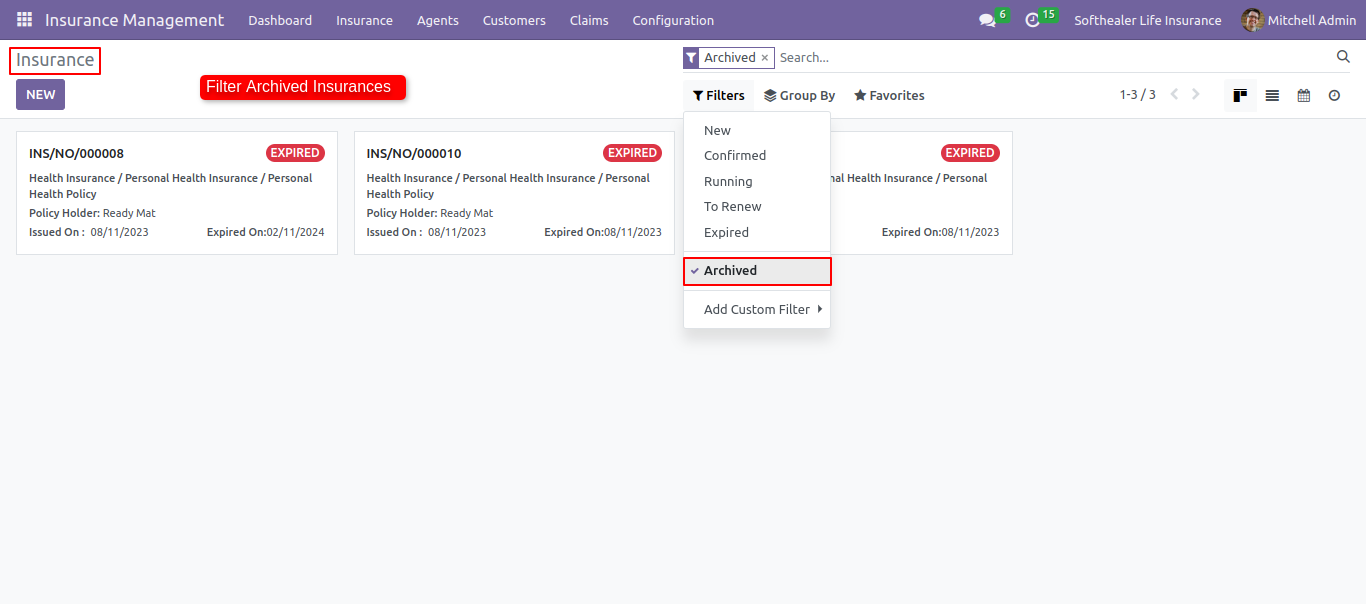

You can see archived insurance from filtering by archived.

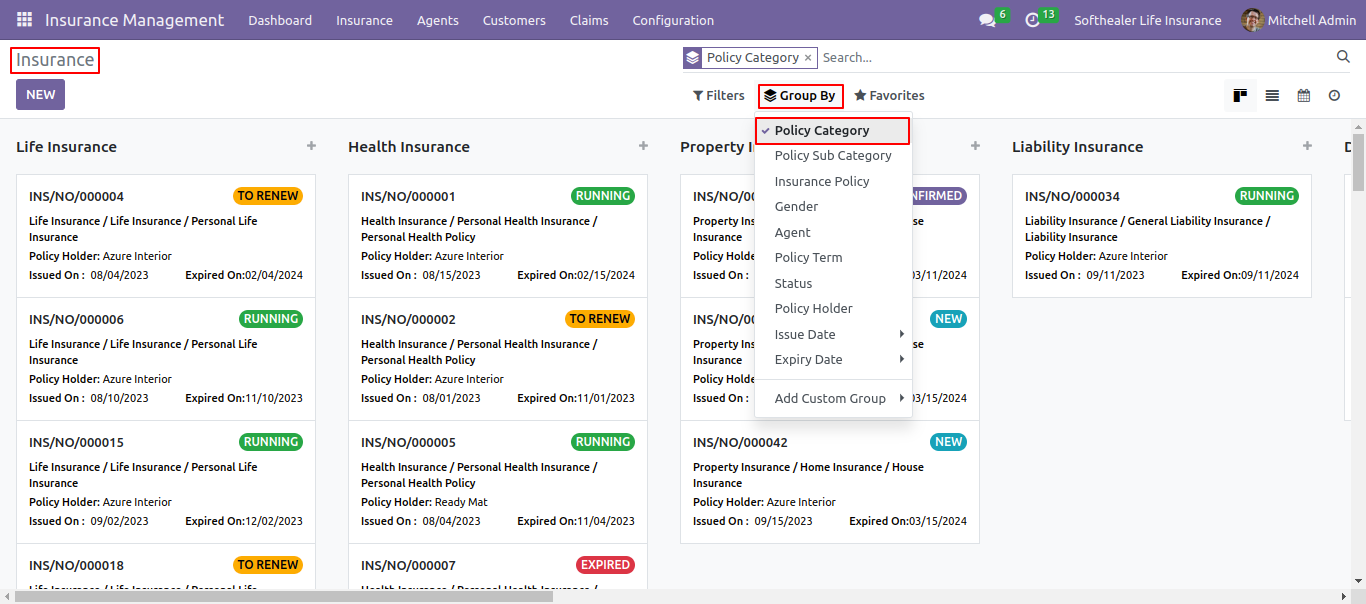

You can see the insurance group by Policy category.

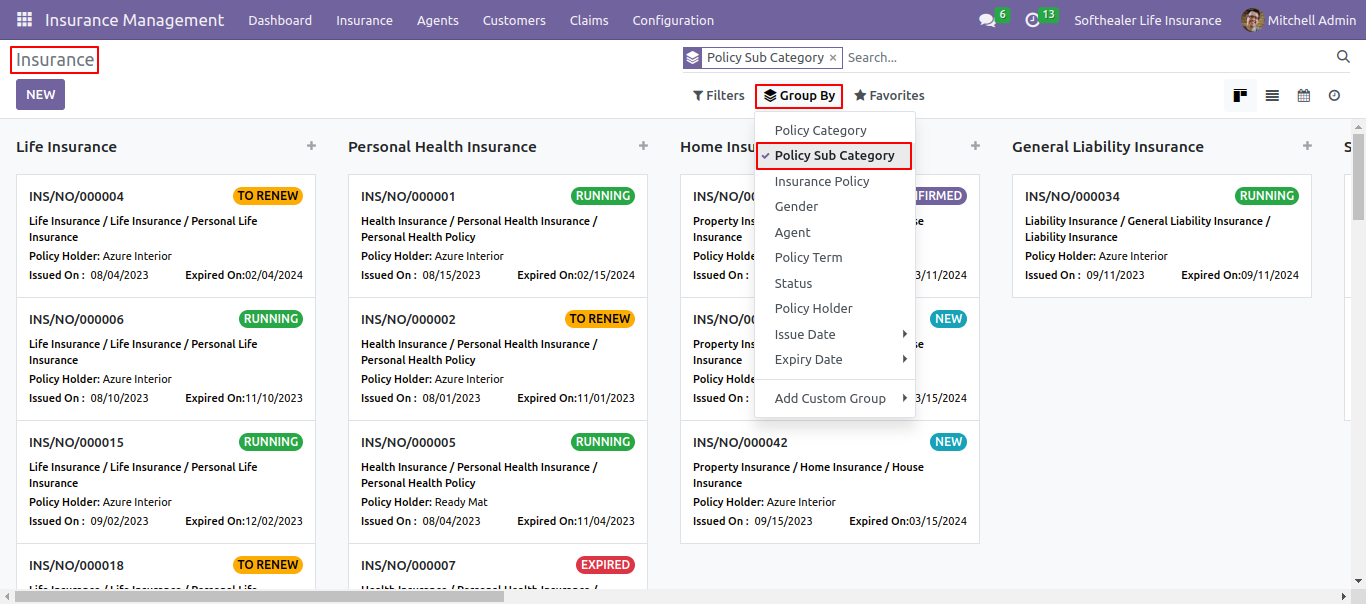

You can see the insurance group by Policy sub category.

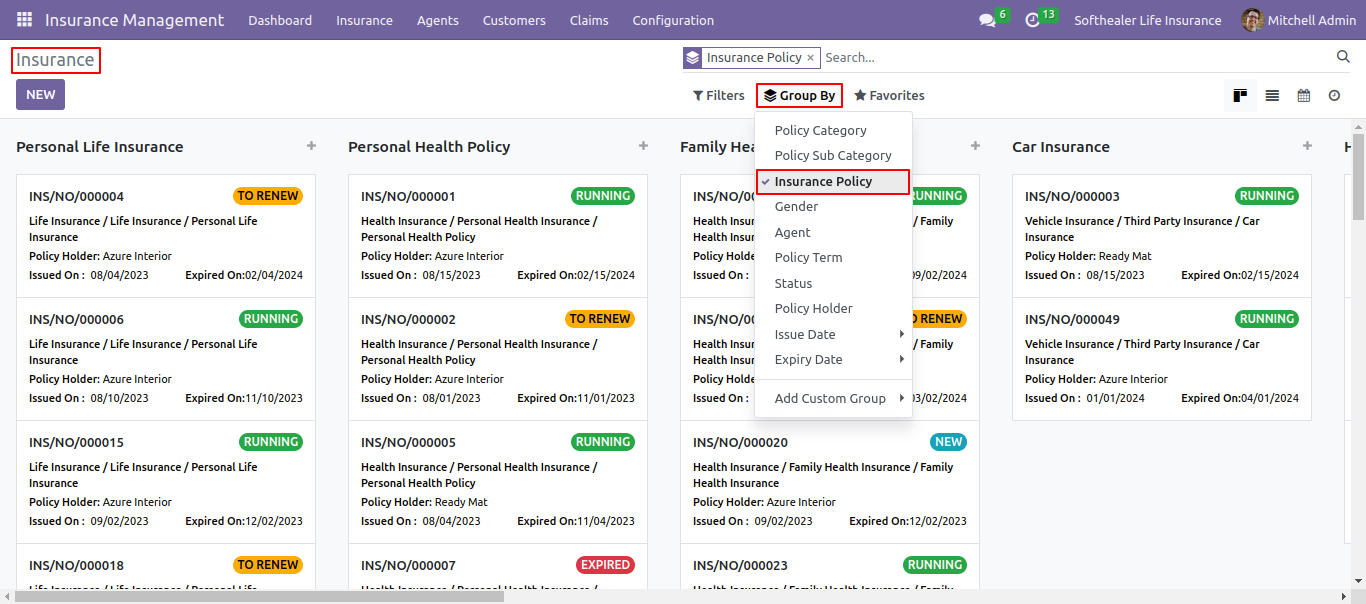

You can see the insurance group by Insurance Policy.

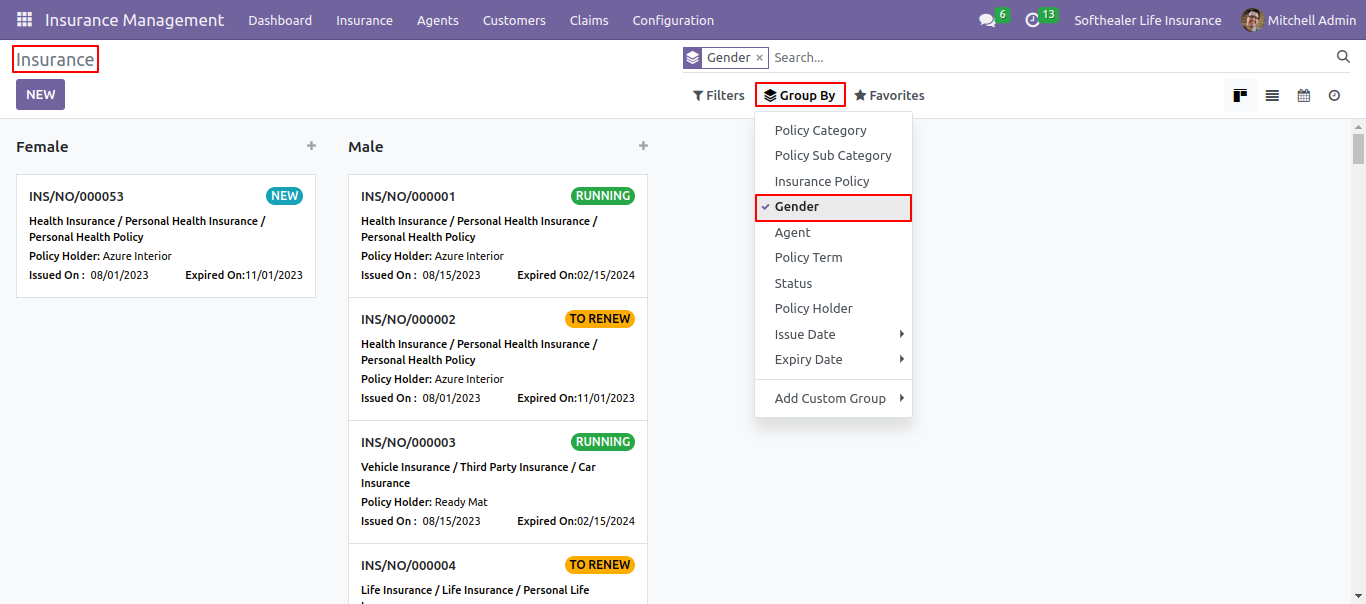

You can see the insurance group by Gender.

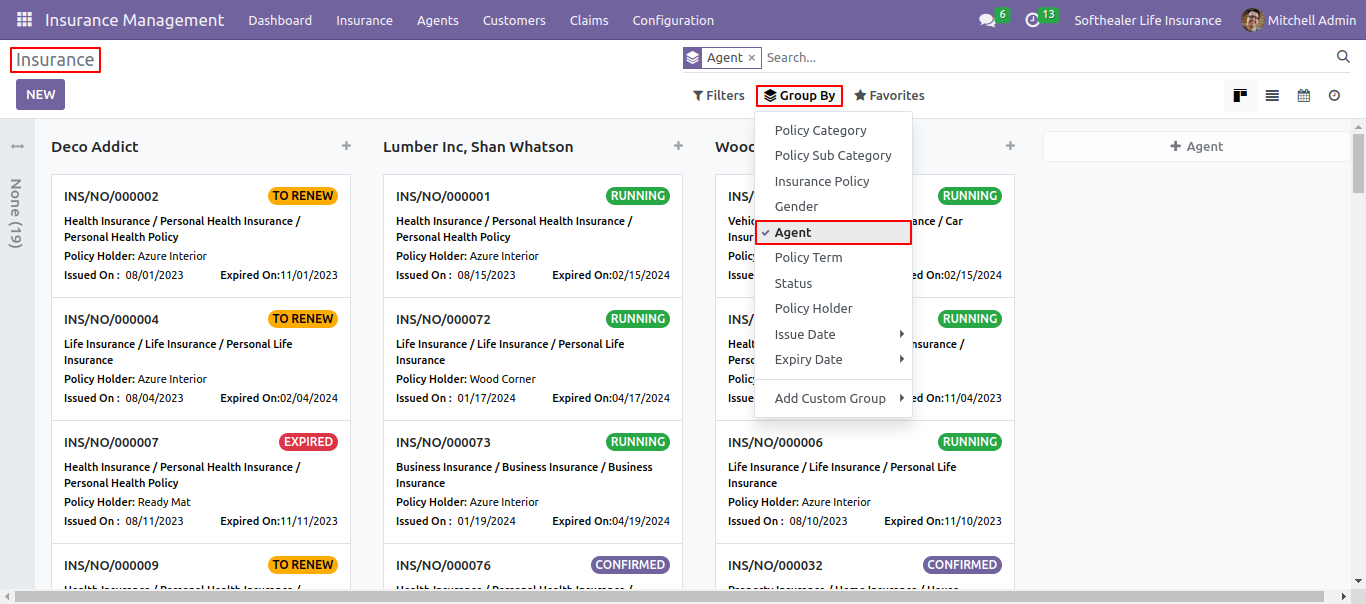

You can see the insurance group by Agent.

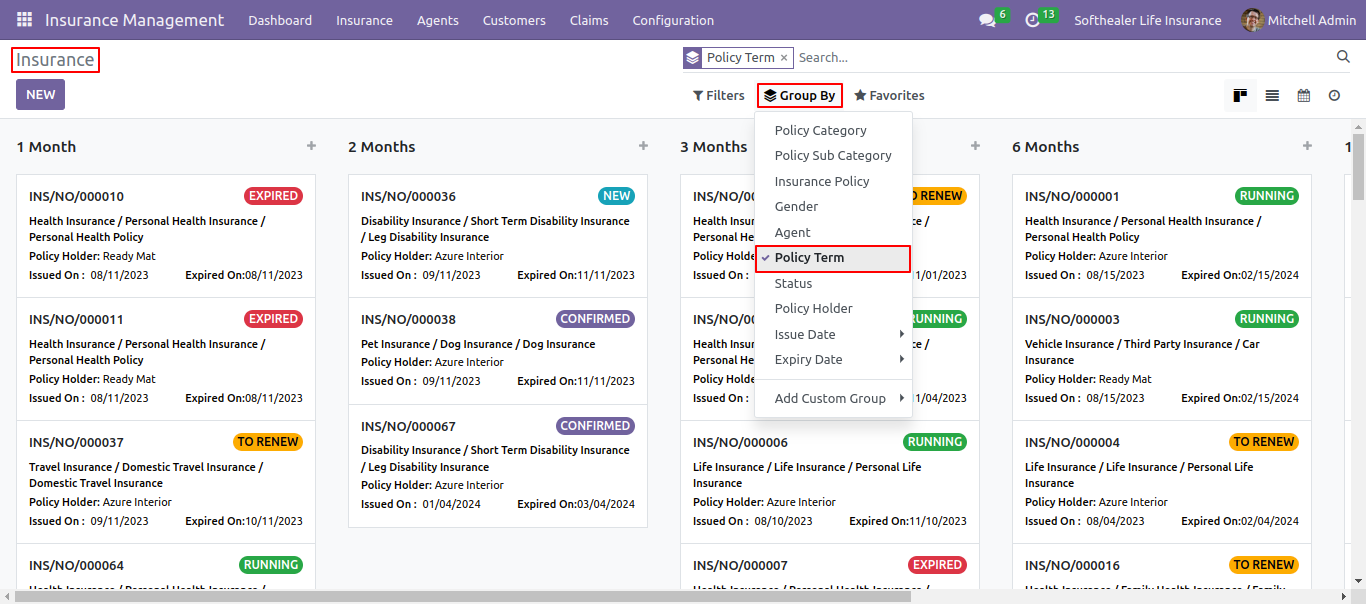

You can see the insurance group by the Policy term.

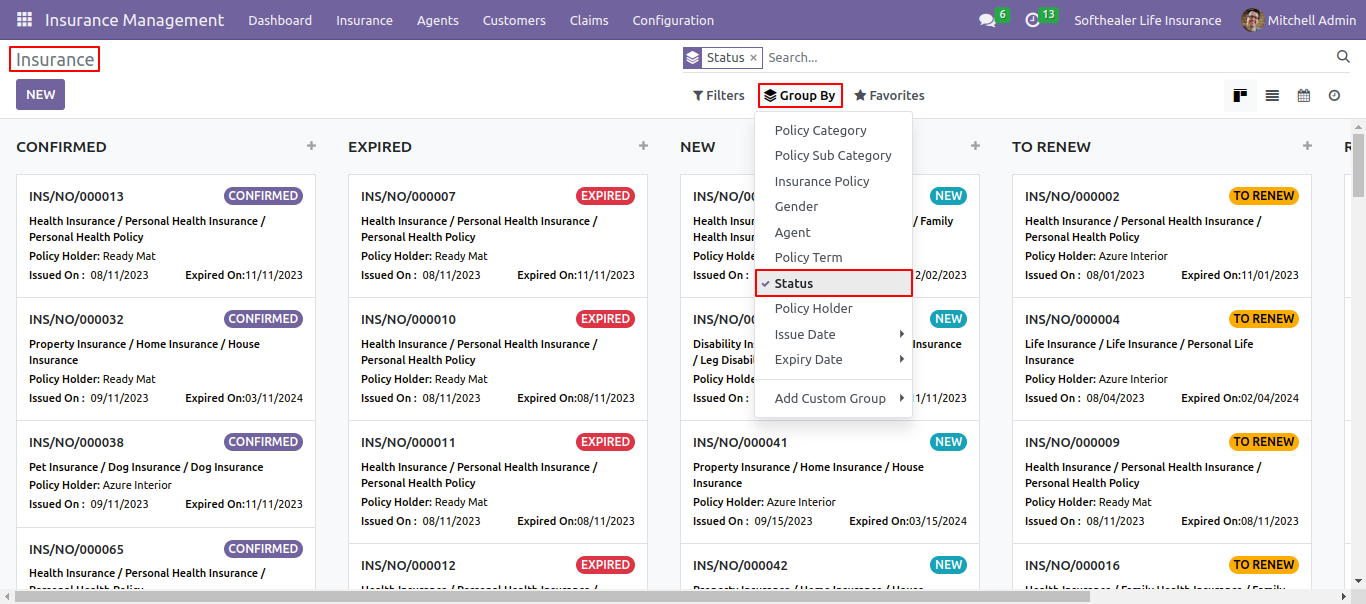

You can see the insurance group by Policy status.

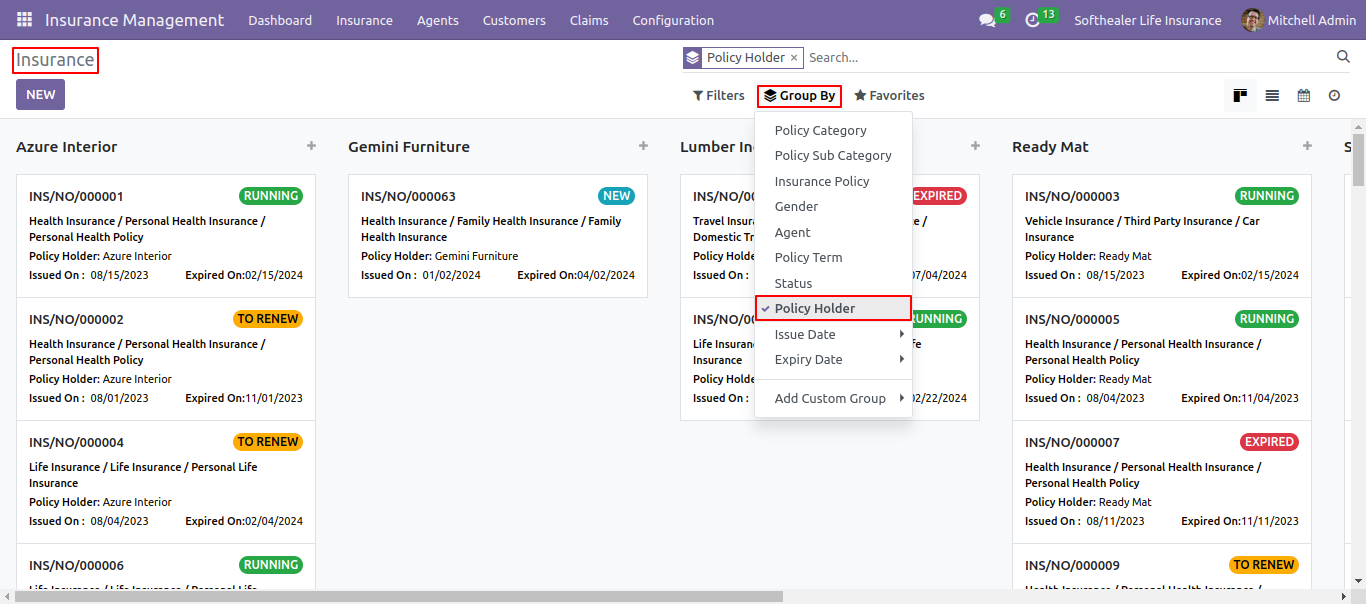

You can see the insurance group by Policy holder.

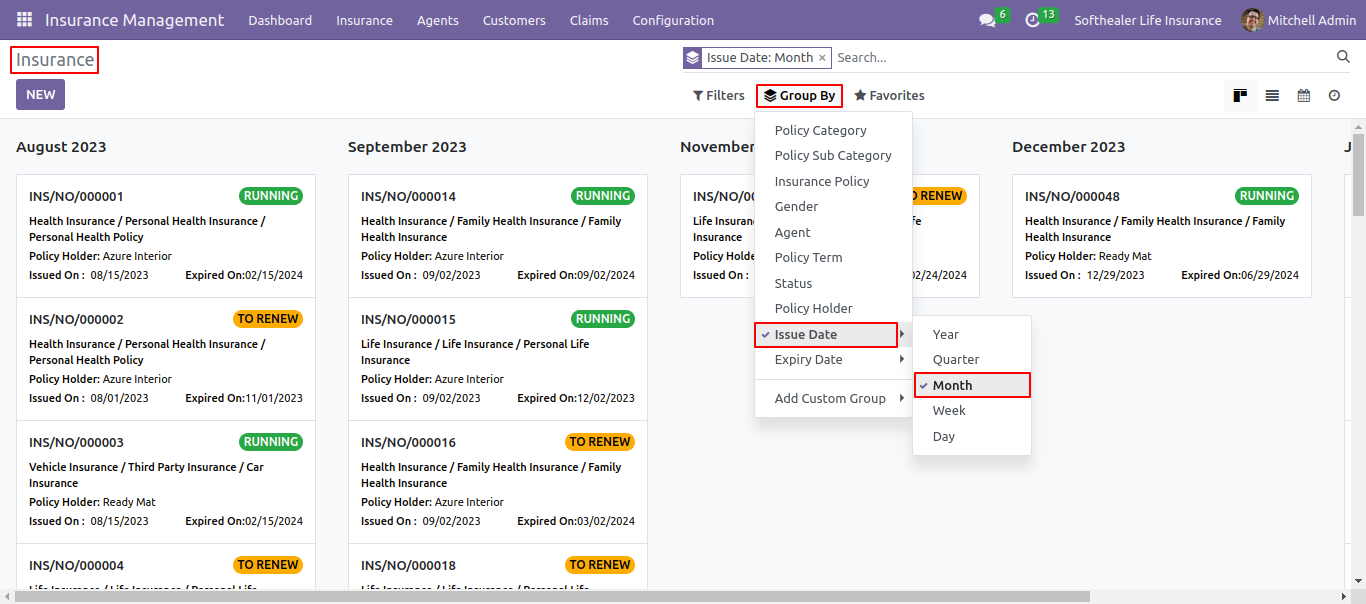

You can see the insurance group by issue date.

You can see the insurance group by expiry date.

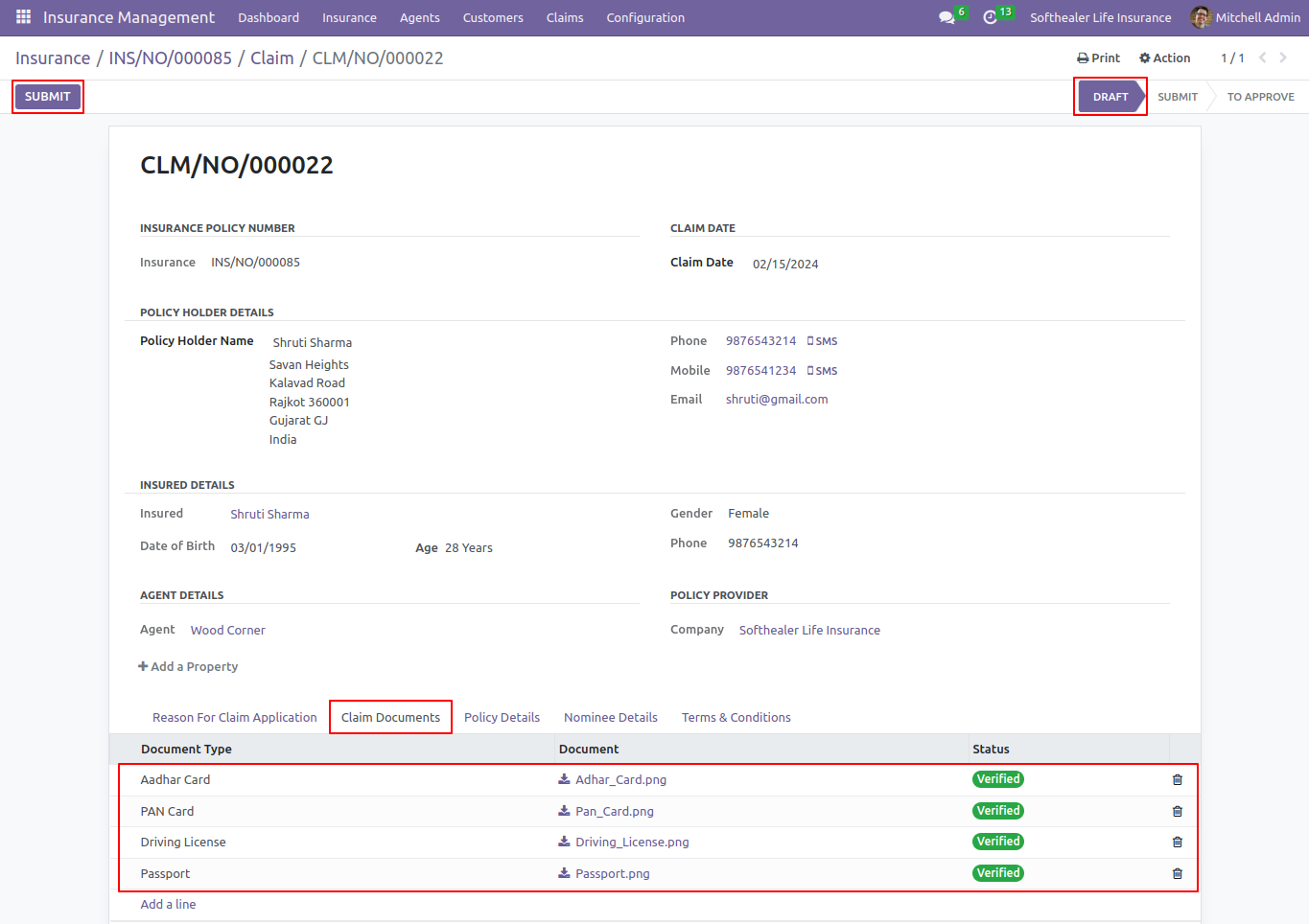

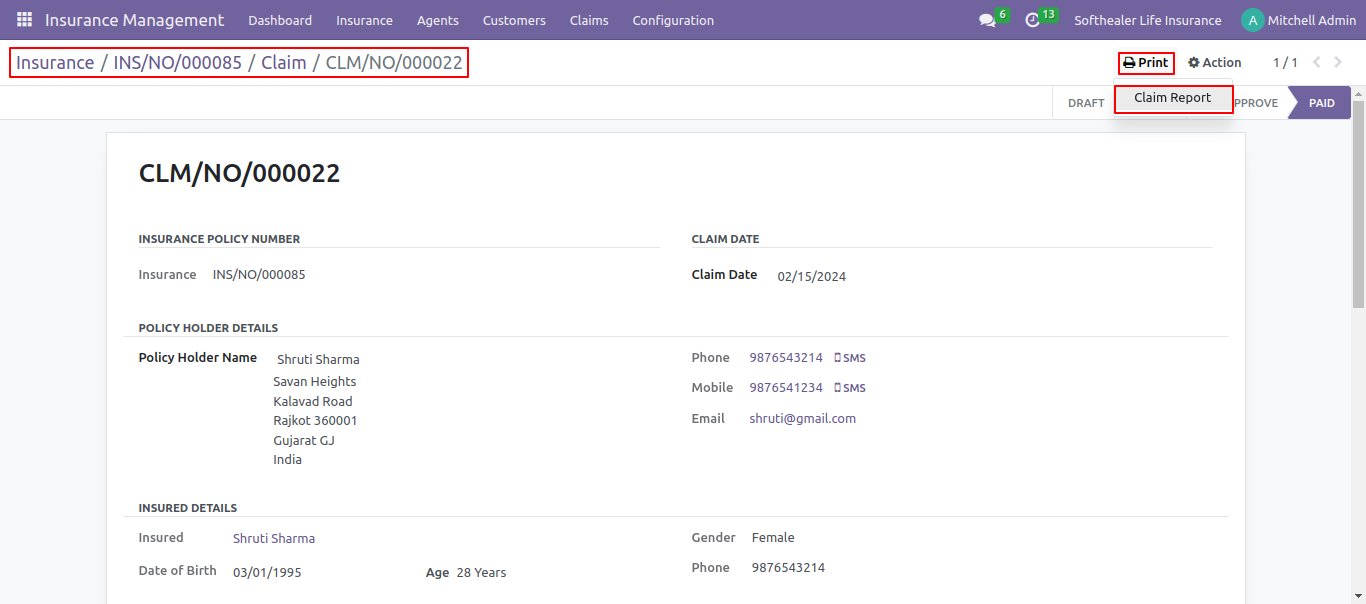

Create a claim by clicking on the Create Claim button from insurance.

Claim in draft stage.

Enter a reason for the claim application.

Enter policy details and add the claim amount in the paid amount field.

Auto fills nominee details from insurance.

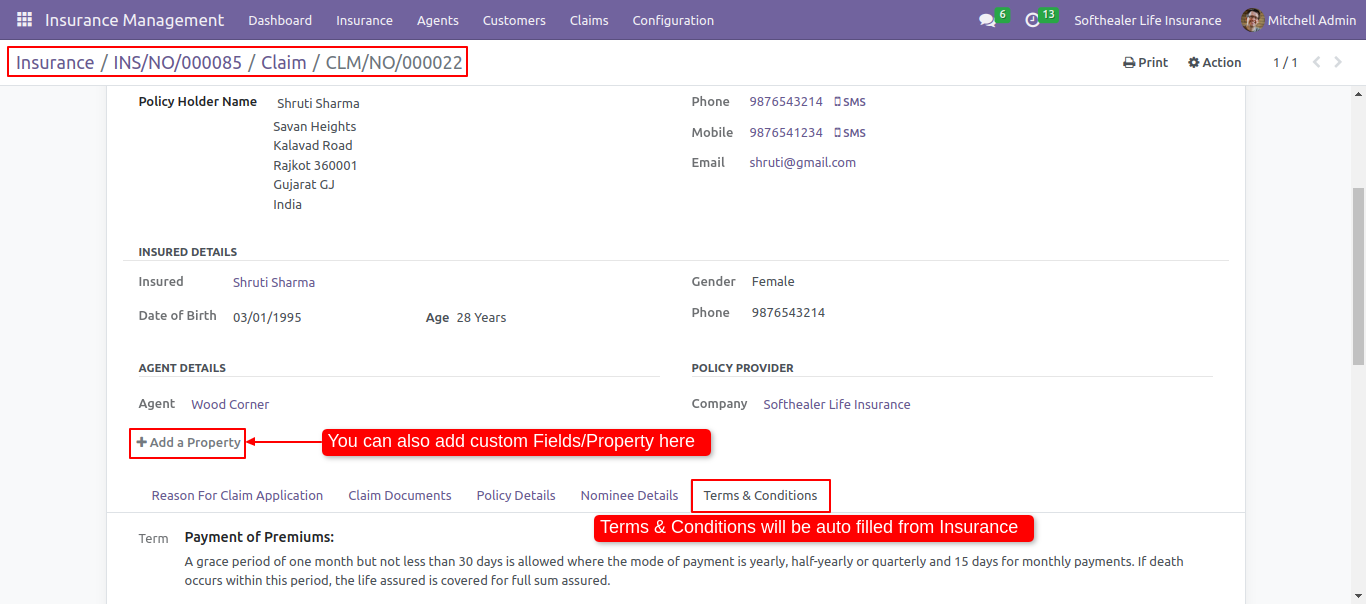

You can add custome fields in claim.

Policy Terms & Conditions auto filled from insurance.

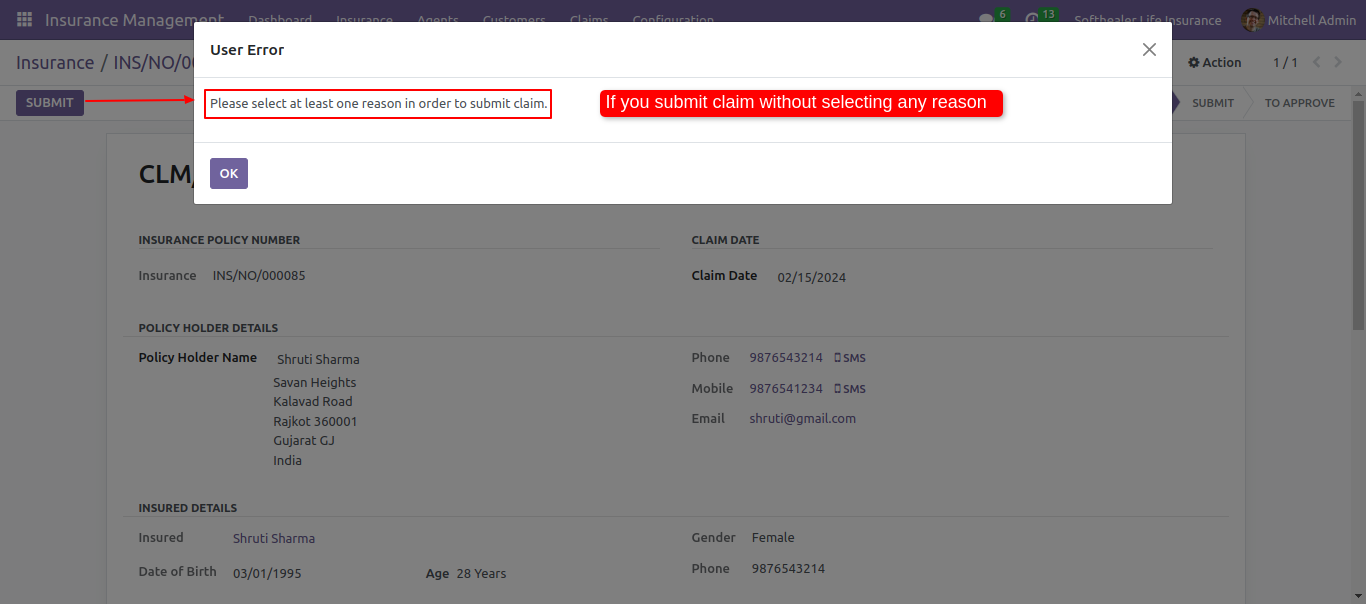

If you submit a claim without selecting any reason it will give a warning message to select reason.

Select a valid reason from the Reason for Application tab.

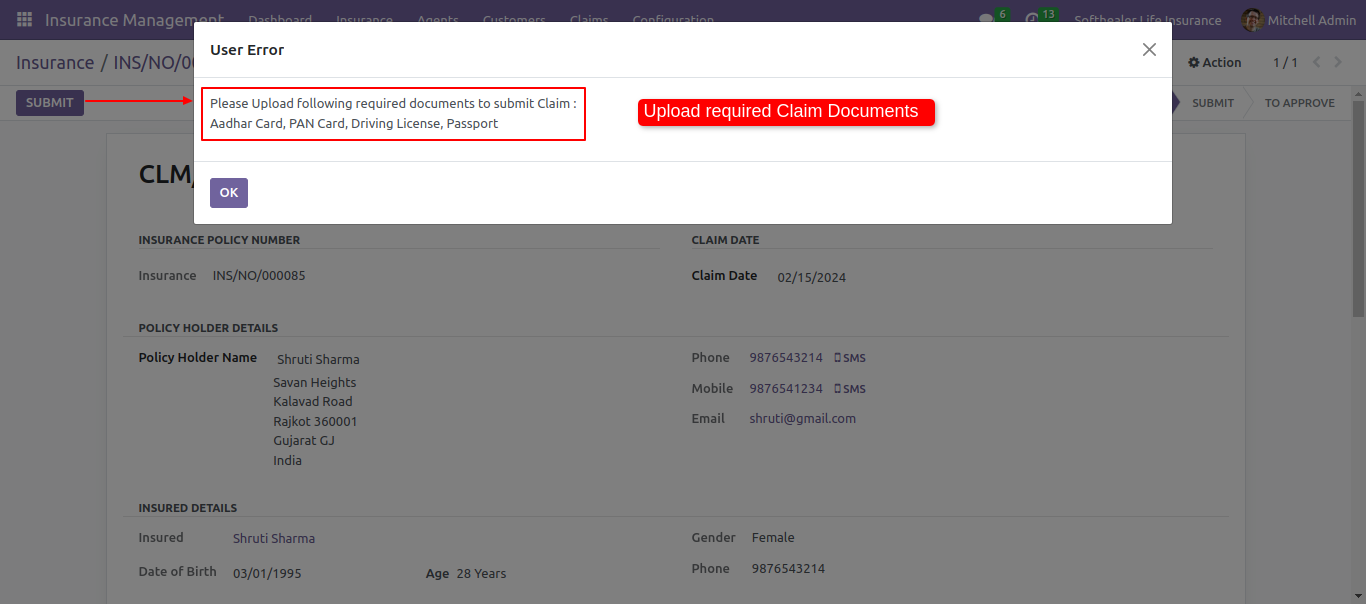

If you submit a claim without uploading a document it will give a warning message to upload a document.

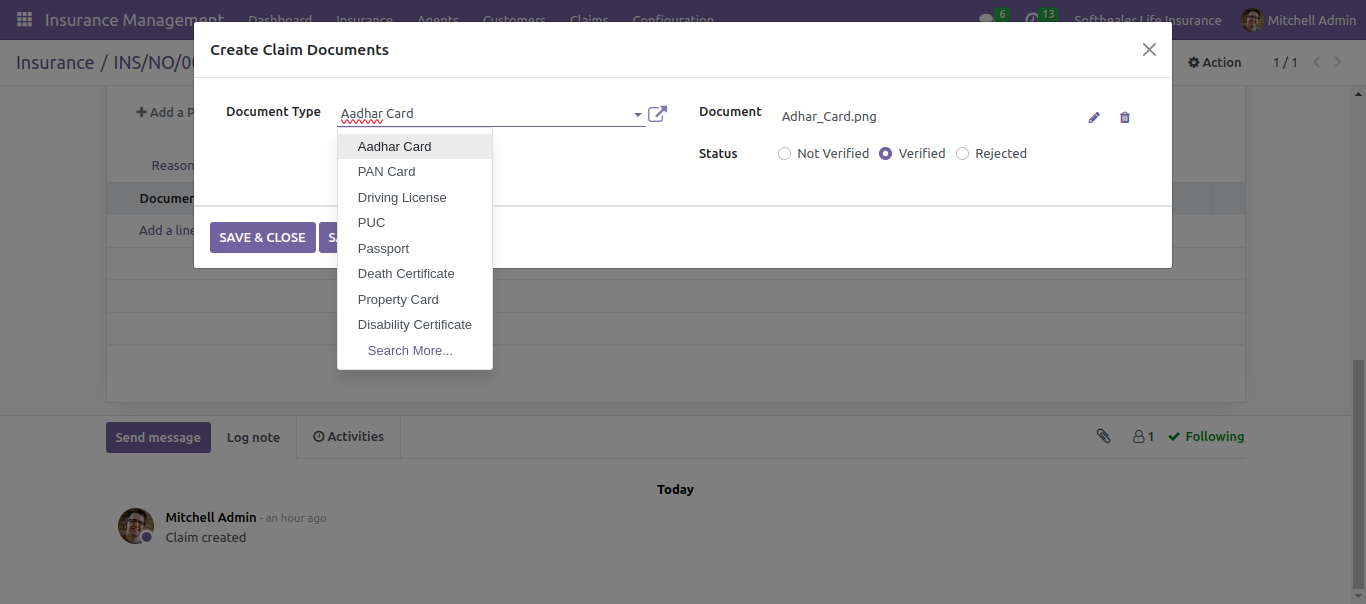

Click on Add a line from claim documents tab and upload claim documents.

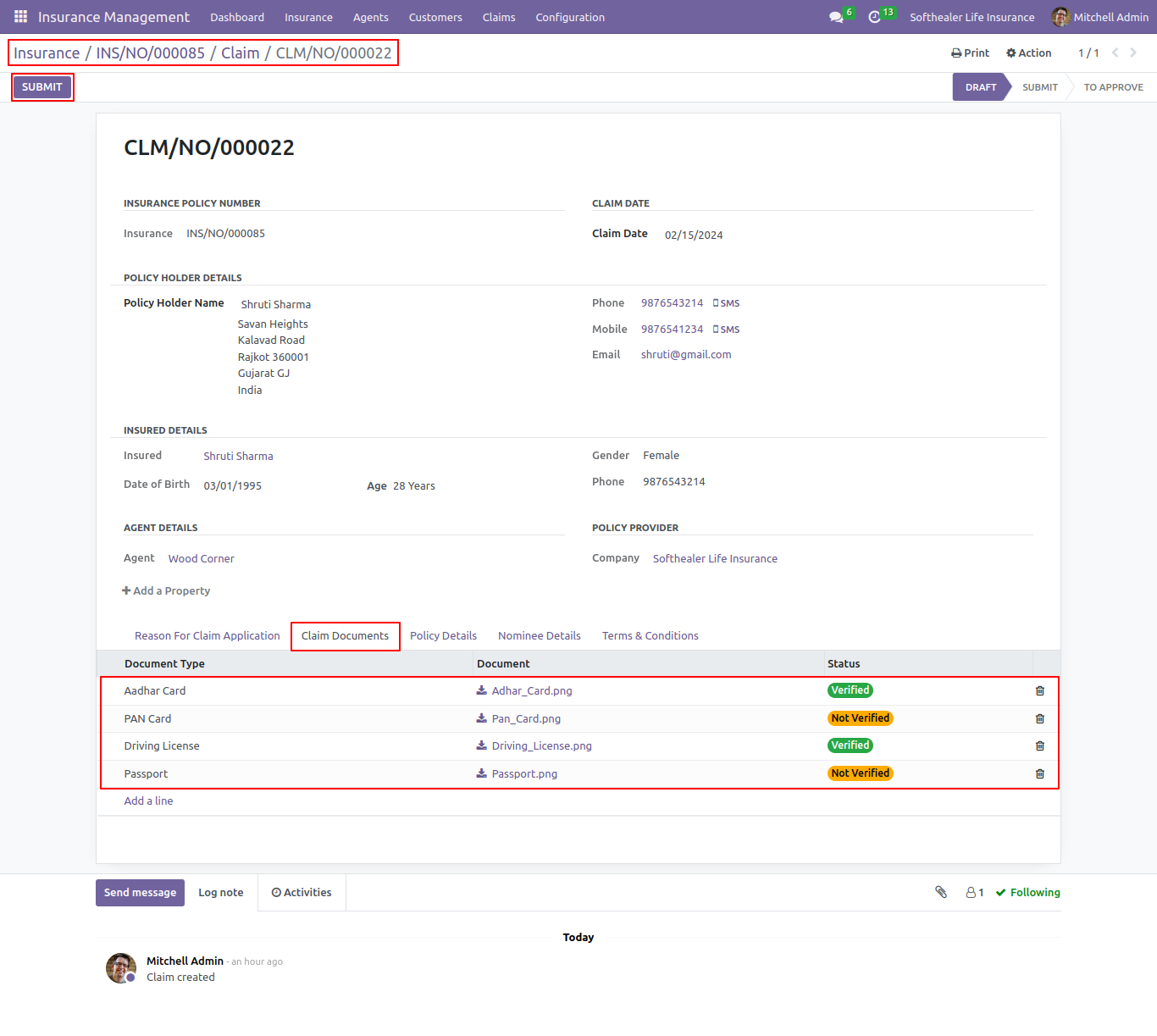

You can see a list of claim documents in the Claim Documents tab.

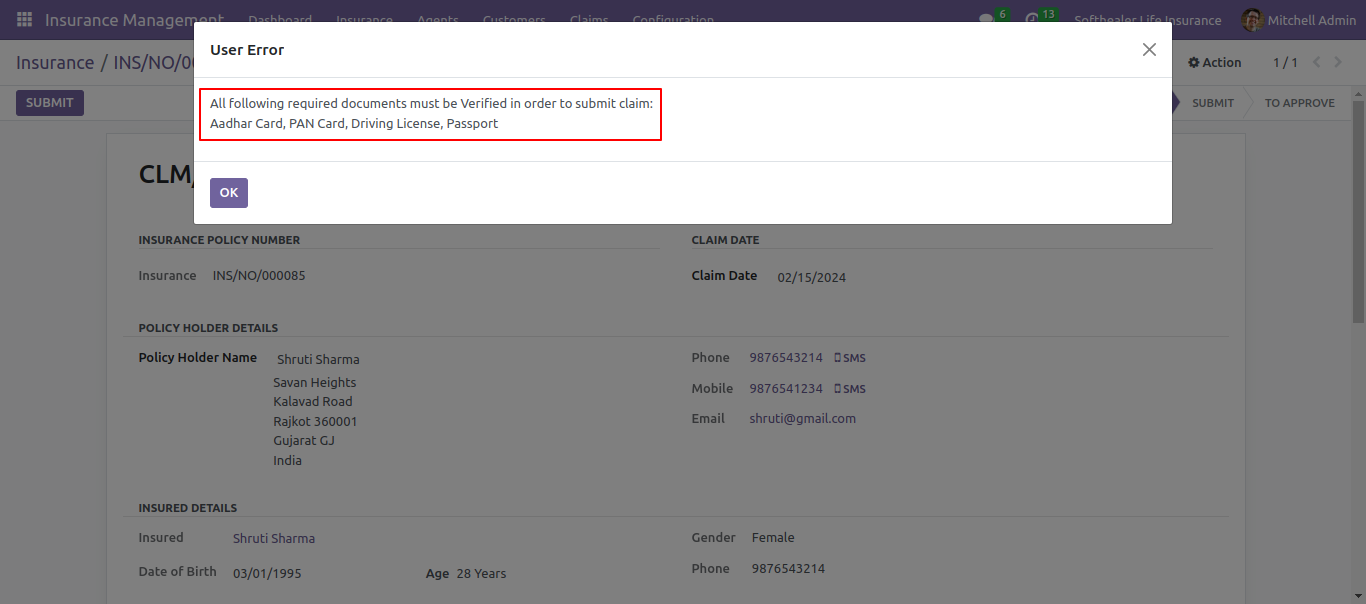

If you submit a claim without verifying the document it will give an error message to verify the documents.

You can see a list of verified claim documents in the Claim Documents tab.

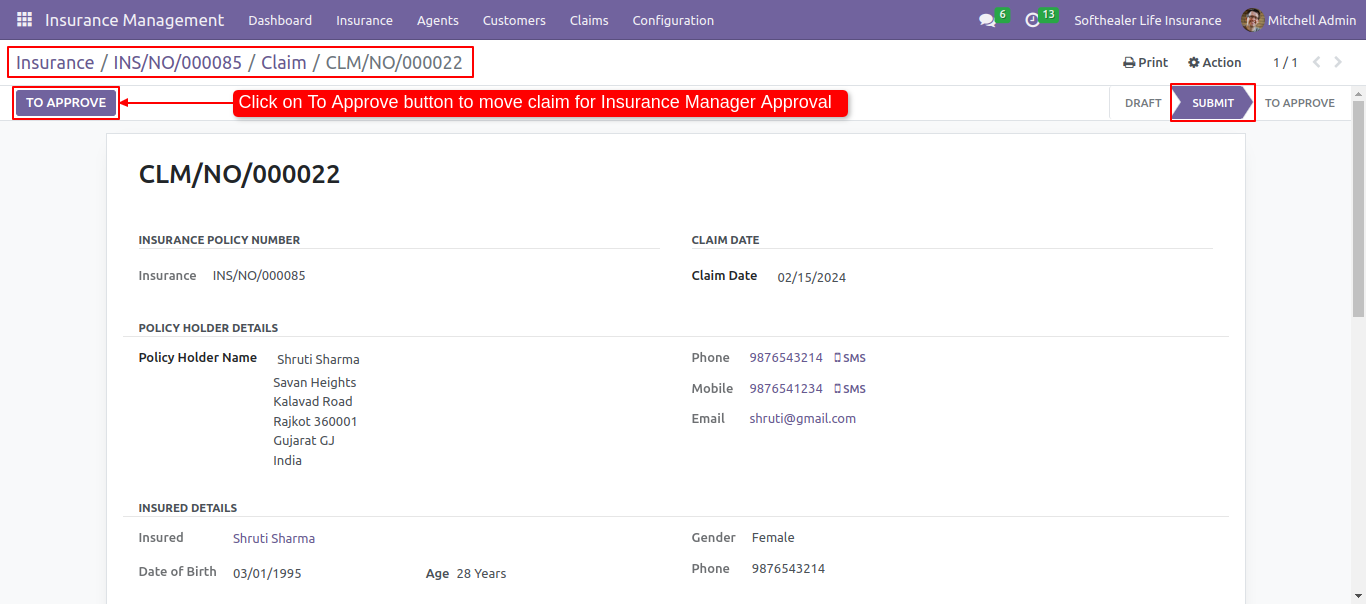

Click on the submit button after all documents are verified.

It will show the To Approve button to move the claim for insurance manager approval.

Click on to approve button. It will move to the To approve stage from the submit stage.

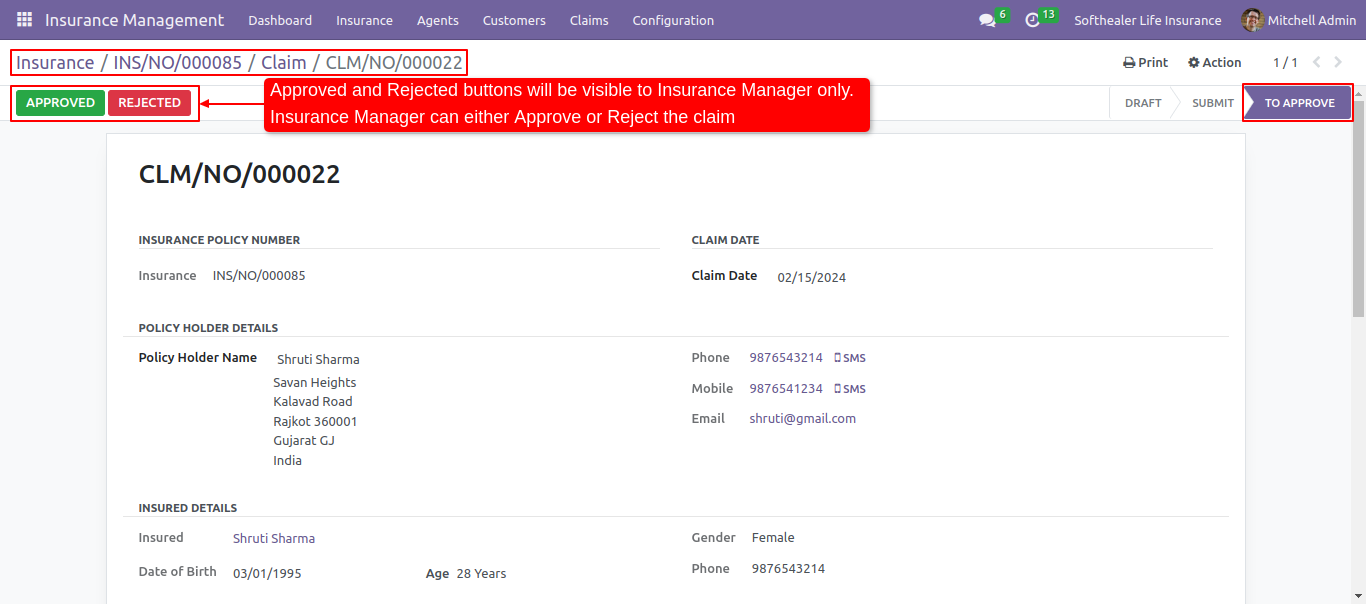

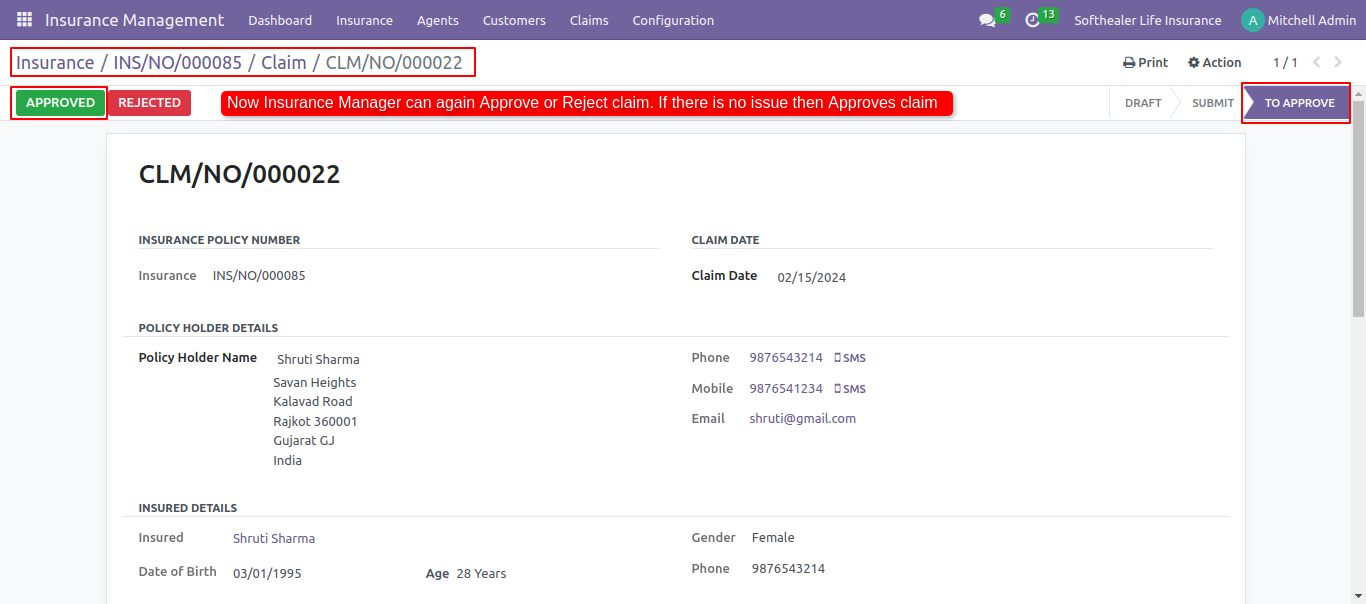

Approved and Rejected buttons are only visible to the manager.

The insurance manager either approves or rejects the claim.

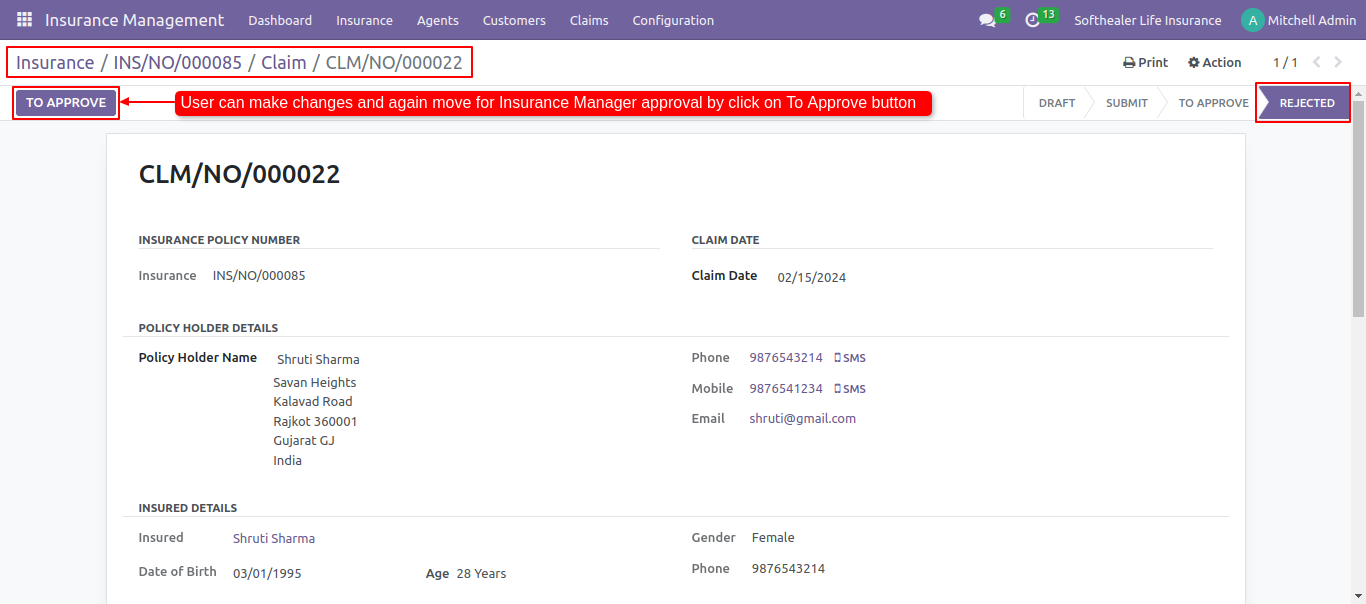

If the manager rejects the claim it will be in rejected stage.

Users can make changes and again move for approval by clicking on the To Approve button.

The manager can again approve or reject the claim. If there is no issue then approve the claim by clicking on the Approved button.

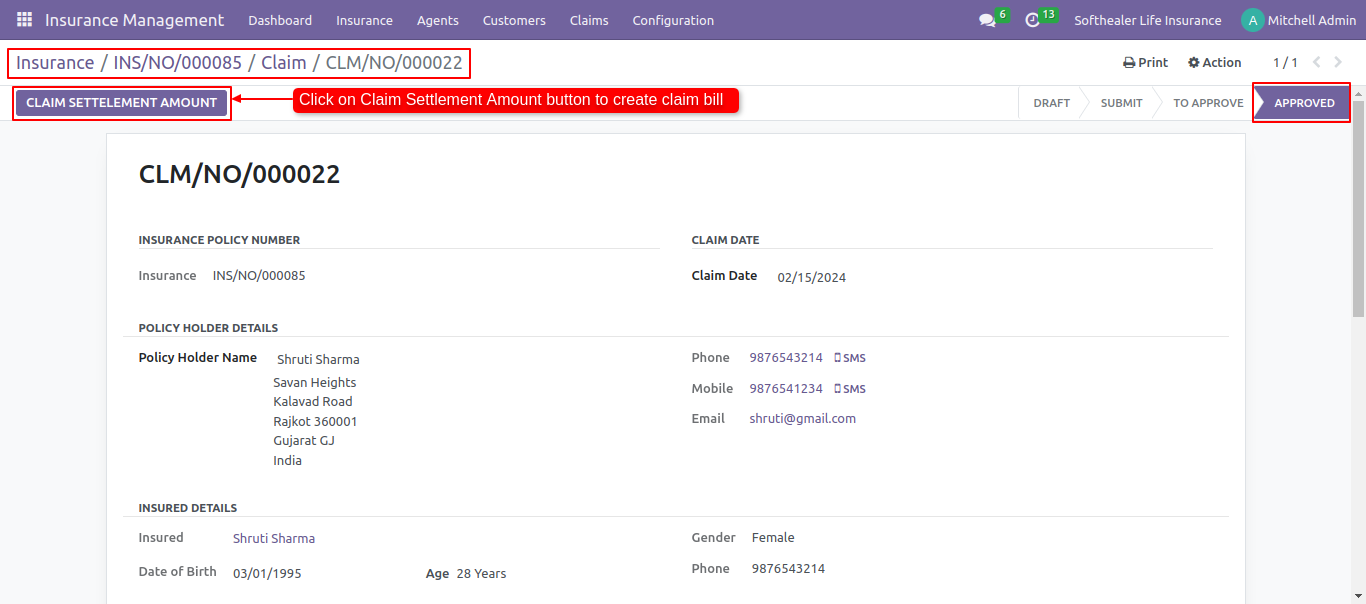

Once the manager approves the claim it will be in the Approved stage.

After approval of the claim Claim Settlement Amount button will be visible.

Click on the claim settlement amount button to create a claim bill.

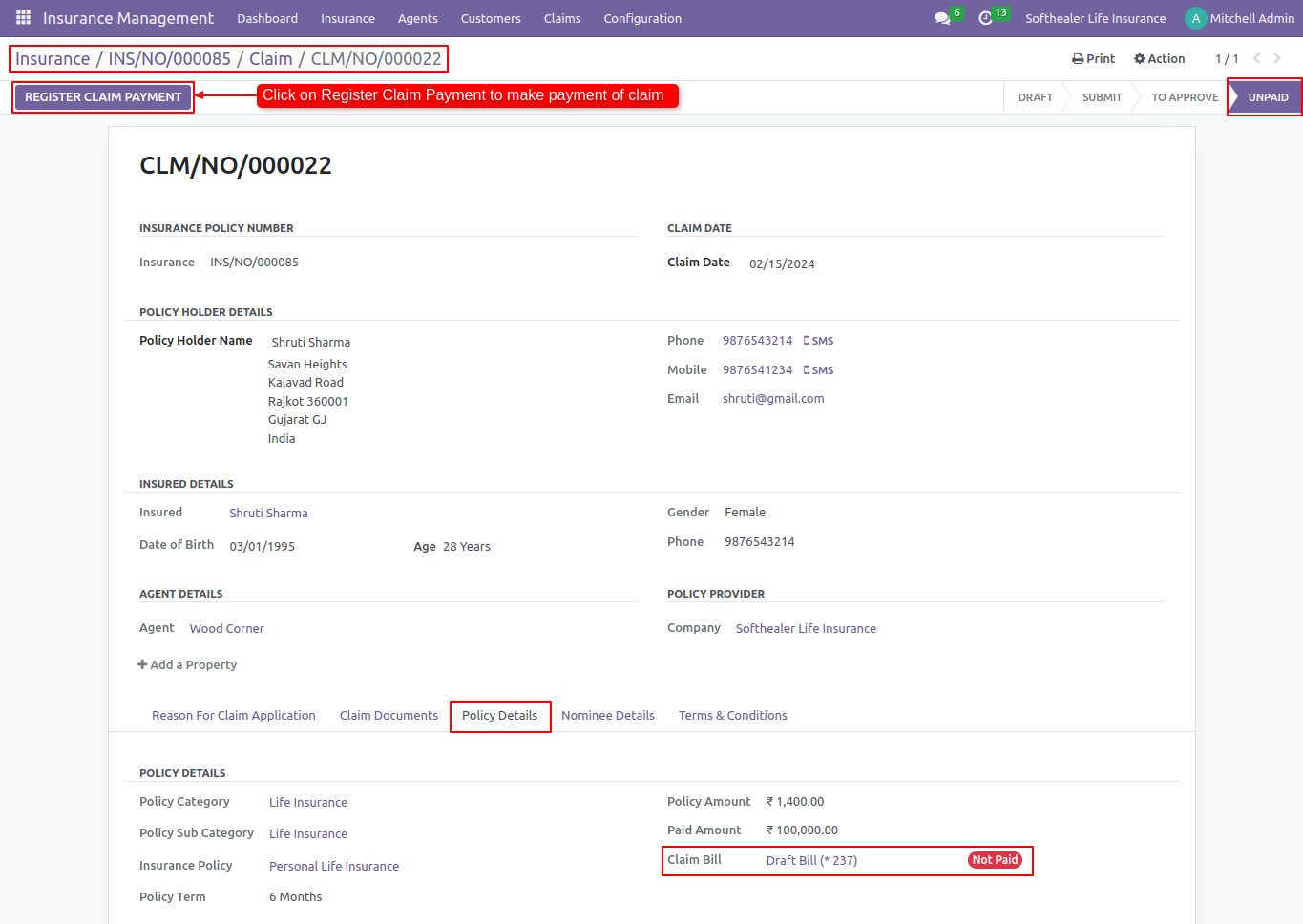

Click on the Register Claim Payment button to make a claim payment

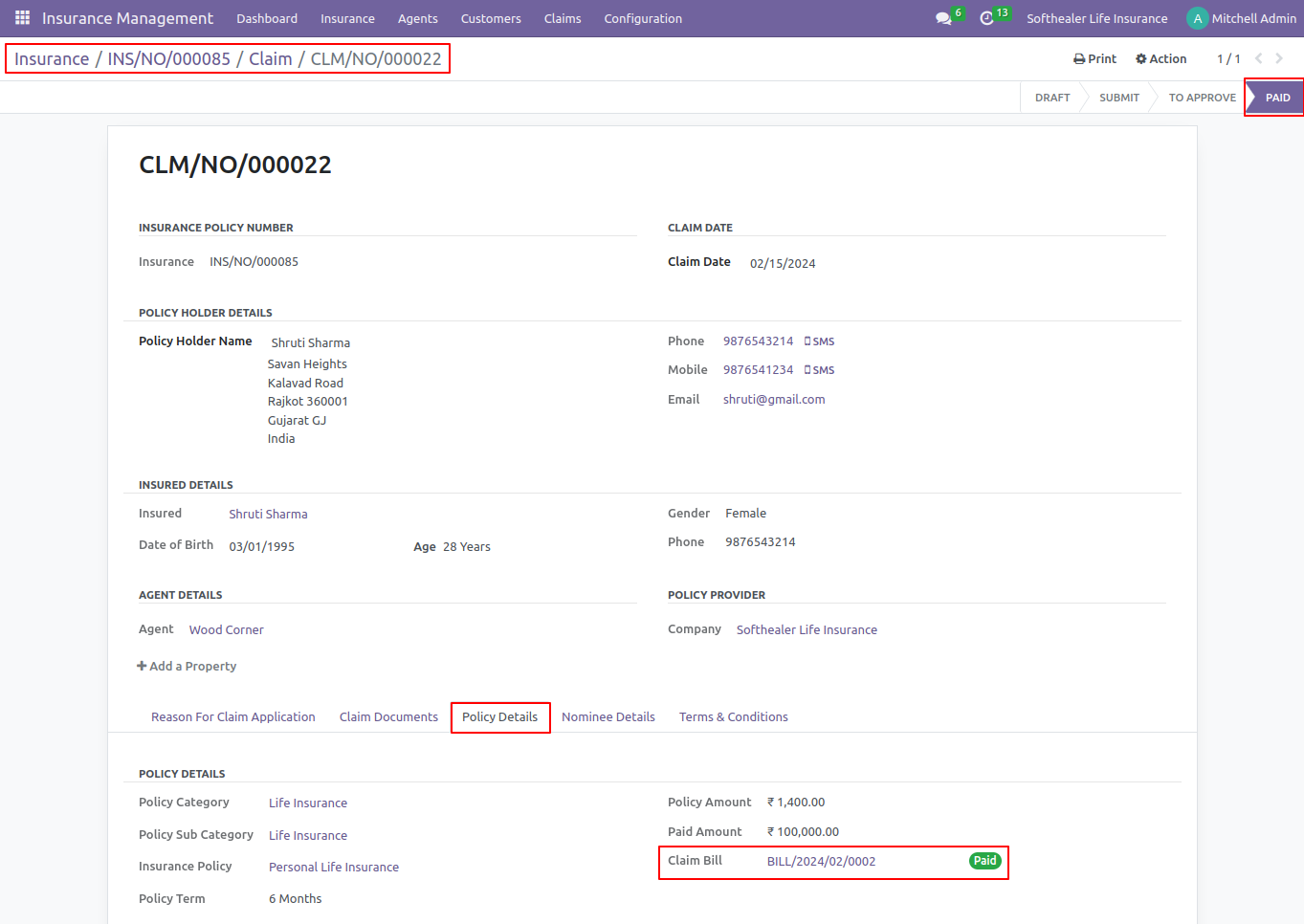

You can see the claim bill paid status in the Policy details.

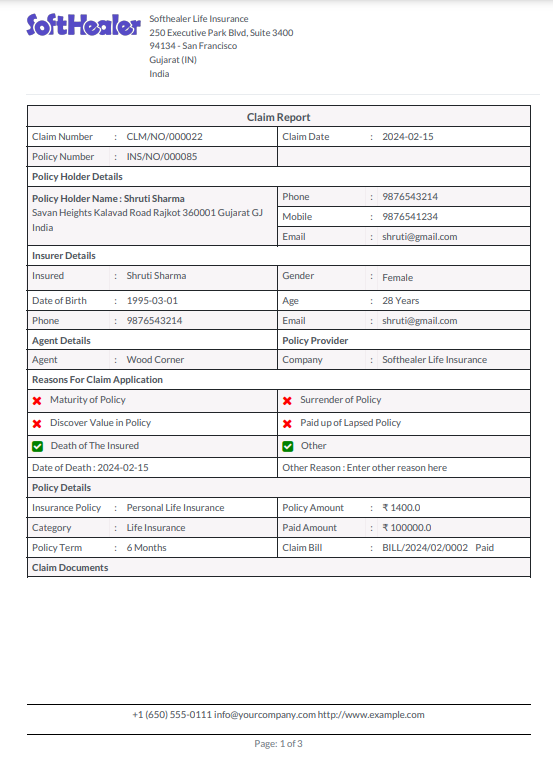

You can print the claim report.

Claim report in pdf format with all relevant data.

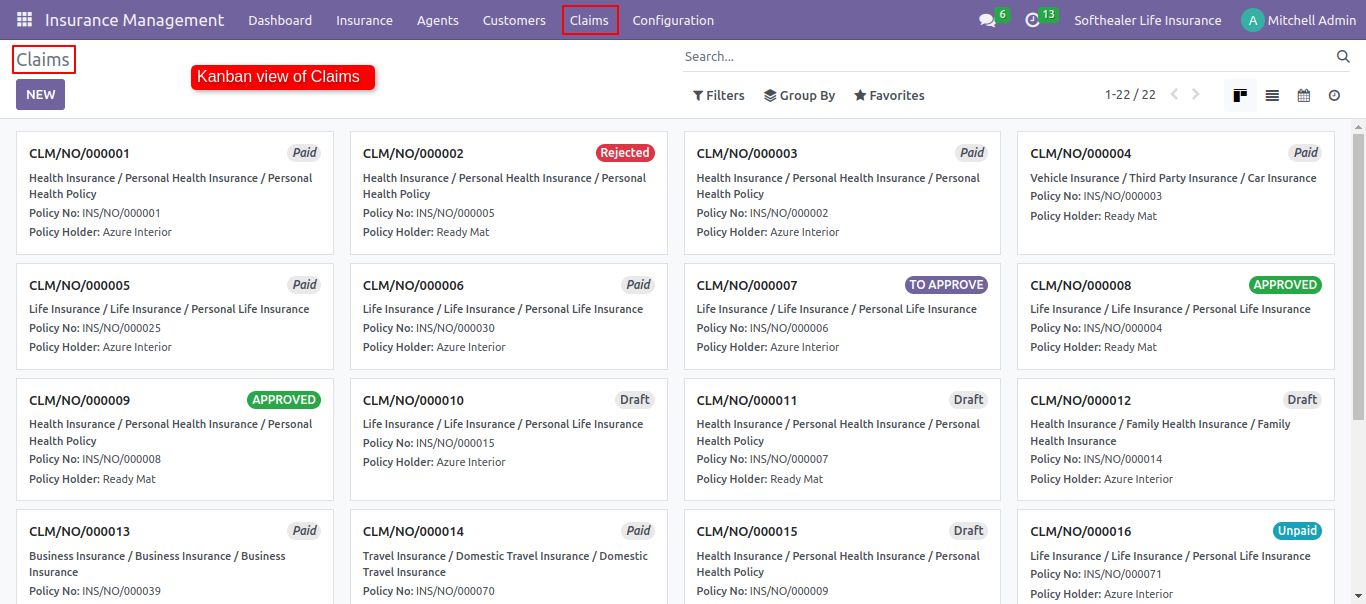

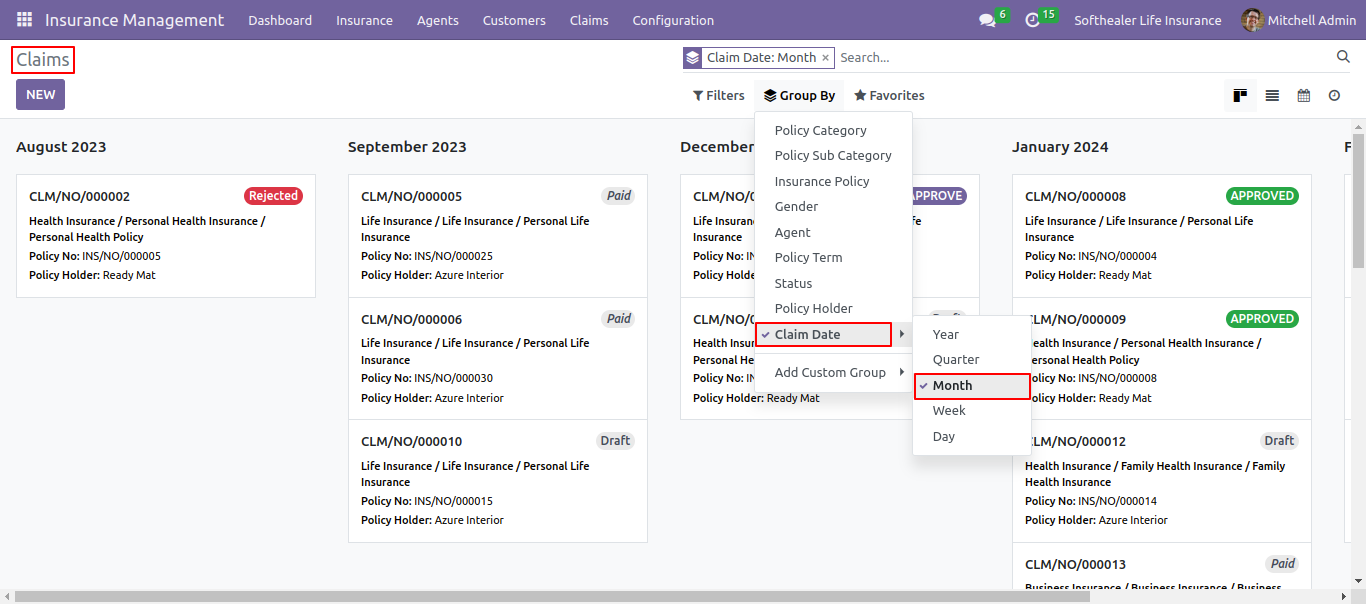

Claim kanban view.

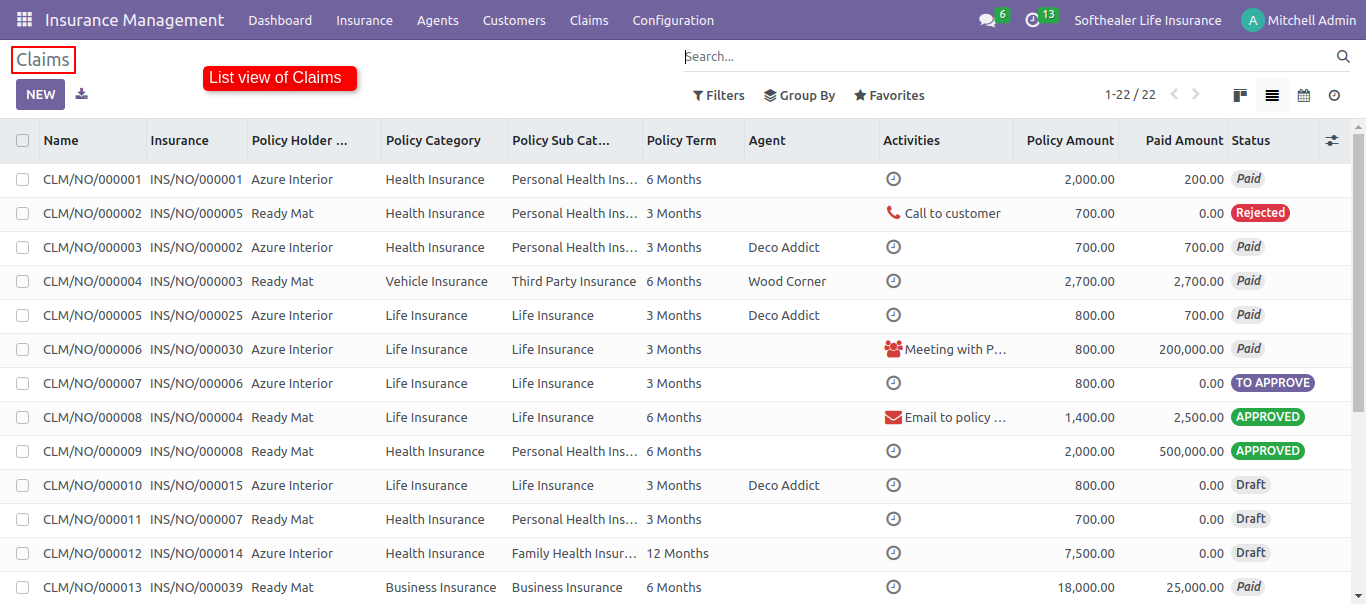

Click list view.

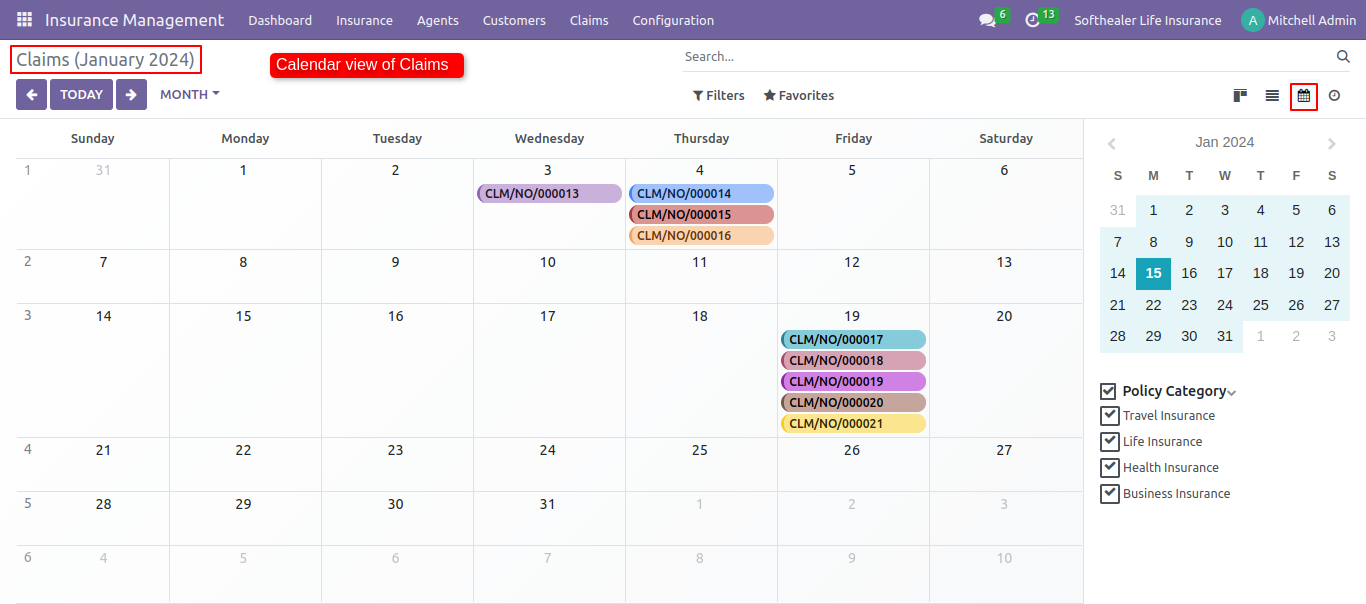

Claim Calendar view.

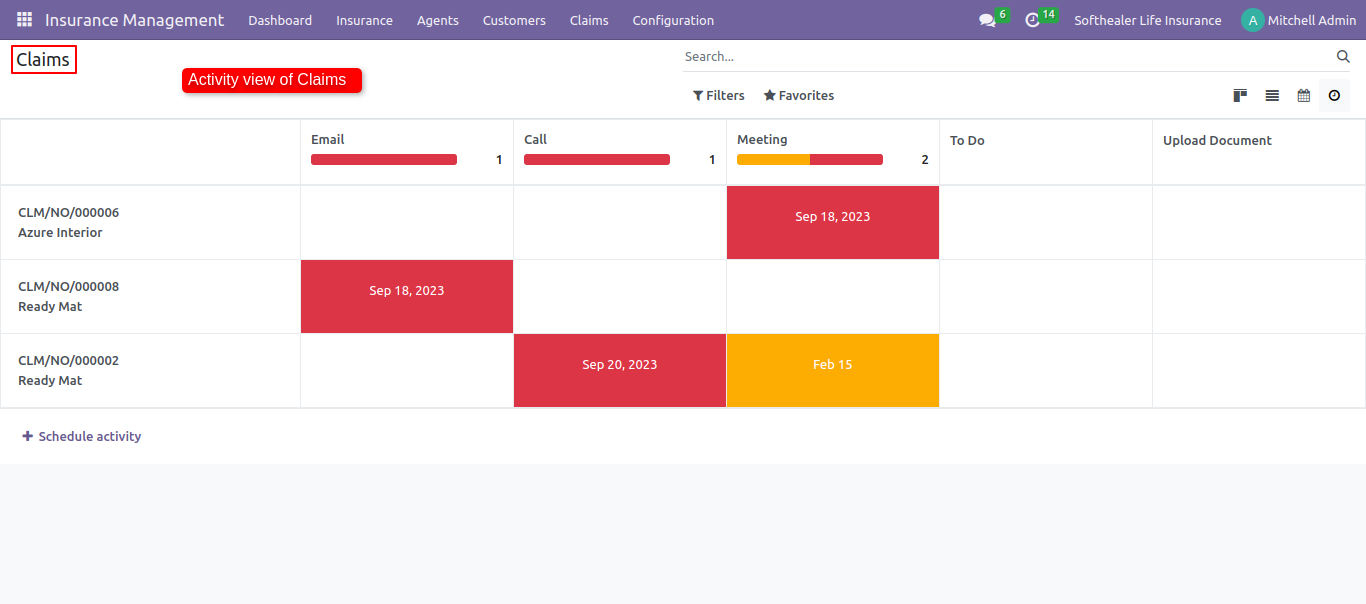

Claim activity view.

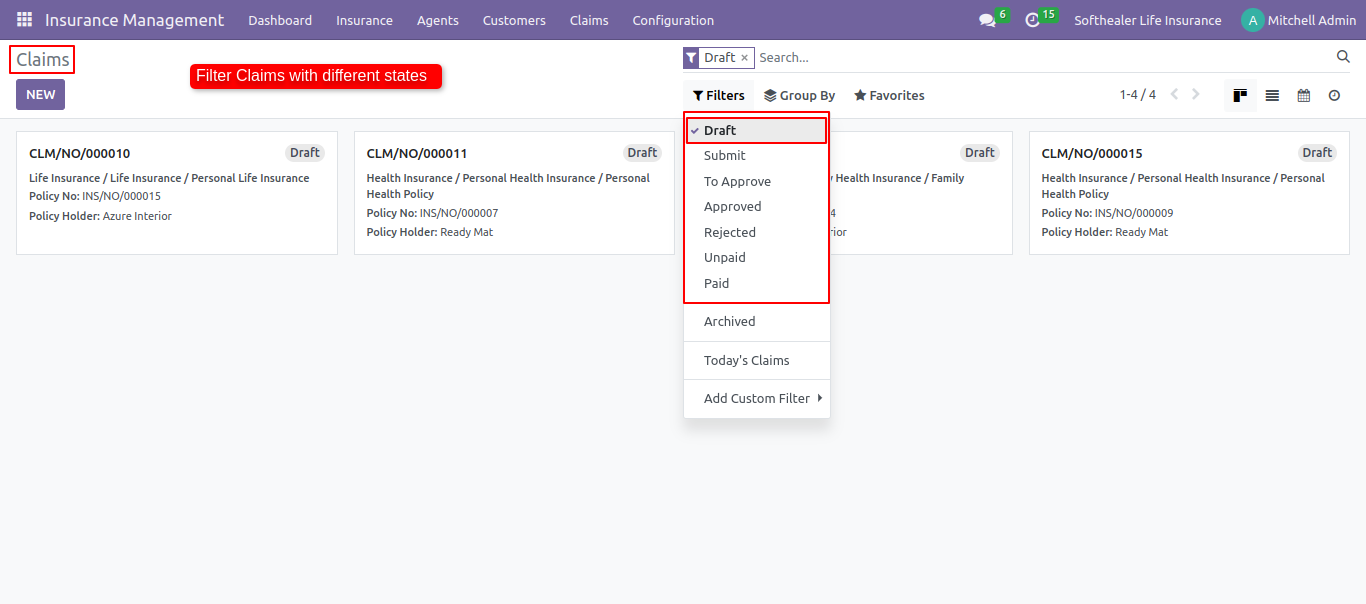

Filter claims with different stages.

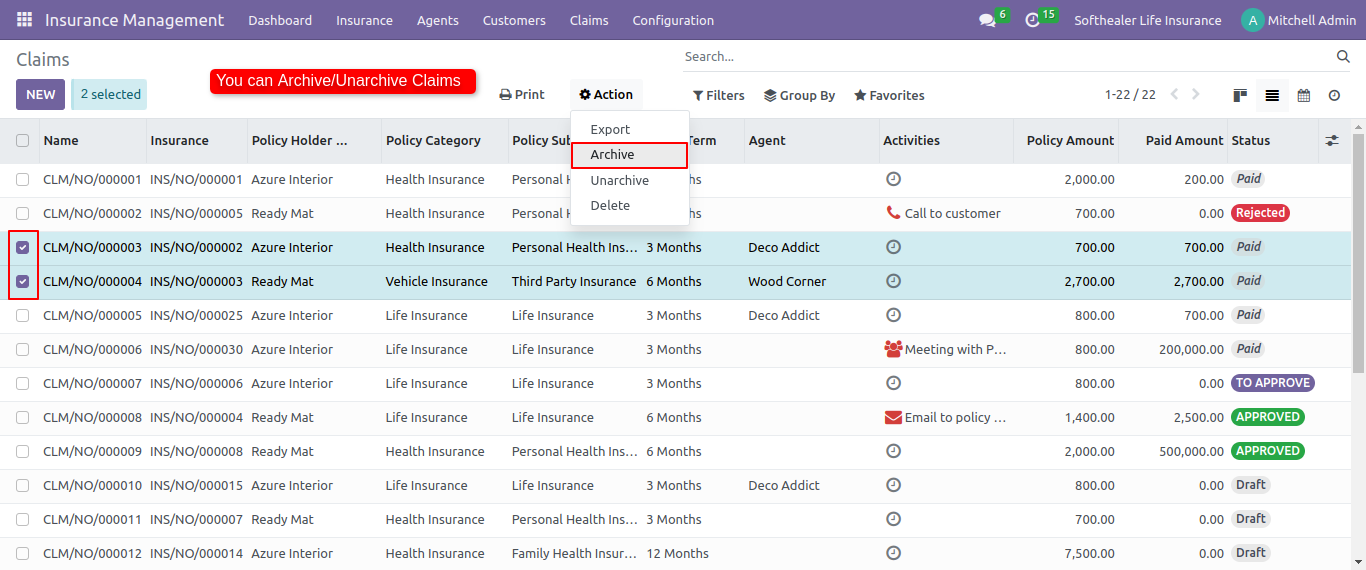

You can Archive or unarchive Insurance by action button.

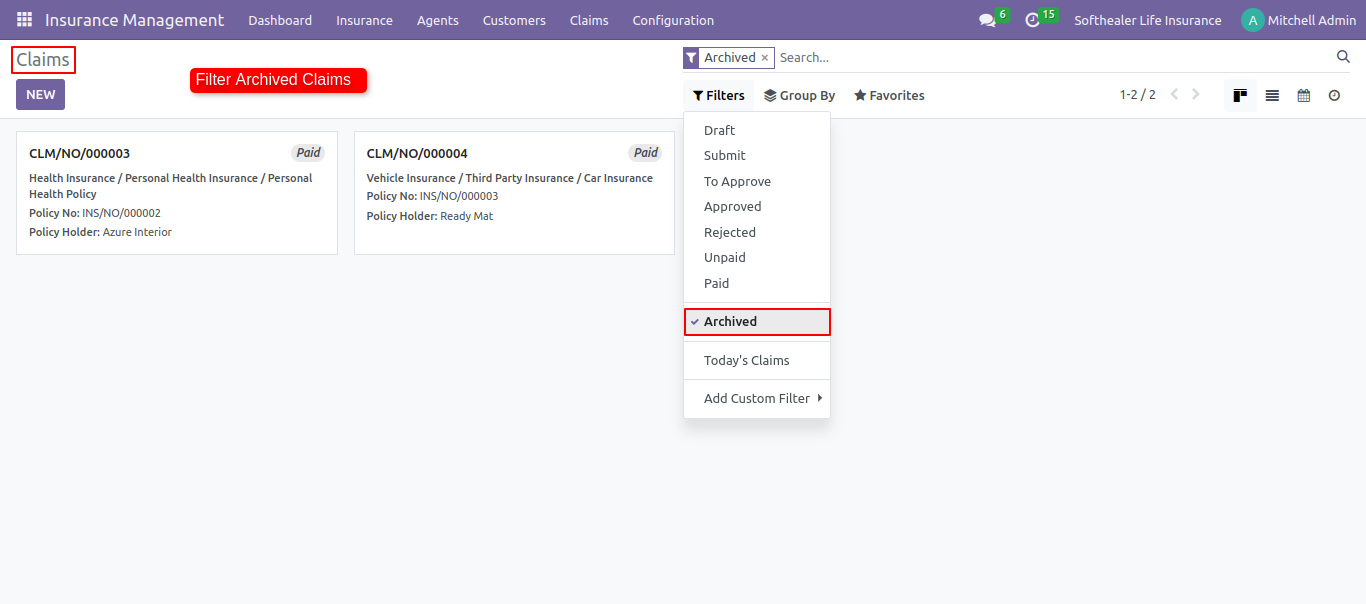

You can see archived claims from filtering by archive.

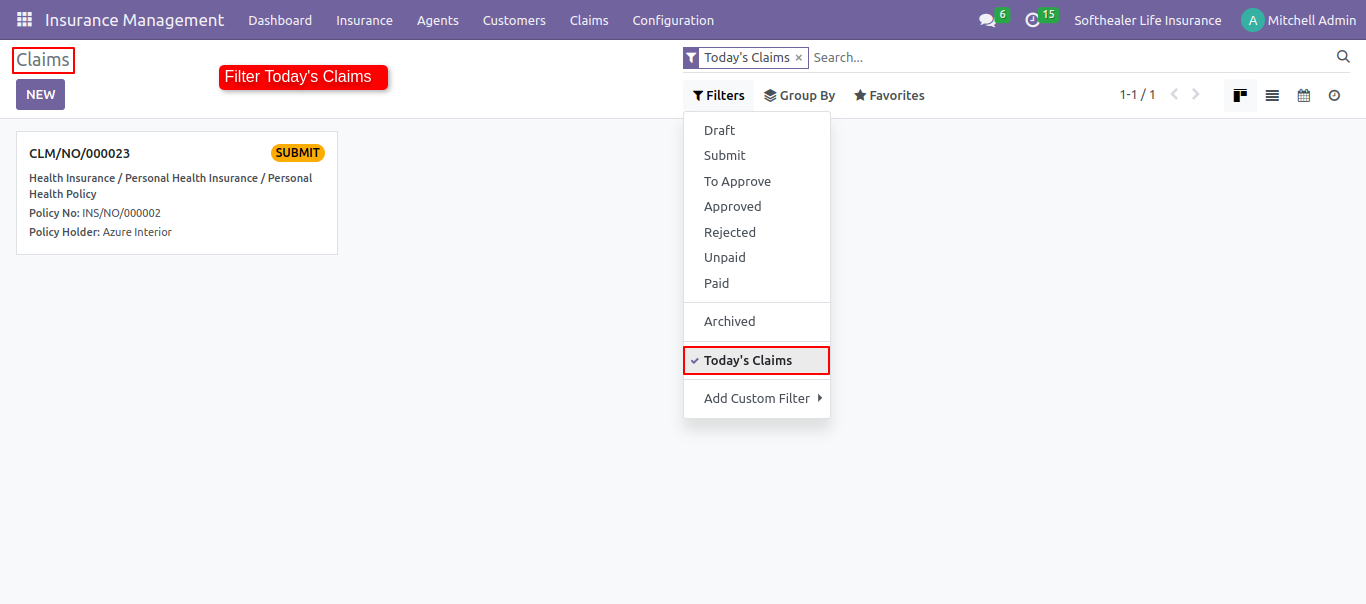

You can see Today's claim by filtering.

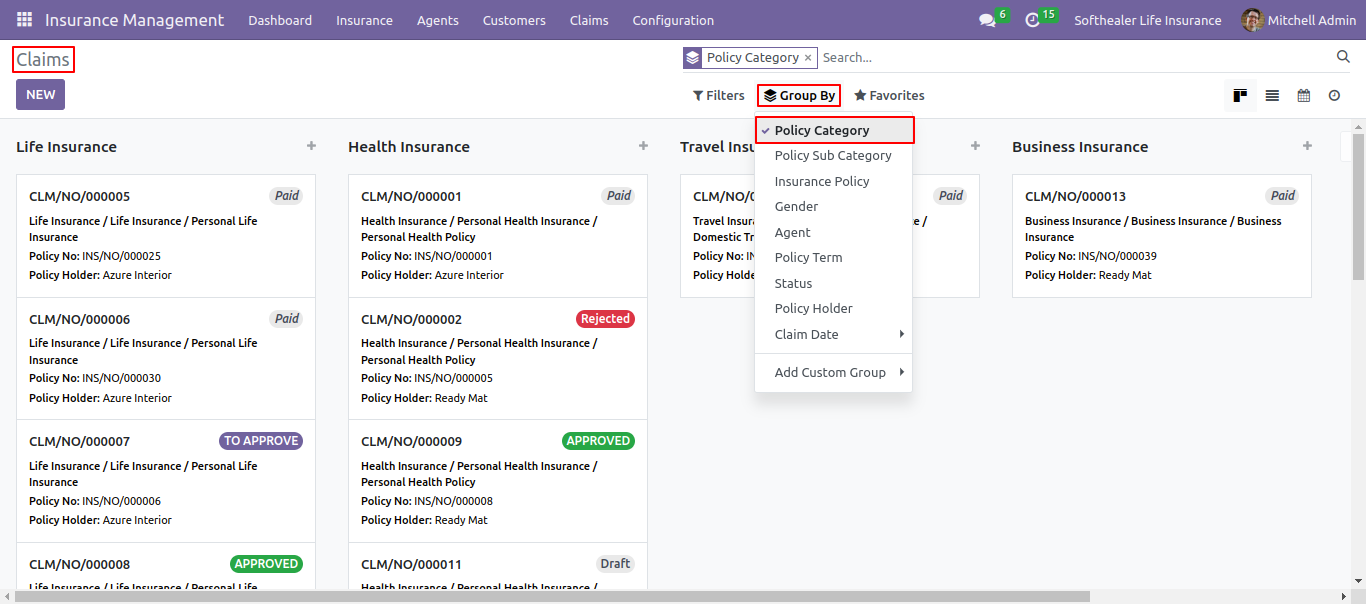

You can see the claim group by Policy category.

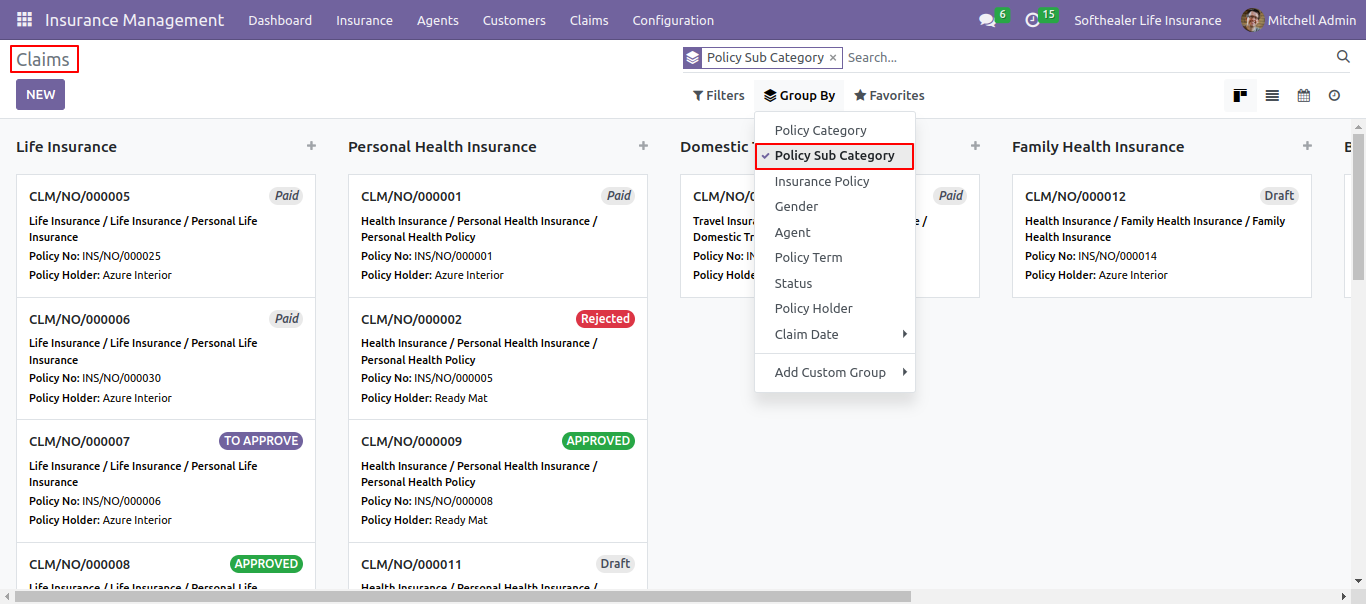

You can see the claim group by Policy sub category.

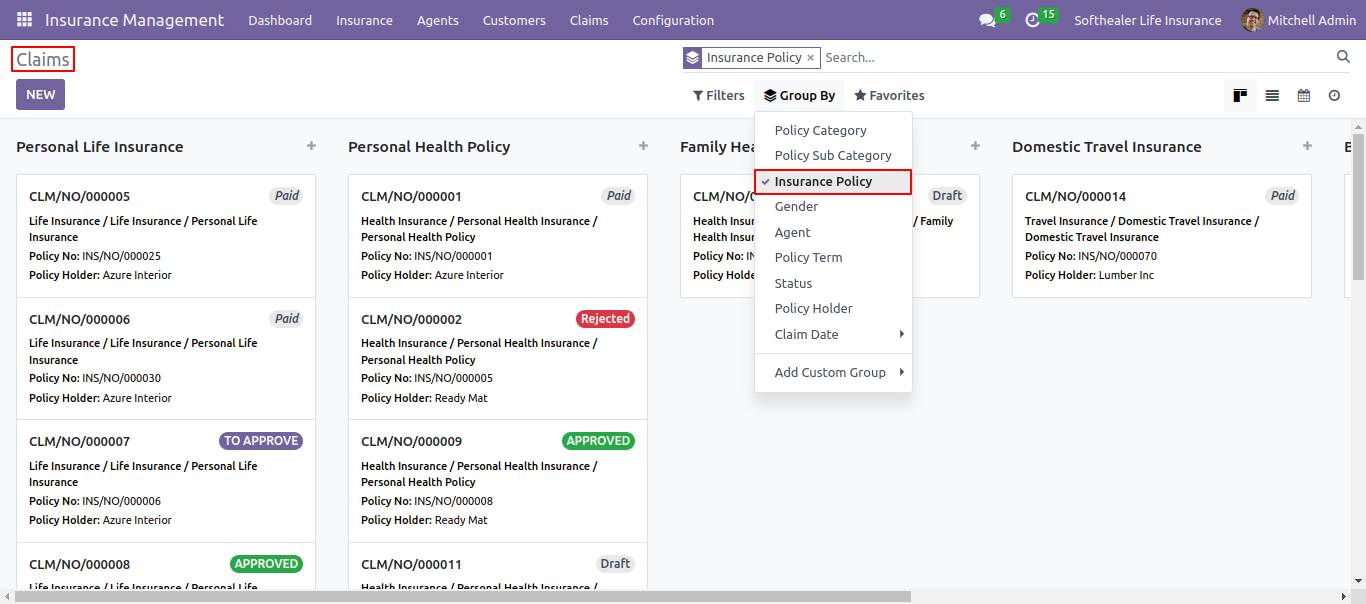

You can see the claim group by Insurance Policy.

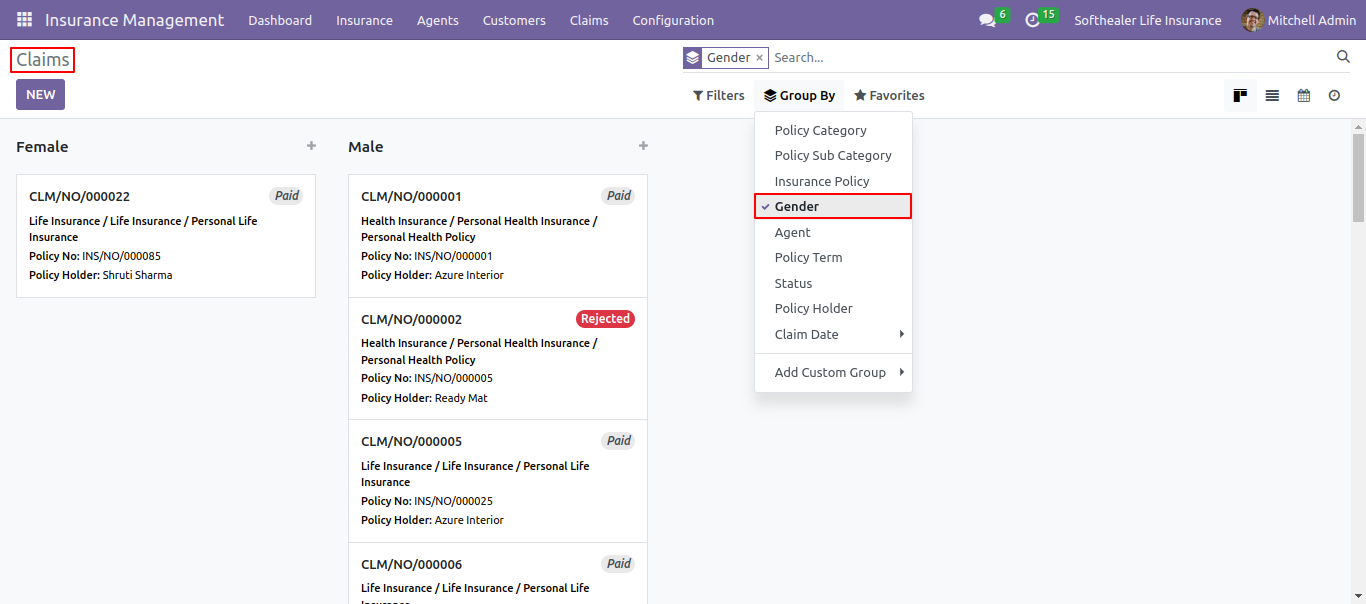

You can see the claim group by Gender.

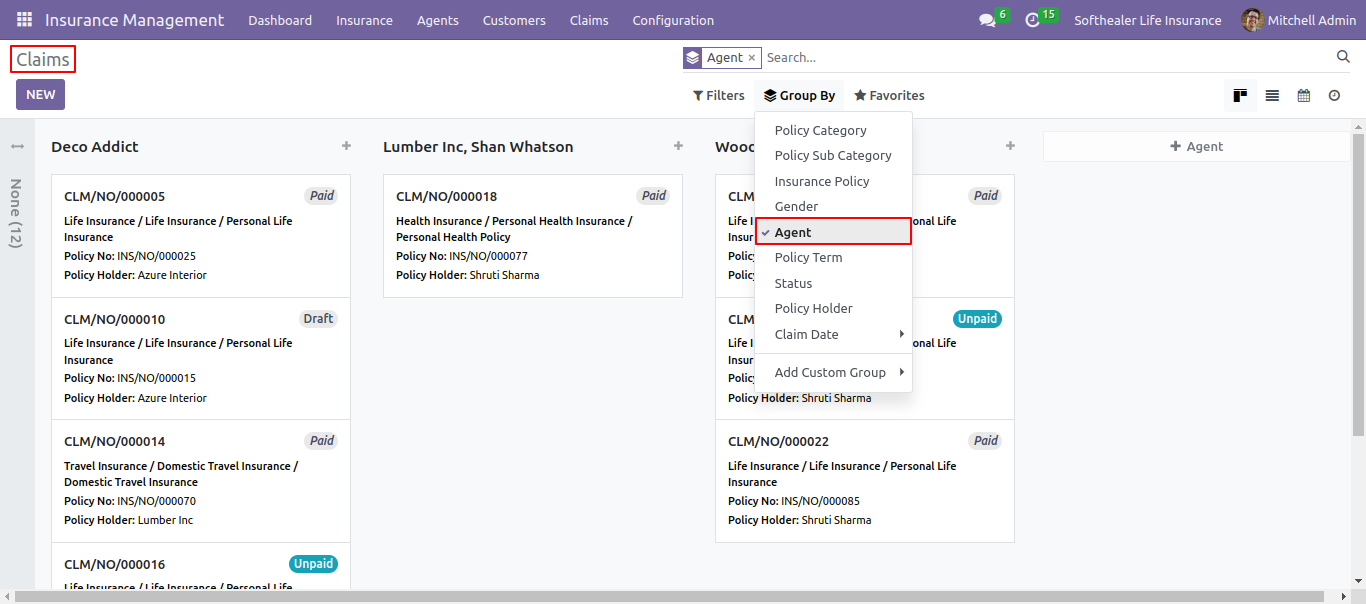

You can see the claim group by Agent.

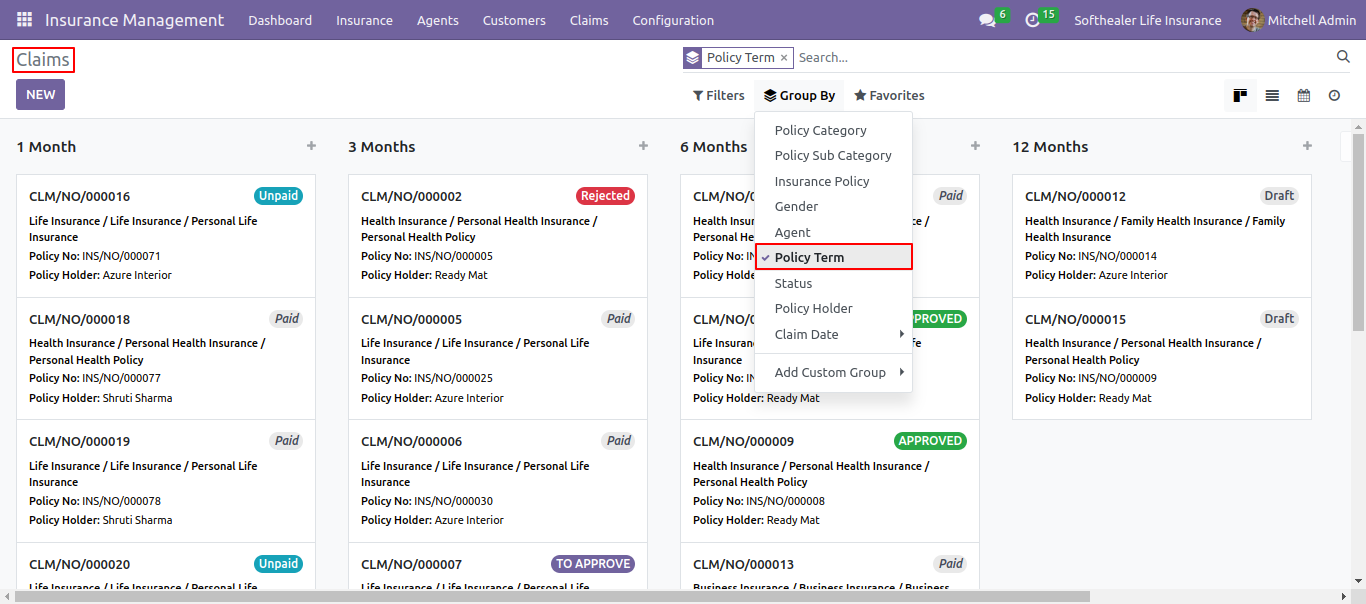

You can see the claim group by the Policy term.

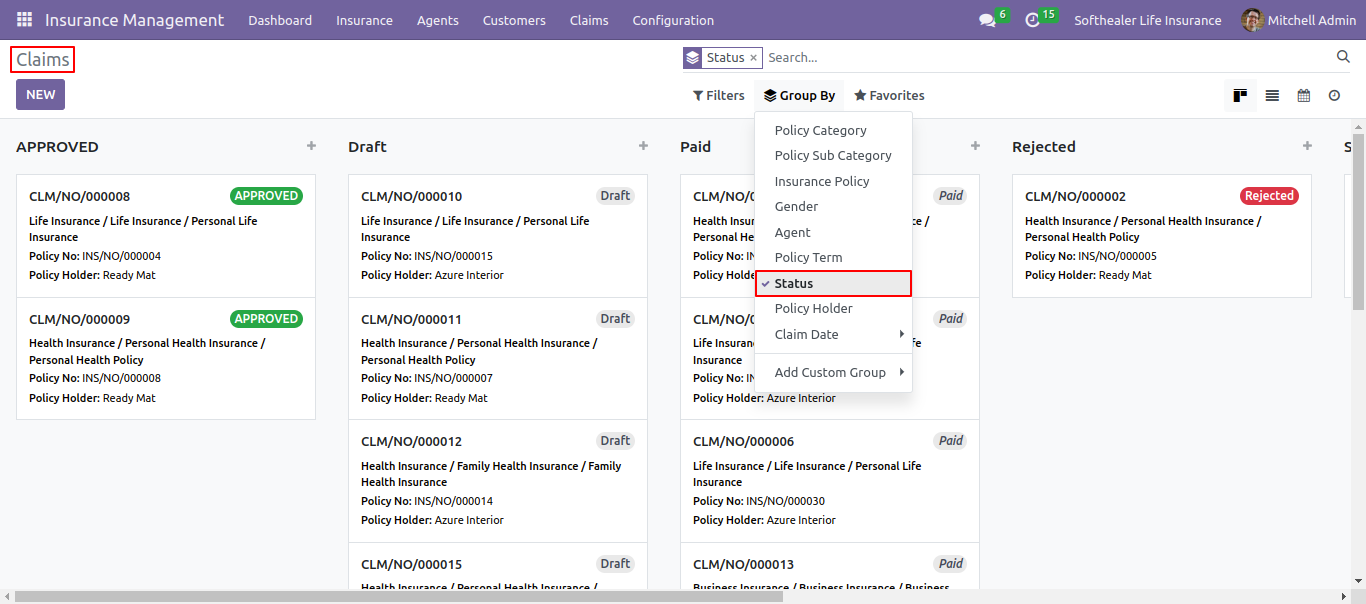

You can see the claim group by Policy status.

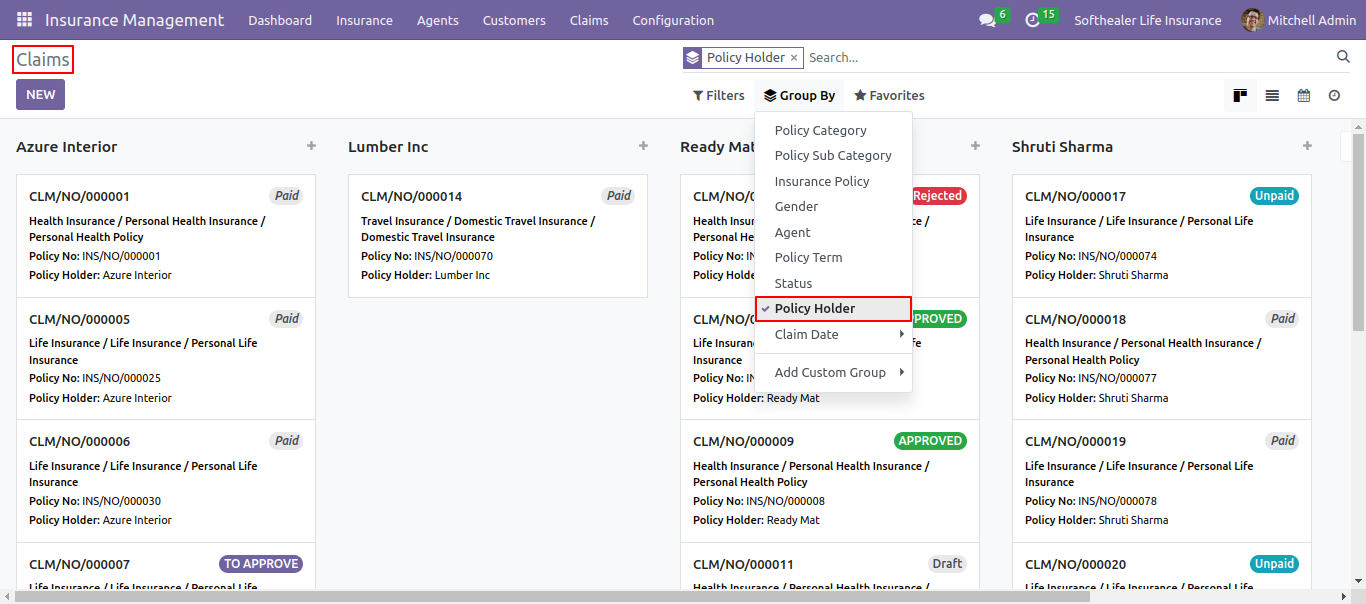

You can see the claim group by Policy holder.

You can see the claim group by claim date.

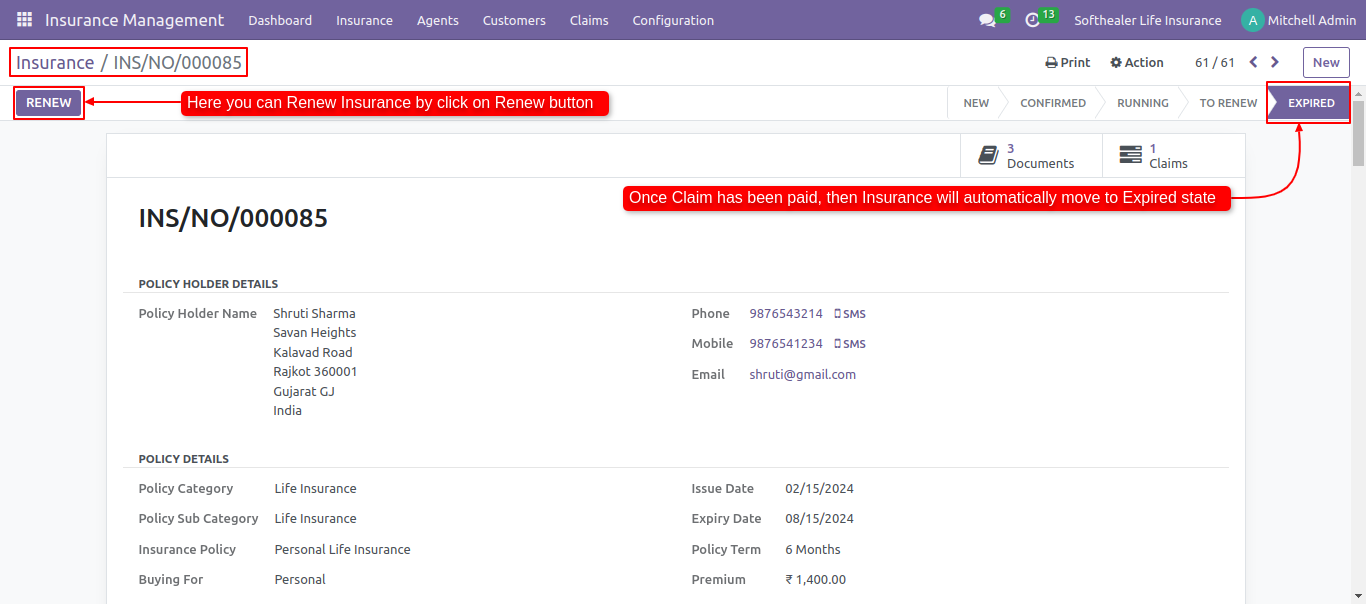

Once the claim has been paid insurance will automatically move to the expired stage.

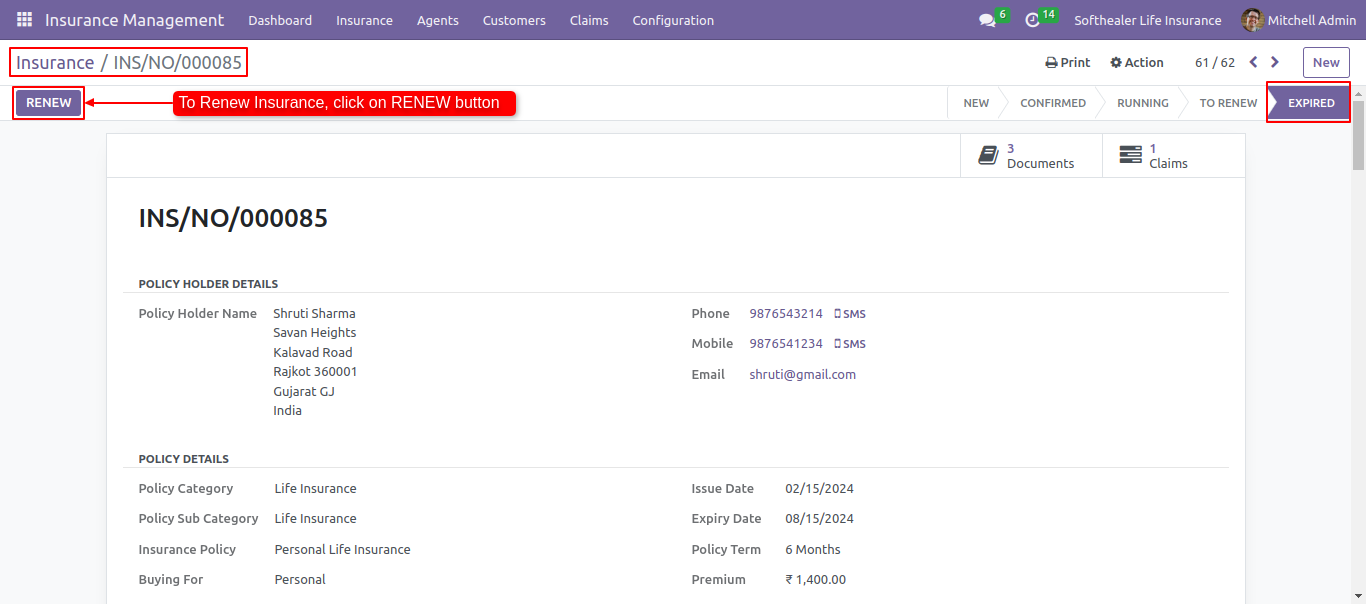

You can renew your insurance by clicking on the renew button.

Click on the renew button.

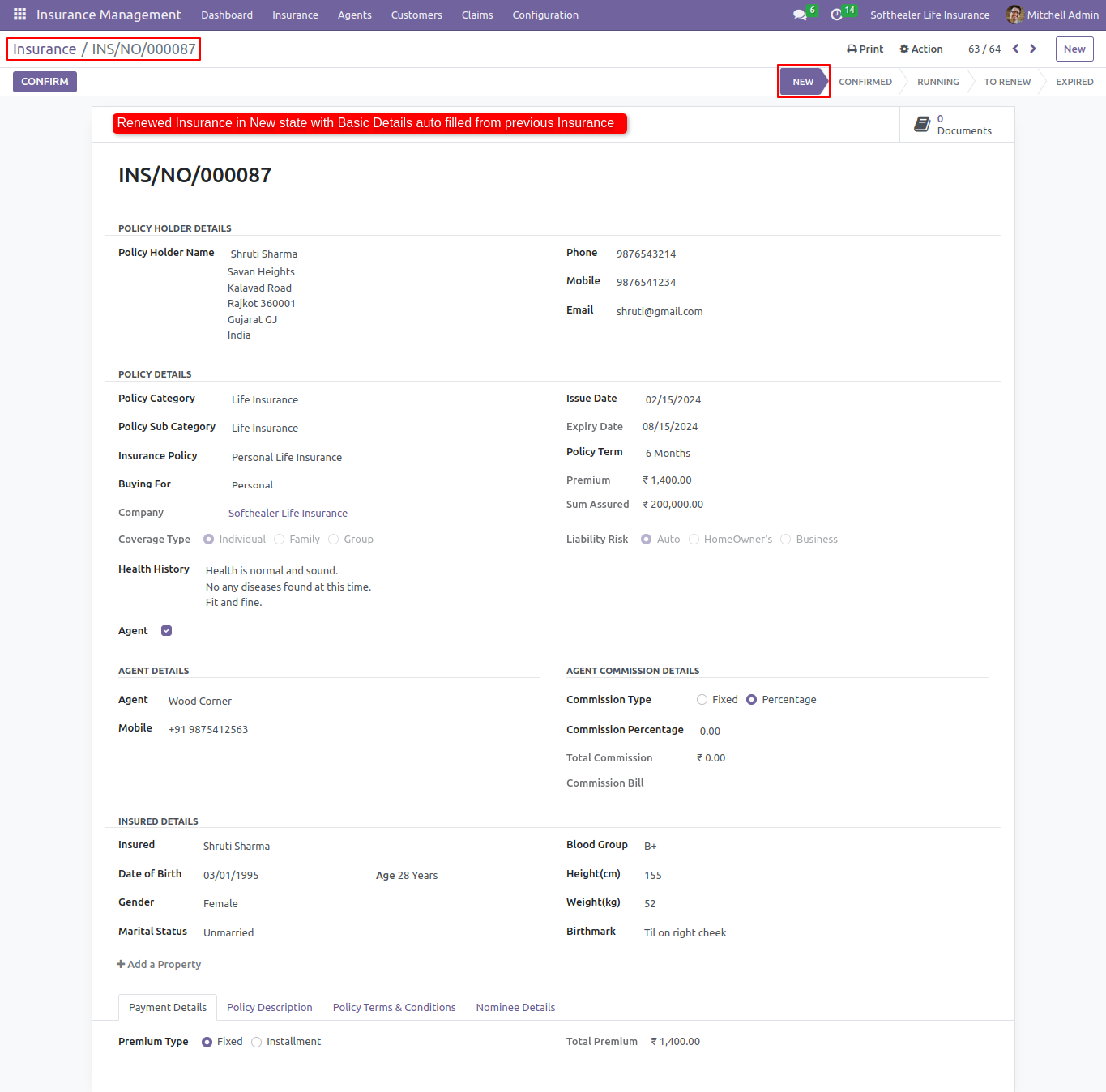

When clicking on the renew button it will create a new insurance policy with policyholder details.

Version 16.0.1 | Released on : 22nd February 2024

- Yes, this app works perfectly with Odoo Enterprise (Odoo.sh & On-Premise) as well as Community.

- No, this application is not compatible with odoo.com(odoo saas/Odoo Online).

- Please Contact Us at sales@softhealer.com to request customization.

- Yes, you will get free update for lifetime.

- No, you don't need to install additional libraries.

- For version 12 or upper, you will need to purchase the module for each version that you want to use.

- Yes, we provide free support for 100 days.

- No, We do not provide any kind of exchange.